Early 5G Solutions Showcased

Article By : Rick Merritt

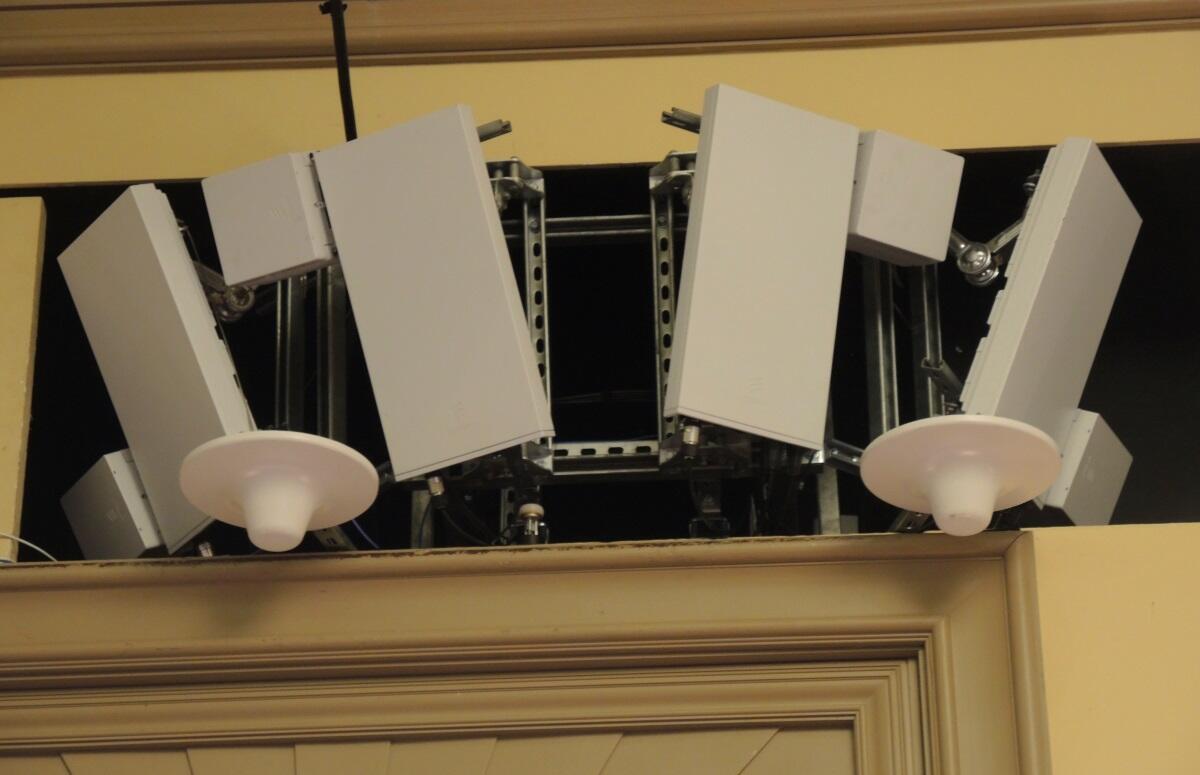

Live 5G network demonstrated by Ericsson at a Qualcomm event in Hawaii

WAILEA, Hawaii — For a few hours on Tuesday, 5G cellular was live — warts and all — in two ballrooms of a resort hotel here. Ericsson set up the network at a Qualcomm event to give press and analysts a first look at what its new chipsets will enable.

Samsung showed an early version of its first 5G smartphone streaming 4K video to a large-screen TV. Motorola demoed a 5G upgrade module that attached to its LTE smartphone to download a gigabyte movie in 17 seconds.

Inseego showed a mobile 5G hotspot that it will launch at CES for Verizon’s network. And AT&T demoed a prototype for a cool augmented-reality app requiring fast nets to download hundreds of Mbytes of content to a handset.

So far, it’s a mixed bag of blessings and curses. For example, the demos were cool, but there were few of them.

Tests of millimeter-wave services are going better than expected, said carriers. In addition, handset makers have an unnamed alternative supplier of mmWave RF front ends beyond the module that Qualcomm announced in July.

Plenty of 5G handsets are in the works, but most won’t be available until sometime next year. The lack of support for frequency duplex division in the current 5G modems is delaying deployment in sub-6-GHz bands until late 2019 for AT&T and possibly other carriers.

A working prototype of Samsung’s first 5G smartphone was the star of the press and analyst event. (Images: EE Times)

Data rates for the first batch of handsets will likely be limited to a few hundred Mbits/s as carriers work toward Gbit and, ultimately, multi-Gbit goals. Meanwhile, vendors are working on consumer-friendly metrics to help users set their expectations.

Many vendors are racing to market in the next few months. But 5G will be more of a marathon than a sprint with the full build-out and payoff years away.

All three carriers in South Korea officially launched services over the weekend, dubbing Dec. 1 as “5G Day.” AT&T is next, having promised a 2018 rollout based on a first cut of the 3GPP’s standard released in June.

In the past, carriers had about 18 months to gear up services after a cellular standard was frozen. This time around, vendors lobbied 3GPP to create a quick-to-market version of the spec that they could drive into networks quickly.

AT&T’s self-declared deadline of six months from a final draft spec to a live network created a unique challenge.

“I told [management] that I want every day that’s left in the year,” said Gordon Mansfield, an AT&T vice president who helped set and oversee the carrier’s 5G plans. “The equipment is literally coming off of production lines and going into the field — we are not even using normal shipping channels.”

Carriers report better-than-expected reach with millimeter-wave signals, but the data rates that they deliver are still far below their multi-Gbit potential.

“We were assuming that if we mounted radios at a certain height on poles, we could reach a sixth-floor apartment with 28 GHz,” said Nicki Palmer, chief networking officer at Verizon in an interview. “It turned out we got close to the 19th floor, and when that came to light, that changed our thinking” about costs and deployments.

Carriers are discovering to their delight that reflected signals extend the reach of millimeter waves.

“Urban canyons that were a nightmare in sub-6[-GHz] bands now are your friend,” said Mansfield of AT&T. “Bank shots are very real and extend your coverage for millimeter wave,” he added, noting that AT&T will initially use mmWaves to deliver mobile broadband services to handsets.

Ericsson set up a full core-to-RF 5G network at the event. Its 5G radios are nearly three times the size of the LTE versions.

Unfortunately, those mmWaves are not initially hitting 5G’s promise of multi-gigabit data rates.

Verizon showed a video here boasting its fixed-wireless services delivering, in some cases, 780 Mbits/s to 1.04 Gbits/s. However, it officially promises just 300 Mbits/s.

“Users are routinely experiencing much higher rates [than 300 Mbits/s], and we’re closing in on a Gbit,” said Palmer.

For perspective, EE Ltd., a cellular carrier in the U.K., typically delivers about 150 Mbits/s over its existing LTE network, although in best-case scenarios, it has clocked it above 700 Mbits/s, said an EE executive. Qualcomm has, for some time, claimed a capability to support Gbit/s LTE with plans to double that rate.

Cellular vendors are working out simple metrics to communicate to consumers what performance levels to expect on evolving LTE and 5G networks. They are likely to use something akin to the new metrics that the Wi-Fi Alliance released in October for 802.11.

Representatives of AT&T, EE Ltd., and Verizon declined to share information on their expected 5G data rates and prices before their official launches.

“Not long ago, we talked about 5G handsets coming in 2023,” said Palmer of Verizon, which launched fixed-access services in October in four cities and plans a mobile broadband launch next year. “This year, it changed to seeing them definitely in 2019 — it’s just a matter of what month.”

AT&T will launch limited mobile broadband services with “low-single-digit” numbers of handsets by the end of the year. Samsung showed a single 5G handset that it will use on AT&T, Verizon, and South Korean networks that will support 28- and 39-GHz mmWave bands, but it won’t be ready until sometime early next year.

The Samsung handset uses Qualcomm’s recently announced Snapdragon 855, a 7-nm integrated applications processor, along with its X50 5G modem. A Samsung representative would not say whose mmWave RF front end the handset uses.

At the event, Samsung showed a version of the phone that it said was not its final form factor. In November, it showed plans for a foldable phone that it will release in 2019, but it gave no details of its specs. The South Korean giant will supply a second 5G handset in the second half of 2019 to AT&T, supporting its mmWave and sub-6-GHz nets.

Motorola gave no price for the 5G upgrade module that clips onto its $480 4G handset

For its part, Motorola showed a 5G clip-on for its Moto Z family, exclusive to Verizon’s network. It also uses the Snapdragon 855 and X50. It includes a 2,000-mAh battery and supports 28-GHz mmWaves with antennas in all four corners so that hands won’t block signals.

Inseego showed a mobile 5G hotspot roughly the size and weight of a hockey puck with USB and Ethernet ports. The device, exclusive to Verizon’s network, uses the Snapdragon 855 and X50 chips, supports mmWaves, and will be available in 2019.

The Inseego product, to be formally launched at CES, looked like a similar mobile 5G hotspot that NetGear is making exclusively for AT&T.

Subscribe to Newsletter

Test Qr code text s ss