Big Hurdles Facing Autonomous Vehicles

Article By : Junko Yoshida

Industry observers identified seven topics as the big hurdles facing the automotive industry this year and beyond...

As the curtain rises on CES 2019 this week, developers of automotive technologies will be crowding the stage in Las Vegas, elbowing one another aside in an effort to keep alive their self-driving car dreams.

Given that the annual event is all about shiny new objects, CES will feature a host of head-turning auto-related technologies and partnership deal announcements. For anyone following the autonomous-vehicles (AV) beat, however, the room-sized elephant will be a number of technology, business, regulatory and social issues likely to hobble the automotive industry in 2019.

For example, a backlash against driverless cars has begun in Arizona. According to police reports, some residents in Chandler are already so sick and tired of Waymo vehicles cruising the neighborhoods that they’ve started throwing rocks at AVs and slashing tires, the New York Times reported.

These reactions serve to remind the AV industry that despite all the hype, the public isn’t exactly buying the tech community’s rosy picture of a utopian society where robocars scurry hither and thither saving people’s lives.

EE Times talked to leading thinkers in automotive technology and asked what they see on the horizon as top of the AV agenda in 2019. While their opinions and predictions vary, we identified seven topics as the big hurdles facing the automotive industry this year and beyond.

1. Can We Get Past Road Testing?

In assessing who’s ahead in the race to first commercially deploy AVs, companies, pundits and media have been using the number of hours each company spent on robocar testing on public roads as the yardstick.

This might be the wrong criterion. Phil Koopman, safety expert and professor at Carnegie Mellon University, stressed that to deploy AVs, the industry must “get past the notion that road testing is enough to ensure safety.”

The industry today is “still trying to get vehicles to work properly on an everyday basis,” Koopman observed. This hardly ensures the safety of AVs. “No reasonable amount of road testing will address the gap between ‘seems to work pretty well’ and ‘safe,’” he stressed. “True safety isn't just about the everyday stuff — it is also about handling edge cases, component failures, and other rare but critical events.”

Mike Demler, senior analyst at the Linley Group, defined the top 2019 agenda item for the AV industry as “ending irrational enthusiasm from the developers of self-driving technology.”

Echoing Koopman’s sentiment, Demler noted, “The focus should shift more to safety.” It’s time to end, he said, “the naive rush to disrupt transportation” pursued by many startups.

2. ‘SAE Levels of Automation’ Can Lose Its Relevance

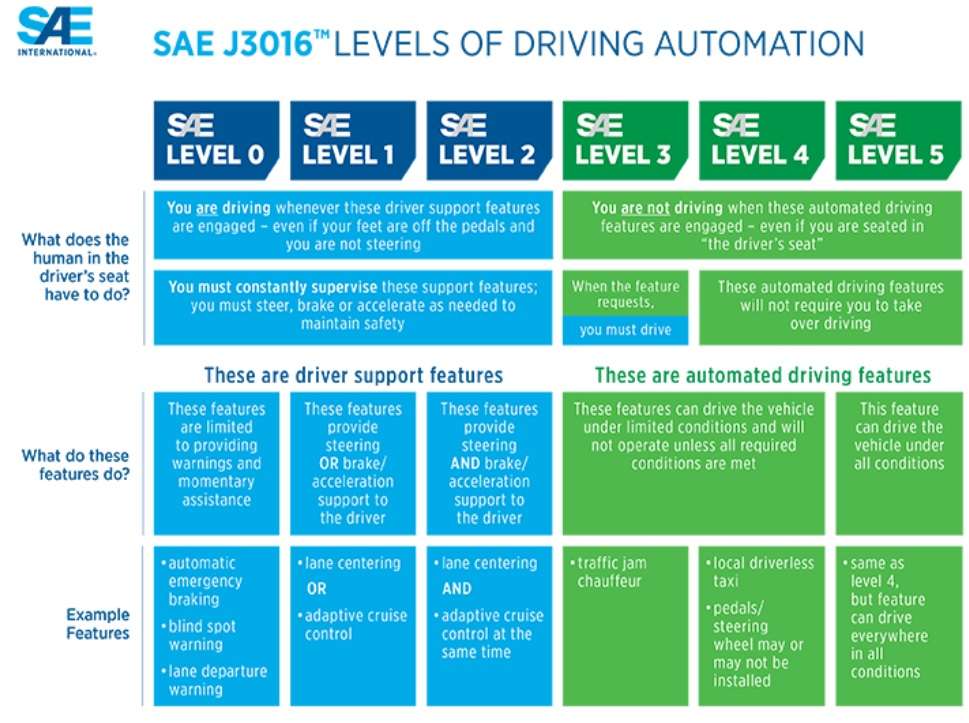

The AV industry has become accustomed to discussing highly automated vehicles according to Levels of Automation defined by SAE.

In December, SAE International announced a new visual chart for use with its J3016 “Levels of Driving Automation” standard that defines six levels from no automation to full automation.

SAE explained that the new chart offers more “consumer-friendly” terms and definitions for the levels, which are frequently cited and referred to by industry and media. “The infographic will help to eliminate confusion by providing clarity and using terms more commonly used by consumers.”

Levels of Driving Automation (Source: SAE)

As ADAS vehicles start to proliferate, levels of automation defined by the SAE might start losing relevance, however.

Phil Magney, founder and principal advisor at VSI Labs, advised, “It's best if we break the habit of applying the SAE levels of automation to a vehicle.”

This is because a vehicle “can have some features that are L0, some that are L1, some L2, and so on. Some L3 features are starting to appear now. For example, Tesla’s Navigate introduces L3 capabilities but still requires the driver to stay in the loop.”

To complicate the issue further, Nvidia last fall came out with a solution designated as “L2+”, not L2. Colin Barnden, lead analyst at Semicast Research, said, “To my knowledge, Nvidia has only won Volvo. It would be very unusual for one OEM to adopt a solution which no one else does. The OEMs tend to cluster around similar solutions at similar times.”

In reality, the “Level 2+” system appears to be a marketing term promoted by Nvidia and Volvo. Instead of simply calling it a Level 2 automated vehicle, the companies are apparently groping for a semblance of differentiation. They seem to define Level 2+ as not quite at the Level 3 handoff stage between car and human, with a platform that outperforms any extant Level 2-like driver-assist package.

As more vehicles with ADAS features roll out, car OEMs will inevitably expose their worst instincts by giving different names to the autonomy level of their own vehicles.

Industry analysts suspect that the source of contention over their vehicle automation level definition lies in the L2-to-L3-handover dilemma. Magney noted, “I don’t think there is pragmatic implementation to Level 3 where the driver is able to step out of the loop. At least not yet.”

Egil Juliussen, director of research for infotainment and ADAS for Automotive at IHS Markit, concurred. “The big question is how safe the handover from L2 to driver and L3 to driver will be,” he said.

While acknowledging that “driver monitoring has become a key technology to make this happen,” Juliussen predicted, “It looks like L2 apps (traffic jam assist and limited auto pilots) will make big gains in deployment in 2019. L3 is harder because the driver can be more disengaged, which can make the re-engagement much harder.” Given today’s massive violation of rules that ban texting while driving, it’s hard to fathom how L3 drivers could possibly take over driving at moment’s notice.

3. Needs Independent Checks and Balances

Since Waymo, Uber and GM’s Cruise decided to go on testing AVs on public roads by saying, essentially, “Trust us, these babies are safe,” the public has had little choice but to take this promise at face value. That these AV companies have gotten away with so little public scrutiny is astounding.

Where is the third-party oversight on AV safety?

Koopman noted, “History teaches us that you only get safety if you have independent checks and balances.” He added, “Billions of dollars chasing tight deadlines put enormous pressure on teams to cut safety corners, perhaps without even realizing it — even if they have the very best of intentions.”

Let's Discuss Eroding Public Trust in AVs

4. Let’s Discuss Eroding public trust in AVs

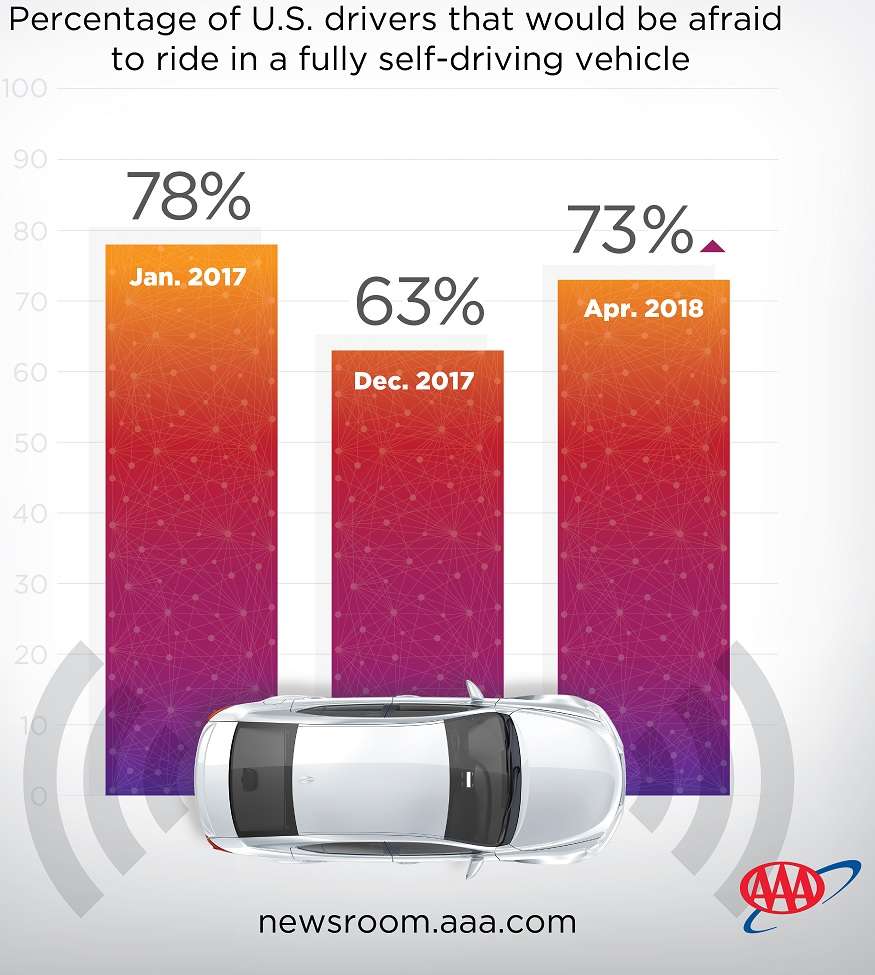

If anyone believes that the public is looking forward to AV proliferation, 2019 is the year to rethink that blithe assumption. Beyond checks and balances, the AV industry’s transparency is a huge factor needed “to build and sustain public trust,” according to Koopman.

Following high-profile incidents involving autonomous vehicle technologies, a report from AAA's multi-year tracking study, issued in May, 2018, indicates that consumer trust in these vehicles has quickly eroded. (Source: AAA)

Last month, on the issue of “public trust,” the Arizona Republic reported at least 21 attacks against Waymo vans in Chandler.

In one extreme incident, a man waved a .22-caliber revolver at a Waymo vehicle and the emergency backup driver at the wheel. According to the police, the gunslinger told the police he “despises” driverless cars, citing the killing of a female pedestrian in March in nearby Tempe by a self-driving Uber car.

While the Uber fatality has been recognized as a huge setback for the technology, safety and development aspects of AVs, there’s been little discussion of how it exacerbated public suspicions about AVs. By not pressing charges against incidents of AV-directed vandalism, Waymo has thus far kept the anti-AV movement from going viral. But Waymo’s luck is likely to run out in 2019.

5. Tech magic bullet on Horizon?

The investment community is eternally optimistic about the emergence of the next startup — just around the corner — that will unveil a breakthrough technology and save the day for the AV industry.

Most market observers, however, aren’t looking down the barrel at a silver bullet.

Magney told us, “From a technology standpoint — I don’t think there is anything revolutionary on the horizon,” even though “componentry is getting incrementally better.” He added that sensors are getting more sophisticated, with variants that include hybrid sensors coupling camera imaging with lidar.

But the industry consensus is that AV advancements do not depend on a single technology but on a combination of tech advancements that include software and hardware. The road to safety will require AV companies to install more redundancy, while demanding that system designers keep grinding away at more tedious incremental improvements.

Asked about technologies that need to be greatly improved, Demler had one word: “Software.”

He said, “We’ve seen that vehicles integrating a multitude of sensors and processors can drive autonomously under controlled conditions, but the real world is full of random events that can’t be planned for.” While simulations are helping to train neural-networks for situations beyond what any amount of road testing can do, “that’s still insufficient,” Demler said.

“For all our fallibilities, autonomous vehicles lack the reasoning capabilities of human drivers,” he added. In other words, “We’ve got a long way to go until AI systems can take over, and it isn’t even proven that the public want them to.”

6. Collaborating or Competing?

At CES next week, expect more partnership deals among tech suppliers, Tier Ones and OEMs. Juliussen believes that the emerging realization about the true challenges of autonomy is pushing companies to join forces.

Koopman, however, remains skeptical as to whether partnerships and industry cooperation will lead to genuine collaborations of “safety” — such as data exchange and setting safety standards. To his frustration, “It’s not happening yet.”

In his opinion, the AV]industry “should compete on economics, ride quality, convenience, and other factors, but not on the safety. Self-driving car safety should be a given, just as it is for aircraft.”

7. Regulations, Anyone?

Speaking of the AV industry, Barnden told us, “This is an industry badly in need of regulatory oversight. 2018 has proven beyond any doubt that safety is taking lower priority than the desire to be first to market.”

On the issue of mandating a Driver Monitoring System in all vehicles with four wheels or more (truck, coach and bus, too), Barnden thinks that NHTSA is asleep at the switch. “This needs to be done as soon as is practically possible. It is the fastest and easiest way to reduce traffic fatalities.”

Meanwhile, Demler pointed out, “We desperately need standards for testing autonomous-vehicle technology. Few politicians have the technical knowledge needed to do this, so we need an industry-government collaboration to establish the rules.”

Magney is equally frustrated with the U.S. government’s inaction on AV safety standards.

“Government must get their act together,” he noted. The AV START ACT (American Vision for Safer Transportation through Advancement of Revolutionary Technologies Act), a bill that would pave the way for a regulatory framework to govern autonomous cars, is stalled, he noted. “Furthermore, there is nothing but voluntary guidance. Honestly, the rate of innovation is so fast that those trying to regulate it cannot get a handle on how to do this.”

Magney noted, “What the industry wants to avoid is a patchwork of local and state regulations.” He explained that at least 36 states have enacted legislation governing self-driving vehicles. But as the deployment of AV technology advances, “the differences between all those sets of rules could become a major pain,” said Magney.

— Junko Yoshida, Global Co-Editor-In-Chief, AspenCore Media, Chief International Correspondent, EE Times Circle me on Google+

Subscribe to Newsletter

Test Qr code text s ss