China Drives Foundry Business Growth

Article By : Dylan McGrath, EE Times

Chinese fabless companies giving foundries more business, more than doubling their orders since 2016

SAN FRANCISCO — China-based fabless IC firms are expected to account for 19% of the global total of pure-play foundry sales in 2018, up from about 9% in 2016 and about 13% last year, according to market research firm IC Insights.

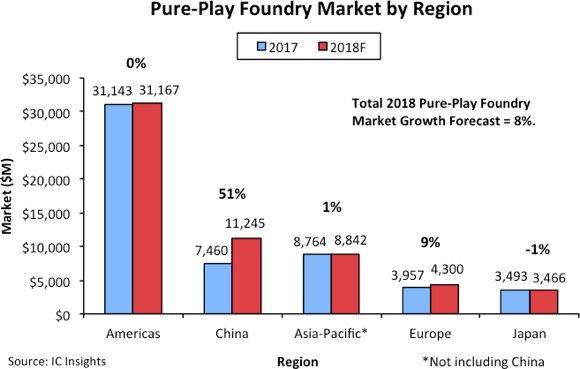

Overall, IC Insights forecasts that the pure-play foundry market will be worth about $59 billion this year, up 8% compared with 2017. China is forecast to be responsible for 90% of the $4.2 billion increase in the total pure-play foundry market this year, the firm said.

With the rise of fabless firms in China in recent years, the country’s share of the global pure-play foundry market has been growing rapidly. But in 2018, China’s pure-play foundry business is projected to grow at the fastest rate yet, rising by 51% to reach $11.25 billion — more than any other market outside of North America. The 51% growth rate of sales to China is more than eight times the forecast 8% rise for the market as a whole.

IC Insights credits much of TSMC’s sales surge into China in recent years to increased demand for custom devices going into the cryptocurrency market. Many of the large cryptocurrency fabless design firms are based in China and most of them have been turning to TSMC to produce their advanced chips for these applications, IC Insights said.

— Dylan McGrath is the editor-in-chief of EE Times.

Subscribe to Newsletter

Test Qr code text s ss