ST Intent on Capturing Silicon Carbide Market

Article By : Nitin Dahad

ST Microelectronics is intent on securing a third of the silicon carbide market, which could be a $1 billion opportunity by 2025.

STMicroelectronics is betting big on silicon carbide (SiC) as a critical part of its strategy and revenues, as it outlined at its Catania, Italy, plant last week. In all the company’s recent quarterly and annual results briefings, CEO Jean-Marc Chery has consistently stated his intent to capture 30% of the SiC market, projected to be a $3.7 billion market by 2025.

SiC is one of the wide-bandgap technologies increasingly being adopted by silicon vendors to address the high power and high efficiency needed for the vehicle electrification.

But with supply side and ecosystem challenges, such as the global shortage of SiC wafers due to the limited number of vendors, ST has been making strategic moves to control the entire supply chain. This includes its recent $250 million agreement with Cree to ensure a supply of Wolfspeed 150-mm SiC bare and epitaxial wafers, and the acquisition of a 55% stake in Swedish SiC wafer supplier Norstel, with the intention to ultimately buy up the remainder.

Speaking at the heart of its SiC plant in Catania last week, Marco Monti, president of ST’s automotive and discrete group, said he believed 50% of the power semiconductors market in 30 years will be based on SiC. While the company currently outsources the supply of ingots and substrates (with the epitaxy and wafer processing carried out in Catania) he said ST wants to have more control of the supply chain and bring it internal.

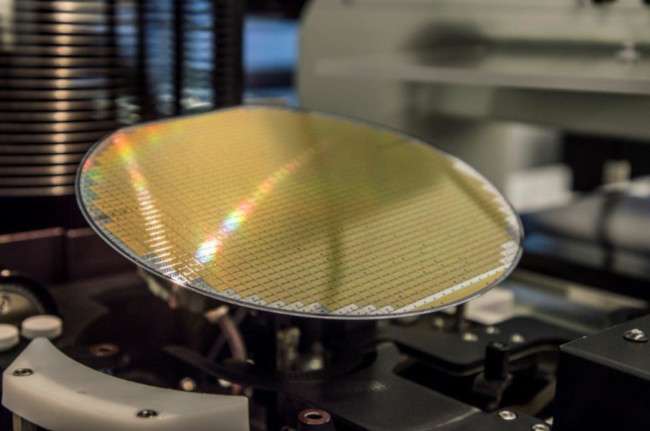

Monti said while ST already has plans to further integrate Norstel into its supply chain, the company isn’t ready to disclose them, saying it may reveal more at its capital markets day in May. He said the alliance with Cree is important, and the ambition is to be more vertically integrated. While its SiC is currently on 6-inch wafers, it intends to use its Norstel and local research links to push to 8-inch slices, probably by 2025.

A silicon carbide wafer. (Source: ST Microelectronics)

With ST’s 2018 SiC revenue being $100m and its target of $200m for 2019, to get to $1 billion by 2025 means ST needs to really take charge of its supply chain in order to meet demand and deliver on this ambition. Chery said, “Our focus is on internet of things (IoT) and smart driving, and for this energy management and power management will be a key growth driver in the future. Hence, we are engaged in developing wide-bandgap material. ST wants to take a leadership position in this market.” He added that the company will invest consistently to reach its revenue goal.

So what does Chery see as the challenges for reaching this target? He told EE Times there are two key challenges that need to be addressed, at least in the short term: one is supply chain, the other is cost. Raw materials suppliers and device suppliers need to align the supply chain in terms of volume. He said that there will need to be a push to demonstrate that electric cars are power-efficient, for which silicon carbide will be a key solution. “The only way to be very power efficient in the electric car is to use MOSFET on silicon carbide,” he commented.

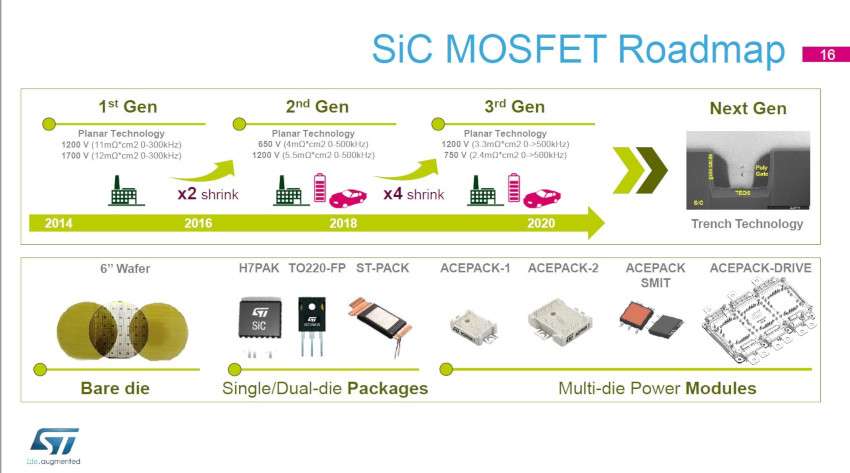

The second challenge would therefore be to decrease the cost to increase uptake. “So, we will have to shrink the device, we will have to increase the wafer size, and we will have to decrease the cost of materials, and we will have to optimize the design of the module.

In Catania, the company produces both bare die and packaged modules. Monti outlined ST’s SiC MOSFET roadmap, indicating development of trench technology in parallel with its third-generation planar technology scheduled for 2020.

Silicon carbide poses manufacturing challenges compared to silicon, which is one of the reasons why the cost increases, which in turn creates the challenge for wider adoption. SiC has higher intrinsic material defectiveness that propagates during substrate manufacturing, leading to a more complex manufacturing flow to achieve quality and reliability. It’s also a harder material and hence needs a more sophisticated manufacturing process at key diffusion steps.

SiC devices will consequently be significantly more costly, but ST emphasizes ultimate cost savings. For example, in an electric vehicle, SiC devices might add an additional upfront cost of $300, but overall there could be a $2,000 saving derived from lower battery cost, EV space and cooling.

The ST plant at Catania is not just focused on SiC, but power semiconductors more broadly. Gallium nitride (GaN) is also part of ST’s portfolio, including its GaN-on-silicon collaboration with Macom for 5G, as announced recently at MWC in Barcelona.

ST has been working with SiC since 1996, and produced its first SiC diodes in 2004, and its first SiC MOSFETs in 2009, which are available with 1200V versions as well as 650V versions. ST, like several others, are now producing automotive-grade SiC power devices, a key enabler in vehicle electrification. ST’s 6-inch SiC wafer production started in 2017, with the ramp-up of production addressing SiC applications in solar inverters, industrial motor drives, home appliances, and power adapters, among others.

SiC and GaN Adoption

Talk to any of the main European semiconductor vendors and you’ll hear how addressing vehicle electrification is high on the agenda, especially with the huge growth in electric and hybrid vehicles development.

In terms of technologies to meet the demand from a specification point of view, wide band gap devices on silicon carbide and gallium nitride offer significant benefits over silicon in terms of the higher voltages and power efficiency. Operating temperatures are higher, heat dissipation is improved, and switching and conduction losses are lower. Again, those benefits must be balanced against the greater difficulty and cost to mass produce compared to silicon.

SiC demonstrates higher energy conversion efficiency, enabling power devices to go beyond the limits of silicon. It also has a higher intrinsic breakdown threshold voltage which leads to better conductivity and enhanced electrical performance.

In automotive, the traction inverter is an example of a key function that benefits from SiC. The inverter converts the energy stored in the battery pack to electric motor actuation, so the lower the losses in that energy conversion (part of the SiC proposition), the more efficient the device. The enhanced conductivity and faster switching frequency of SiC devices also reduces power losses. This means less energy is lost as heat. Ultimately, the higher efficiency of SiC can benefit electric vehicle mileage.

The higher energy efficiency and lower losses also make SiC suitable for many industrial applications as well, including factory automation, smart power grids and solar inverters.

Subscribe to Newsletter

Test Qr code text s ss