Forecasters See Slowdown Ahead

Article By : Rick Merritt, EE Times

The semiconductor industry will slow this year and may go flat in 2019, said analysts looking over their shoulder for signs of an economic downturn.

HALF MOON BAY, Calif. — The mood of semiconductor executives was upbeat at their annual gathering in this coastal town socked in with fog. The weather was an appropriate backdrop for the cautious optimism market watchers recommended here.

Semiconductors should have another good year in 2018, but growth is slowing. Further out, a downturn may be coming for the industry and the broader economy — but just when and why is still not clear, speakers said at the Industry Strategy Symposium here.

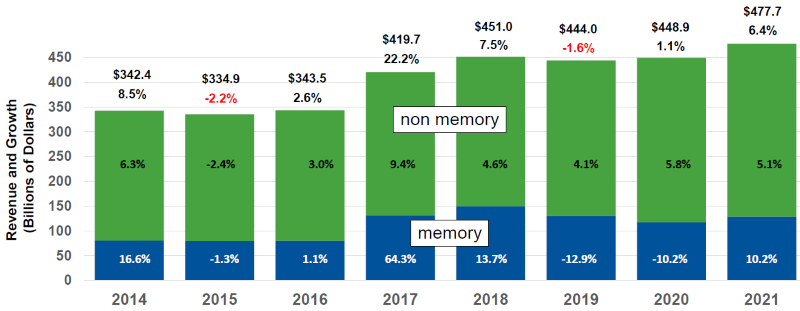

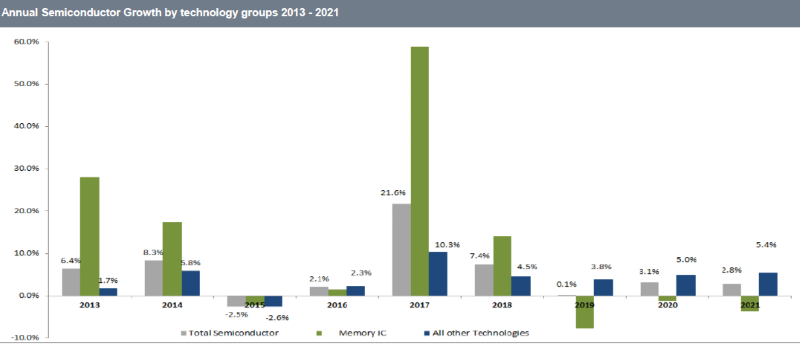

Gartner predicts after last year’s 22.2-percent revenue surge, the chip market will settle down to a still better-than-average 7.5-percent growth this year. It predicted the chip market will cool off in 2019 and 2020 with two basically flat years.

In the current quarter, managers may tap the breaks on a market with too much inventory, but 2018 will pick up to 7.4 percent growth overall, according to Len Jelinek, a chief analyst at IHS Markit.

Apple’s inventory has ballooned 128 percent, and inventories are up 44 percent at Cisco, 41 percent at Samsung and 29 percent at HP — far above revenue growth, noted Dan T. Niles, a veteran industry analyst and manager of the AlphaOne NexGen Technology Fund.

Looking at the big picture, “this is the best global economy we’ve seen since 2007, all regions are doing well, but there are signs of a bubble,” Niles said, noting an overheated housing market in China, high bond prices in Europe and price/earnings ratios higher than any time since 2000.

The U.S. stock market is on one of its longest bull runs since World War II, and all 45 OECD countries are reporting growth, Niles noted. He compared the current moment to early 1999, a time of expansion not far from a significant contraction.

The global bull market can continue another 6 to 12 months, and the greatest political risks are with rising economic and political tensions between the U.S. and China, said Matt Gertken, an associate vice president at BCA Research. He predicted China will start economic reform in earnest this year, scaling back growth that has long been a global economic driver.

Continue reading on EE Times US: Race to 7nm could bring over-capacity

Subscribe to Newsletter

Test Qr code text s ss