Intel to Leapfrog Samsung as Top Chipseller

Article By : Dylan McGrath

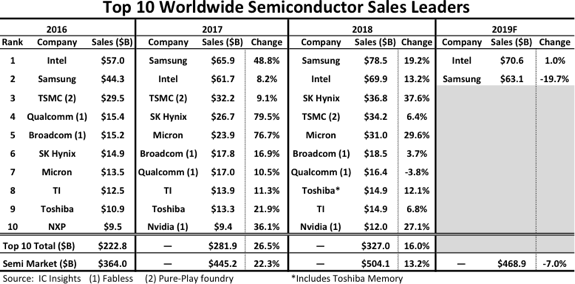

The memory chip boom is over. And so, too, is Samsung's time as the leading supplier of semiconductors by sales, according to market research firm IC Insights.

Thanks to a steep plunge in the memory market that is expected to drag Samsung's sales down by 20% compared to last year, Intel will once again assume the mantle as the leading chipseller in 2019, IC Insights projects.

The memory market is expected to decline by about 24% this year compared to last year. Roughly 83% of Samsung's chip revenue in 2018 was derived from memory chip sales. With the market downturn, IC Insights projects that Samsung's chip sales will slip to about $60.7 billion, down from $75.9 billion last year.

Intel, meanwhile, forecasts sales of about $71.5 billion, up just slightly from $70.8 billion last year.

In 2017, amid a prolonged boom in memory chip prices and sales, Samsung passed Intel to take the No. 1 spot in semiconductor revenue. Prior to that, Intel had been the leading chip seller from 1993 to 2016.

But the long memory boom has finally come to an end. NAND flash prices began declining early last year, and DRAM prices have been in decline since the fourth quarter of 2018. IC Insights said it expects all major memory chip suppliers — including Samsung, SK Hynix, Micron and Toshiba Memory — to suffer revenue declines of more than 20% this year. These companies could see sales decline to 2017 levels or below, the firm said.

"This year will likely prove once again that the infamous volatile IC industry cycles are still very much alive and well in the memory market," IC Insights said in a statement.

IC Insights also projects that the slowdown in the memory market will drag semiconductor industry capital spending down by least 14% this year.

Subscribe to Newsletter

Test Qr code text s ss