NXP’s Qualcomm Rollercoaster

Article By : Junko Yoshida, EE Times

A look at how the broken down Qualcomm deal changed the company's path

An 11-hour flight from San Francisco to Frankfurt in mid-June flipped almost every expectation in Lars Reger’s business life — lock, stock, and barrel. Anticipating the eventual merger between Qualcomm and NXP Semiconductors, Reger, NXP’s automotive CTO, had devised a technology roadmap for an automotive division that generates roughly half of NXP’s revenue.

Eleven hours earlier, Reger was resting in an airport lounge after the NXP Connects Conference in Santa Clara, awaiting his flight home. At that moment, someone approached Reger and asked him about an article in that day’s South China Morning Post. The title: “Beijing ‘approves Qualcomm’s purchase of NXP.’”

NXP and Qualcomm had been waiting 20 months for this moment. Reger broke into a big smile, high-fived his colleague, and ordered champagne.

Now fast-forward 11 hours. Reger lands in Frankfurt, only to encounter another stranger asking him if he’s heard the latest. Reger, with a broken foot, said, “No. I’ve been in a wheelchair, couldn’t really move around, and haven’t checked any news.”

The stranger said, “The Qualcomm-NXP merger is a bust.”

He was referring to a Reuters’ follow-up on the South China Morning Post’s report, citing three sources who said that they were not aware of any Chinese approval. The story also alluded to an ominous twist: The U.S. tariffs on Chinese goods to be unveiled later that day might just queer the whole deal.

Twenty months after it was announced, a $44 billion mega-merger still hung in limbo, and the notoriously capricious Chinese government appeared to have the final say.

Reger, over the moon on his flight to Frankfurt, felt a tightening in his chest and saw his world gone upside-down. He asked himself, “Is this a drama or what?” His next question was, “What did I just lose?”

Although it wasn’t until July, a month later, when Qualcomm CEO Steve Mollenkopf officially scuttled his bid for NXP, when the difficulty of consummating the marriage had already dawned.

‘What did I lose?’

The union of the two companies had an explicit goal for Qualcomm as it strove to diversify beyond the smartphone technology business that the San Diego company dominated.

More significantly, the industry expected the merger to give birth to a formidable automotive technology company. “With NXP, Qualcomm would have had the entire car, and together, they may have offered competitive solutions for Levels 4 and 5 autonomous control,” said Jim McGregor, founder of Tirias Research.

For NXP, already the No. 1 automotive chip supplier in the world, Qualcomm offered a wealth of technologies that it needed to usher in the future of highly automated vehicles.

Reger, quickly coping with the eventual collapse of the deal, did a little math in his head: “Things I lost include cellular technologies — not just 5G but also 4G.” Also, “I no longer have the Snapdragon SoC platform.” The merger would have enabled NXP to use Snapdragon not only for in-vehicle infotainment systems but also “for sensor fusion,” according to Reger.

Lars Reger, CTO of NXP Automotive, discusses automotive connectivity at NXP Connects in San Jose, June 2017. (Photo: NXP)

The big plan was to combine Qualcomm’s Snapdragon with NXP’s Layerscape processors (originally developed by what used to be Freescale’s digital networking group), said Reger, to push NXP’s Bluebox platform further to autonomy — Level 3 and beyond. Significantly absent from NXP’s auto tech portfolio was a high-performance computing device that could go with NXP’s functional safety chips.

But as one astute EE Times reader remarked on EE Times message forum, “When it comes to corporate acquisitions, losing the bid is more often than not the winning move in the long run.”

It didn’t take long for Reger to realize that “nothing has collapsed.” Even with the deal ditched, NXP’s automotive product roadmap remained in place.

As soon as Qualcomm walked away from the merger plan in late July, Reger heard companies knocking on NXP’s door. By early August, a couple of suitors were asking Reger, “Now that you are no longer tied to [Qualcomm], can we partner?”

Declining to name names, Reger said that these new partnership discussions are ongoing. While Reger declined to comment, NXP’s goal appears to be close to a deal within the next few quarters.

Autonomous vehicle hype cycle

Meanwhile, since summer, a once red-hot industry debate on robo-cars has cooled. Last month, Nvidia announced that it is downgrading its AI-based Nvidia Drive AGX Xavier System — originally designed for Level 4 autonomous vehicles — to Level 2+ cars. Tesla has decided to take its full self-driving (FSD) option off the menu “to avoid confusion.” Timing for the FSD rollout has become indefinite.

In parallel, new concerns began swirling around in the industry. Because carmakers haven’t yet nailed down their Level 2 advanced driver assistance systems (ADAS), Level 4 cars appear to be a lot further down the road.

The Insurance Institute for Highway Safety’s (IIHS) ADAS tests over the past summer exposed big gaps in Level 2 vehicle performance under a host of different scenarios. The systems proved fallible in numerous circumstances. In some cases, certain models equipped with ADAS are apparently blind to stopped vehicles and could even steer directly into a crash.

Against the market’s changing narrative on autonomous vehicles, it’s not surprising to hear Reger say that “the hype cycle of Level 5 cars — fully automated vehicles — has fallen off the cliff.” He recalled the time, a few years ago, when the initial excitement about EVs took a similar nosedive. Consumers were turned off by the prospect of an EV that couldn’t last 200 miles without a recharge.

Reger noted a few data points that led him to believe that the autonomous vehicle is no longer the next big thing in automotive.

First, despite the claims made about AVs and the many divergent opinions among experts, AVs simply aren’t here yet. Waymo’s driverless cab service in Arizona might be the only exception.

Second, car OEMs are reportedly burning through billions in the EV and AV race. This profligacy has begun to trigger earnings warnings.

Third, Tier 1 suppliers have begun negotiating safety-in-numbers “partnerships” among themselves. This trend speaks volumes about the technical challenges involved in developing Level 5 AVs. Going it alone is a risky strategy.

Fourth, it’s clear that no car OEMs or tier ones will be making money on Level 5 cars in the next five to six years.

To top it off, Reger said, “Think about challenges involved in the big SoCs that must go inside AVs.” For designers of those “big SoCs” to make money, they must install their chips in millions of cars in the next few years. TSMC might be able to supply those big SoCs, probably using a 16-nm process technology, but this is a stopgap solution.

Reger said, “Six or eight years from now, the advanced process technology will move from 10 nm to 7 nm or even down to 3 nm. That simply means one thing: By the time your big SoC hits the volume market, you’re using a two-generation-old technology.”

Where’s NXP’s big SoC?

Despite NXP’s claim as the world’s No. 1 automotive chip supplier, it often gets a short shrift from a media that loves to hype the autonomous vehicle future. Why? NXP’s sex appeal gap prevails because it doesn’t offer a big SoC, which the media calls the robo-car’s brain and Reger calls the “mega-chip.” Without a chip equivalent to Nvidia’s Xavier SoC or Intel/Mobileye’s next-generation EyeQ chips, it’s hard to write the horse race.

Had Qualcomm acquired NXP, this would be a different story.

Curiously, Reger doesn’t seem so upset about the missed opportunity. He reasoned, “I see NXP’s role in offering a companion chip to the mega-chip. Our chip will function as a watchdog for the high-performance computing unit. We provide determinism to the AI system.”

Reger rejects the “big brain on the wheel” idea as a false premise. “Just as our human brain is compartmentalized so that different parts of the brain perform different tasks, so is the AV’s brain.”

For example, a part of the human brain connects directly to the spine. It translates information coming from sensors and detects an obstacle. That part of the brain is connected to muscle reflexes. In contrast, another part of the brain serves as the brain’s consciousness. When it sees several vehicles bunched up on the road ahead, for instance, it performs an analysis: Am I seeing the back end of a traffic jam or is there just a car up there trying to park? The “conscious brain” is there to “develop a strategy” for the best and safest course of action.

Supposedly, NXP’s chips will perform the former part of the task (communicating to the reflex system) while offering functional safety “supervision” to the latter (for strategy development).

The world has already seen fatal accidents while companies were testing self-driving cars on public roads. In most cases, Reger told us that the culprit was “inferior sensors.”

Where did NXP invest while the merger was still on?

During the company’s earnings call last week, financial analysts grilled NXP CEO Rick Clemmer about where NXP invested during the 21-month period when the Qualcomm-NXP merger plan was still alive.

Clemmer stressed that NXP did not cut back its investments during that uncertainty. “I think we were a little gentler in cutting back to fit within a budget as we went through that period, and now we get the benefit of it,” he claimed. Largely, the company invested in radar and battery management, he explained. This helped NXP “see that through to an opportunity that we think is key for us.”

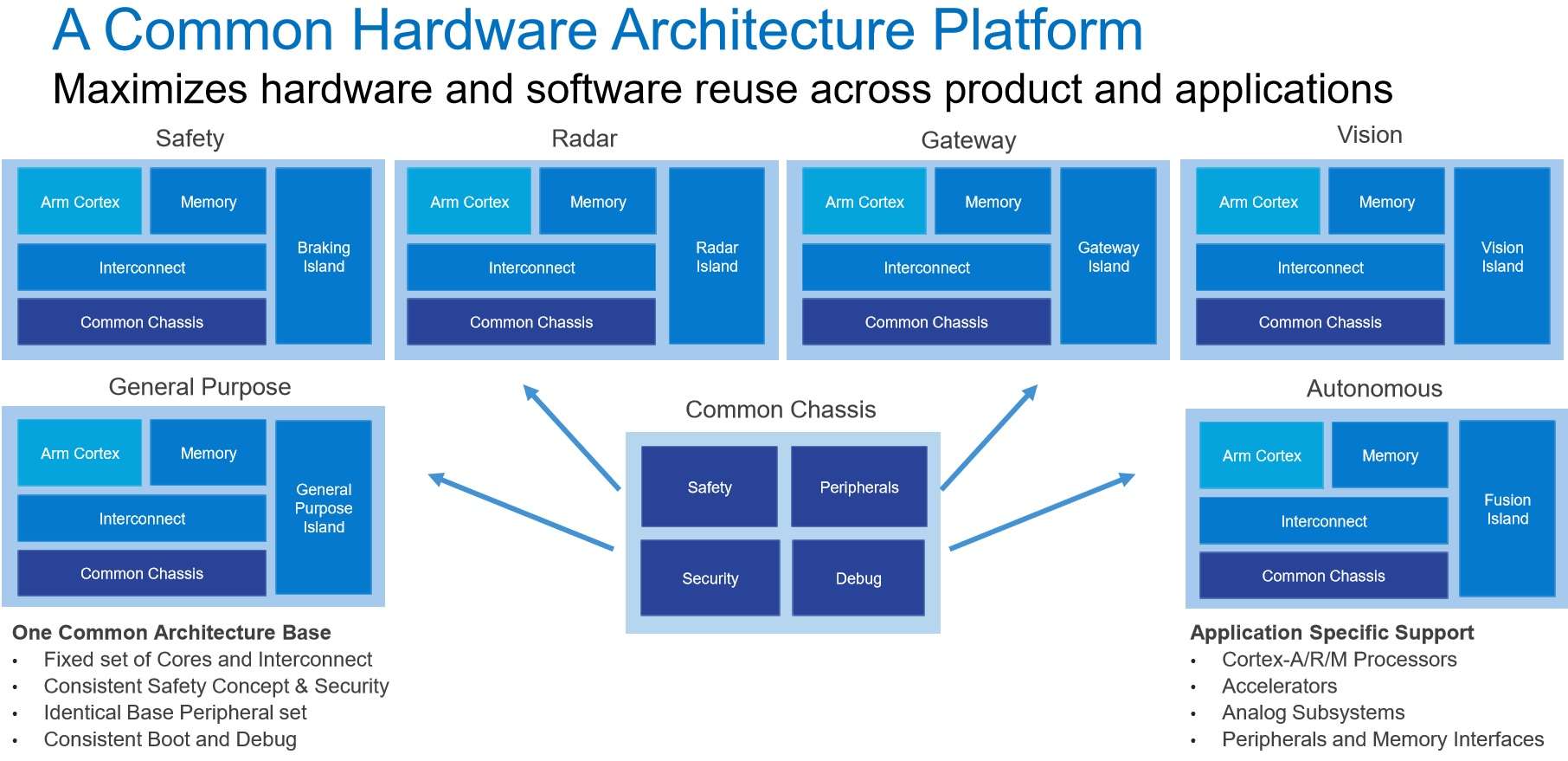

NXP’s investment in the S32 micro-platform, meanwhile, “sets us up very well in a unique position that no other competitor has the ability to drive,” added Clemmer. “The ability to drive 16-nm FinFET solutions while our competitors are now, at the same time, beginning to introduce 28 nm positions us in a very unique position quite well and will help drive our growth.”

Focus on vision and radar

Reger confirmed NXP’s intense efforts to improve sensors — both vision and radar.

However, NXP doesn’t have a front camera system equivalent to that of Intel/Mobileye. NXP inherited Cognivue’s IP from Freescale when the two companies merged. Does this mean that NXP is working a brand-new vision chip?

“Yes, we’re working on it,” said Reger.

Although NXP’s vision chip won’t launch until late 2019, according to Reger, it will be “an open platform system” into which customers with their own vision software can plug their algorithms. NXP’s open approach is meant to contrast sharply with Intel/Mobileye’s strategy. While Mobileye is unquestionably a dominant force behind many automotive vision systems, its approach often draws criticisms from carmakers because it is a black box providing no opportunity for adjustments.

Reger said, “Our chip comes with its own software on top of it. But we are also going to provide a system enablement toolkit so that our customers can add their own algorithms.” He noted, “NXP is a chip vendor. We are not going to compete with car OEMs or Tier 1 suppliers, who are our customers.”

While NXP plays catchup in the vision field, Reger is confident of NXP’s pioneering role as the first CMOS radar chip supplier.

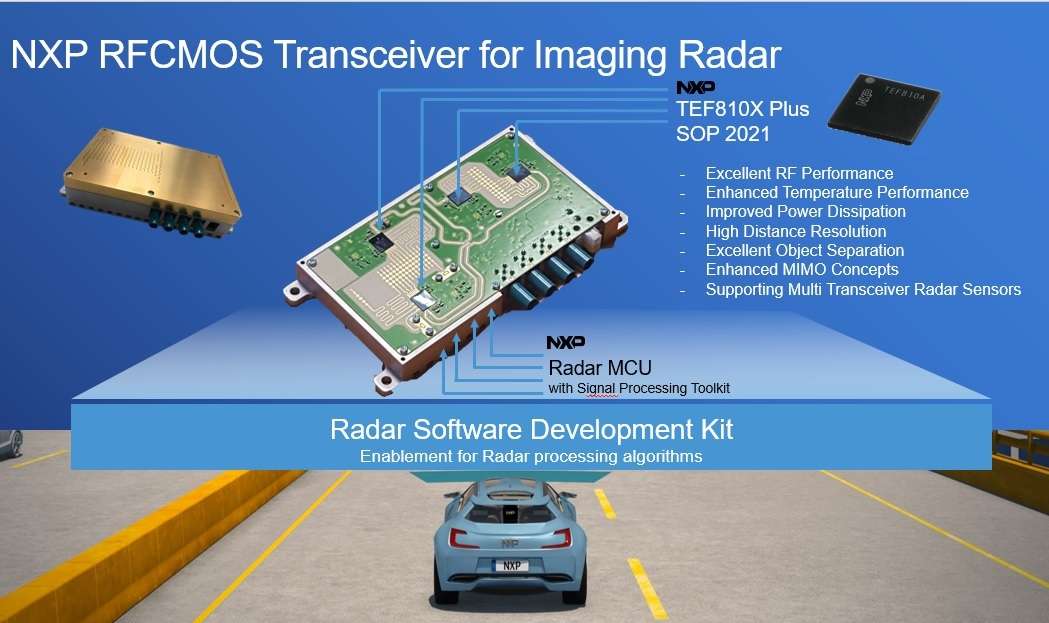

Reger’s R&D team is tasked to advance its radar chips. What if NXP develops radar chip solutions with 12 channels sending radio signals and six channels receiving signals? The result, as Reger sees it, is a very high-resolution imaging sensor. Combining NXP’s new front-facing camera sensor with a cluster of NXP Dolphin radar chips, with enough angular resolution, Reger said, “We might be able to create a sensor system that may not require lidars.”

(Source: NXP)

In fact, it isn’t just NXP but every radar chip supplier these days gunning for the development of “imaging radars.” For example, earlier this year, Texas Instruments showed off what it calls “cascade radar.” This demo was built with four single-chip automotive mmWave sensor devices.

In general, an imaging radar produces high-resolution 2D and 3D pictures from radar reflections. Because it relies on radio or microwaves rather than visible light, it can see through haze, clouds, and sometimes even walls.

Think about it, said Reger. Both cameras and lidars are optical systems. “When a camera is blind, so is a lidar. It makes sense to combine vision and radar [which is not an optical system].”

Autonomous cars sans lidar

The idea of autonomous vehicles without lidar has been floating around the technology community. It’s tantalizing at a time when the future of lidar remains ill-defined. Lidar will remain costly and its technology landscape is far from being settled. Earlier this year during an interview with EE Times, Alexis Debray, a technology and market analyst at Yole Développement, told us that he considers lidars “not [yet] mature.” He said, “We are at the beginning of big changes.”

There are two types of automotive lidars. “Industrial-grade” lidars are used for robo-taxis. Lidars that Debray calls “automotive-grade” will be deployed in mass-market consumer autonomous cars. The industrial-grade lidar is defined as “durable enough for 24-hour usage, good sensitivity, and performance.” Because they are used for industrial/commercial applications, the cost of lidars, for now, is not a primary concern. They are expensive. When it comes to automotive-grade lidars in mass-market cars, OEMs worry about everything from price and size to cosmetic look and feel.

Reger isn’t saying that a lidar-free future is imminent. “We have to first prove it.”

Several important innovations must be made for the higher-resolution imaging sensors to which Reger is referring. He is talking about a cluster of radars that send and receive signals coherently through multiple channels. “We will need a very mighty microcontroller to steer radars, and the radar system must come with a front end capable of very advanced beam forming,” explained Reger. The volume of data processing for this radar system will be huge. Ideally, radar systems will offer not only stereo-sonic views but also several radar systems around a vehicle. The plan is to make a radar system in an antenna-in-package (AiP) to easily fit in a variety of places around the car.

The automotive industry’s agenda

Asked about the automotive industry’s agenda for the immediate future (instead of long-term full autonomy), Reger was clear on two mandates: to increase EV range to more than 500 miles and to design a Level 3 vehicle.

These missions align with what Reger believes to be NXP’s automotive agenda. “We are working on the development of “super high-precision battery management” for EVs, while improved sensors will help develop L3 cars that could be pushed to L4.

He said, “My father is 82 years old. He lives more than 500 kilometers away from me. He is in good shape, but a 500-kilometer drive is beginning to be a little too much for him.” If he has an EV capable of assisting him to drive on motorways, all he would have to worry about is the short drive to the freeway.

This may sound like a fairly staid autonomy dream. But Reger said, “This will be our use case for EV/AV in the next 10 years. It’s an evolutionary path.”

NXP’s plan for S32

NXP’s partnership deal with an unnamed high-performance computing chip company is likely to be sealed once NXP completes and validates its S32G. S32G is a gateway ECU equipped with full security and safety functions. It’s a microcontroller critical for over-the-air software updates.

Reger acknowledged that the rollout of S32G has been “a little delayed” but added, “We are at the finish line. It will be ready in 2019.”

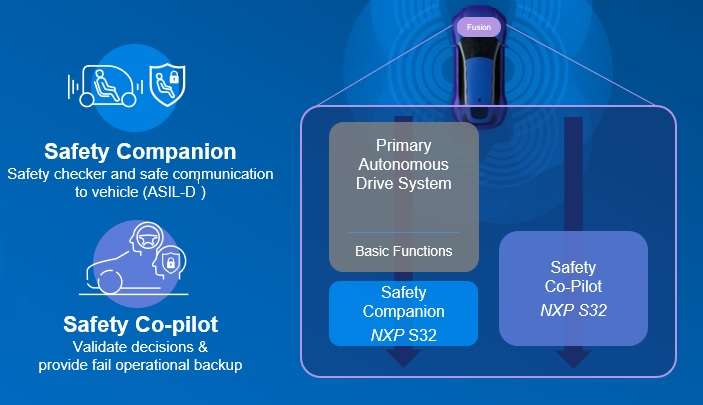

S32 processor for ‘safety companion’ and ‘safety co-pilot’ (Source: NXP)

NXP is preparing the rollout of a host of S32 processors. They include S32R (for radar), S32V (for vision), and S32G (for gateway). There will be another S32 processor, although unidentified, capable of functioning as both a “safety co-pilot” and a “safety companion.” By “safety companion,” NXP means that an S32 processor serves as “a safety checker and safety communication to a vehicle.” Meanwhile, a safety co-pilot S32 “validates decisions made by a big SoC and offers fail-operational backup in case the mega-chip gets sick or dies,” explained Reger.

NXP plans to expand S32 platform. (Source: NXP)

Asked about details of each of these S32 processors, Reger told us that NXP is holding off on the exact specifications and identification of them for now.

— Junko Yoshida, Global Co-Editor-In-Chief, AspenCore Media, Chief International Correspondent, EE Times

Subscribe to Newsletter

Test Qr code text s ss