Qualcomm Benefits From China’s Belt & Road Initiative

Article By : Junko Yoshida

China’s leading smartphone vendors such as Oppo, Vivo and Xioami aren’t just pursuing the Chinese market. Qualcomm president Cristiano Amon said these companies are “tracking China’s Belt and Road initiative.”

MAUI – On full display at Qualcomm’s annual Tech Summit here last week was the unassailable leadership role Qualcomm has cultivated in China. This status has enabled Qualcomm to advise Chinese smartphone OEMs and facilitate their expansion outside their home market.

Asked at a roundtable in Maui how the company is doing in China, Qualcomm president Cristiano Amon responded that China’s mobile ecosystem has broken beyond China’s boundaries and has gone global.

China’s leading smartphone vendors such as Oppo, Vivo and Xioami aren’t just pursuing the Chinese market, explained Amon. Citing Chinese OEMs’ dominance in South East Asia, Amon said these companies are “tracking China’s Belt and Road initiative.”

The Belt and Road Initiative, launched in 2013 by Chinese President Xi Jinping, and sometimes known as the New Silk Road, is one of the world’s most ambitious infrastructure projects. It harkens back to the original Silk Road, a trade network that connected Europe and Africa to Asia through the Middle East centuries ago, enriching traders from the Atlantic to the Pacific.

Qualcomm, once a foe to the Chinese government, has curried China’s friendship. Qualcomm’s growth strategy now hinges on efforts to help Chinese system companies crack global markets that include India, Africa and South America and the South East Asia.

Chinese handset OEMs are technologically dependent on Snapdragon, and their business plans are based on the transition to 5G. Examining that dependence and those plans is prerequisite to understanding why and how Qualcomm has become so very influential in China’s smartphone industry.

Oppo and Xiaomi

Practically all the leading smartphone suppliers in China today depend on Qualcomm’s Snapdragon platform when going after the upper tier of the domestic smartphone market. Now they are tapping Qualcomm’s marketing expertise to advance their globalization plans.

Both Oppo and Xiaomi sent executives to Qualcomm’s Tech Summit to discuss their 5G smartphone plans. Bin Lin, co-founder and vice chairman of Xiaomi Corp., teased on the stage the company’s plan to launch in the first quarter of 2020 its flagship Mi 10 – one of the first smartphones to feature Qualcomm’s Snapdragon 865 Mobile Platform. He said there are already 427 million Xiaomi smartphones powered by Qualcomm.

Alen Wu, president of global sales at Oppo, said his company will continue to invest in 5G products, research, standard development and application scenarios, with Qualcomm and other partners. Oppo’s goal is “to bring more 5G values and possibilities to users around the world,” he said.

Discussed in Maui

Last week Qualcomm invited a few hundred analysts and reporters whose expenses were fully paid by Qualcomm. Over 60 of those were reporters from Chinese media outlets.

At the summit, Qualcomm unveiled two new 5G Snapdragon mobile platforms: the 865 and 765/765G. The company also revealed the world’s first 5G-supported extended reality platform, XR2. As Qualcomm explained, XR2 is the first virtual and augmented reality (VR/AR) experience uniting 5G and AI. Qualcomm also announced always-on, always-connected PC platforms, 7c, 8c and 8cx — all rooted in Snapdragon.

The key message Qualcomm sought to deliver was that a rapid 5G network build-out is happening on a global scale. Western media and industry observers often talk about the technical difficulties of implementing mmWave for 5G networks, the slow rollout of 5G networks and yet-to-emerge killer apps specific to 5G. Qualcomm executives attending the Tech Summit in Maui complained that these qualms are easily debunked “5G misconceptions.”

To stress the “5G-is-already-here” message, Alex Katouzian, Qualcomm senior vice president and general manager of mobile, explained that China, for example, is installing 120,000 base stations this year, with a million projected by the end of 2020.

Qualcomm’s Amon, touting the cold cash China is putting behind its 5G rollout, explained that China sees 5G as a backbone of a national infrastructure with a plethora of new services.

Cristian Amon talks about China’s 5G rollout plan

(Image: EE Times)

“China is likely going to have the largest 5G rollout and network,” Amon predicted. Defining 5G as the future of Internet, Amon said China is doing the right thing by accelerated its rollout.

In June, China granted commercial-use 5G licenses to the nation’s top three telecom operators — China Telecom, China Mobile and China Unicom, as well as the China Broadcasting Network.

“China has already identified 100 new use cases for 5G,” said Amon. Possible uses include connected manufacturing for robots, connected cars, smart retail, hand-held devices on an industrial scale, autonomous pilots and tele-medicines, he explained.

Markets beyond China

Given that Qualcomm generates more than half its revenue in China, it was only natural to see how fluently Qualcomm executives could discuss every element of the Chinese market today.

However, Qualcomm is not putting all its eggs in a Chinese basket. Demand for advanced connectivity is also burgeoning in emerging markets, prodding Chinese OEMs and Qualcomm to venture farther afield.

As of September 30, according to Qualcomm, the world has approximately 6.0 billion 3G/4G connections. By 2023, this number is projected at 7 billion, with about 88% in emerging regions and China, noted Qualcomm in its recent financial statement, quoting numbers by GSMA Intelligence (November 2019).

Think about it.

Compared to China’s 1.44 billion population, India has 1.37 billion people. Indonesia, the largest smartphone market in South East Asia, has the world’s fourth largest population (272 million) after the United States (330 million).

Mobile, as Qualcomm emphasizes, is the largest technology platform It has transformed the way people compute and communicate. The scale and pace of innovation in the mobile industry affect industries beyond mobile.

We asked our colleague Lefeng Shao, a Beijing-based senior analyst who writes for EE Times China, how Chinese smartphone suppliers are doing outside China. After running numbers provided by market research firms, Shao observed:

In Europe, Huawei has shipped 11.6 million units in the third quarter in 2019, bringing its market share back up to 20 percent, according to data from Canalys Market Research. Growing sales in central and eastern Europe are more than making up for losses in western Europe, where Huawei’s market share is falling.

Meanwhile, Xiaomi’s shipments in Europe jumped 73 percent, to 5.5 million units. Xiaomi now ranks 4th in European market share.

In India, the top smartphone is manufactured by a Chinese local company called OnePlus. Sales of its OnePlus 7 series of phones have surpassed Samsung and Apple. The company had a 43 percent market share in India as of the second quarter.

In Indonesia, the largest market in the South East Asia, Chinese manufacturer Oppo led with a 26 percent market share, followed by Vivo and Samsung, according to IDC. Chinese smartphone manufacturers altogether control 74 percent of the market.

The market in Africa is growing fast. According to IDC, the top three brands on the continent are Transsion – a Chinese manufacturer not well known in western countries, followed by Samsung and Huawei.

The thing about Chinese smartphone manufacturers is that their margins are slim and revenues are low.

As of the second quarter in 2018, Transsion, Huawei, Vivo, and Xiaomi together represent 18% of global revenue. By contrast, Samsung alone represents 17% of global revenue. Apple took the rest of global revenue, equivalent to almost four times that of Transsion, Huawei, Vivo and Xiaomi combined.

Clearly, China’s diverse smartphone brands are taking over markets outside China. That’s the good news, said Shao. However, these Chinese brands are engaged in cutthroat price competition not just domestically but in global markets. “That’s where they need to change their strategy,” he added.

5G pilot plan

Qualcomm often cautions its investors: “We derive a significant portion of our revenues from a small number of customers and licensees, which increasingly includes a small number of Chinese OEMs. If revenues derived from these customers or licensees decrease or the timing of such revenues fluctuates, our business and results of operations could be negatively affected.”

Fully aware of that potential risk, in January 2018 at the Qualcomm China Technology and Cooperation Summit in Beijing, Qualcomm teamed with leading Chinese manufacturers to launch a “5G pilot program.”

Qualcomm pledged to support the smart mobile phone industry in China in the 5G era. Executives from Lenovo, Oppo, Vivo, Xiaomi, ZTE and Wing Tech, as well as Qualcomm President Amon, said they would work together to roll out 5G terminals for commercial use as early as 2019. Through the 5G pilot program, Qualcomm promised to provide Chinese manufacturers with “top 5G commercial terminal platforms, technical expertise and industry leading semiconductor solutions.”

Through the collaboration, Qualcomm and Chinese manufacturers said they would not be limited to new mobile applications. They vowed to focus on other technologies, such as artificial intelligence and the Internet of things.

The 5G pilot plan was supposed to wind down by the end of this year. However, Amon last week told the Chinese press corps in Maui that it will rock on.

Impact of the U.S.-China trade war

When the U.S. government put Huawei on its “entity list,” Huawei had to reduce its reliance on U.S. companies such as Qualcomm.

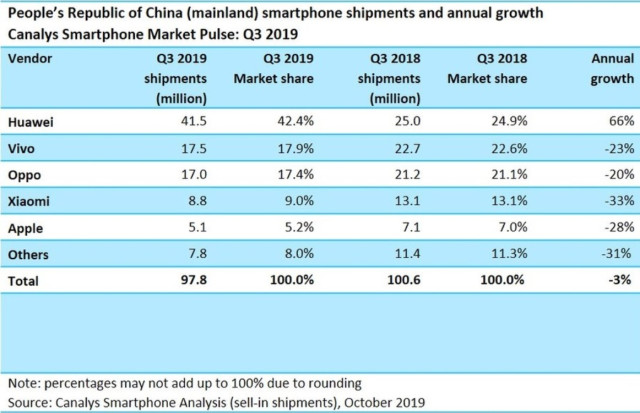

Notably, however, while the domestic smartphone market in China shrinks, Huawei has expanded its market lead. It has shipped 41.5 million smartphones, garnering a record market share of 42 percent and annual growth of 66 percent, according to Canalys. Chinese observers interpret this phenomenon as the goodwill of Chinese consumers pulling for the home team.

In turn, this development makes Huawei a more pronounced competitor to Qualcomm in China.

Huawei, which develops their own application processors, in the past integrated some of Qualcomm’s chips in certain smartphone models. The current trade ban is likely to accelerate Huawei’s drive for independence from Qualcomm, preferring its own chips to Qualcomm’s.

For the time being, Huawei, which hasn’t developed its own baseband processors, is incorporating modules supplied by Japan’s Murata.

Qualcomm, reportedly earning more than 10 percent of its revenue from Huawei, will have to wait until the U.S.-China trade war ends before expecting Huawei to buy its 5G modem modules.

Qualcomm’s commitments in China

Setting trade war issues aside, Qualcomm’s commitments in China have already grown deep and wide.

Among many Qualcomm contributions, one of the most notable is its collaboration with China’s largest foundry Semiconductor Manufacturing International Corporation (SMIC) on 28nm wafer production. The July 2014 agreement made SMIC one of the first local semiconductor foundries to produce some of Qualcomm’s Snapdragon processors.

In parallel, through Qualcomm Ventures, Qualcomm has been investing in Chinese startups. These include SenseTime, Xiaomi, Thurdersoft and Mobike.

Mobike, for example, is a bike-sharing company, and SenseTime is an AI startup. Thundersoft is a leading Android core technology and solution provider. Qualcomm also backed Xiaomi before it went IPO on the Hong Kong stock exchange in July 2018.

Then there is Huaxintong Semiconductor Technologies (HXT), a high-profile joint venture established in 2016 by Qualcomm and Guizhou, one of China’s poorest provinces. With the Guizhou government holding 55 percent of HXT, the joint venture’s goal was to design and produce Arm-based chips for data-center servers in China.

As of August 2018, Qualcomm and Guizhou reportedly had sunk a combined 3.8 billion yuan into HXT. But as the global market for Arm-based servers remained lukewarm, Qualcomm late last year began reducing employees in its data center unit in the United States, an indication that Qualcomm was planning to retreat from the server-chip sector.

Nevertheless, Qualcomm at the time issued a statement in China supporting the HXT joint venture. This might have been window-dressing, because HXT subsequently ran out of money and decided to close shop.

Did HXT’s bankruptcy hurt Qualcomm’s reputation? Not necessarily, said a Chinese industry source. To the contrary, it became an example of Qualcomm’s commitment to China, the source noted.

Qualcomm’s transformation

In November 2013, Qualcomm’s Beijing headquarters and its Shanghai offices were raided by a Chinese government that suspected violations of China’s anti-monopoly law.

When China slapped Qualcomm with a near-$1 billion fine in February 2014, Qualcomm acquiesced. CEO Steve Mollenkopf said then that Qualcomm was actually “better-positioned as a company in China as a result” of the inquiry. The decision “removed the uncertainty” under which Qualcomm had been operating.

Indeed, as it turned out, the do-or-die commitment Qualcomm made to China then — in a desperate move to hang onto the Chinese market — has been richly rewarded. Qualcomm had made itself indispensable to China’s big global ambitions.

Subscribe to Newsletter

Test Qr code text s ss