Renesas/IDT Deal: The Benefits

Article By : Junko Yoshida, EE Times

A look at what Renesas stands to gain from acquiring IDT

TOKYO — Renesas Electronics’ plan to acquire Integrated Device Technology (IDT) signals the Japanese giant’s appetite to expand well beyond the automotive sector and delve into data centers and communications. By leveraging IDT’s strengths in RF, power, sensors and real-time interconnect, Renesas will be poised to build a synergistic product/technology portfolio across its existing markets in automotive, industrial and the Internet of Things (IoT).

The M&A frenzy among semiconductor companies has tapered down in the past two years. The biggest acquisition agreement in 2018 was Microchip buying Microsemi at $8.35 billion. Renesas snagging IDT at $6.7 billion is the year’s runner-up, observed Rob Lineback, senior market research analyst at IC Insights.

Industry observers generally welcomed the announcement. IC Insights’ Lineback called the deal “a pretty good fit” for Renesas “with very little overlap, including the Intersil business,” which Renesas acquired a year ago.

IDT likes to refer to itself “as an analog mixed-signal systems IC supplier versus an IoT or embedded solutions provider,” observed Lineback. “Renesas should benefit from IDT’s focus in sensors, signal conditioning, and actuator/motor control ICs that can fit well into its large microcontroller and automotive presence.”

Renesas will pay $49 a share in cash for IDT, about a 16% premium to the U.S. company’s Monday close and 29% higher than the share price when talks were first disclosed. The total sticker price on the deal is about $6.7 billion.

In a one-on-one phone interview with CEOs at Renesas and IDT, EE Times asked about some specific plans Renesas may have for IDT’s current business.

Where’s the synergy in data centers?

One of the new market segments IDT brings to Renesas is data centers.

During the interview, Bunsei Kure, the chief executive of Renesas, acknowledged that the Japanese chip vendor, over the last few years, has been missing out on a red-hot data center market. “We should have been there,” Kure said.

Although Renesas has some power management ICs (from Intersil) in data centers, the Japanese company doesn’t necessarily see a move into data centers as a key to “synergy” either on the product or technology levels. Renesas doesn’t plan to seek to enter the market of the powerful processors necessary for data centers, either. Instead, Kure said, “We will offer our support to IDT’s data center business by providing more resources.”

Lineback noted that IDT’s presence in data center and high computing ranges has been fueled by its DDR3 and DDR4 memory interfaces, PCI Express and other I/O solutions, and timing products.

IDT in automotive, industrial and IoT

In contrast, Kure sees plenty of synergetic opportunities in automotive, industry and IoT.

For example, Renesas-designed R-Car starter kits — designed to support ADAS software development — already contain two timing chips from IDT, Kure noted. “It’s a perfect match to demonstrate our direct synergy,” he said.

Further, Renesas’ interest in IDT includes IDT’s expertise in RF, optical devices for 4G and 5G communication. “5G is very interesting as a standalone market,” said Kure. “But it also becomes critical for ADAS and self-driving cars.” This is because one of 5G’s anticipated applications is connected cars, especially in no-latency V2X communications.

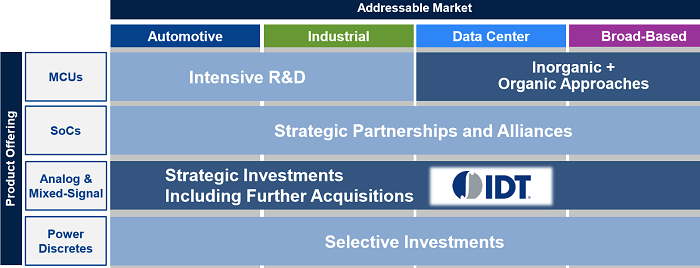

Strategic rationale behind Renesas’ acquisition of IDT: Renesas plans to execute consistent acquisition strategy to strengthen its analog mixed-signal capability. (Source: Renesas)

More specifically, IDT has a portfolio of millimeter wave beamformer products for 5G next-generation communications systems, thus accelerating IDT’s growth in the RF market. It also strengthens its position as a supplier of RF and millimeter wave products for wireless infrastructure. Greg Waters, president and chief executive at IDT, boasted, “5G scheduled for unveiling at Tokyo Olympics in 2020 will be driven by IDT’s RF chips.”

IDT’s leading position in the global wireless power business is also well established. Acquisition by Renesas should lift IDT’s wireless charging solutions to broad adoption among car OEMs in “all types of cars in two years,” Waters predicted.

Kure added that both 5G and wireless charging technologies fit well with Renesas’ IoT portfolio. Communication and wireless charging chips will become a crucial feature “in wearable, medical and monitoring devices,” he explained.

Notably, IDT has been on a growth path through key acquisitions. Last year, IDT acquired optical interconnect IC vendor GigaPeak Inc., a leader in optical, RF and video transport technology.

Late in 2015, IDT bought Dresden-based privately-held ZDMI. This provided IDT a foothold in the automotive sensor market, according Waters.

Highlighting ZDMI’s fame in the auto and industrial segments, Lineback previously told us the ZDMI deal immediately boosted IDT’s appeal. ZDMI’s high-power programmable power devices complement IDT’s existing low- and medium-power devices, “creating a new industry franchise for high-performance, scalable power management solutions ideal for everything from solid state drives to data centers and 4G/5G base stations,” IDT said at the time of the announcement.

China factor

Both Renesas’ and IDT’s CEOs don’t appear concerned about potential rejection by M&A regulators either in China or the United States.

IDT today generates 36% of its revenue in China (including Hong Kong). Twenty percent of Renesas’ revenue comes from China.

Kure said, “Look, our products don’t overlap.” But of course, that didn’t exactly stop China’s M&A watchdog, Mofcom, from delaying the approval process when Qualcomm tried to buy NXP Semiconductors.

Asked about lessons learned from the Qualcomm-NXP debacle, IDT’s Waters said, “Each acquisition comes with a unique set of requirements.” He insisted that the Renesas-IDT situation is much different from Qualcomm-NXP. He added, “Of course, governments have the right to apply their set of requirements.”

However, Waters added, both IDT and Renesas retained “very expensive legal counsels,” who have instilled them with confidence that they can close this deal.

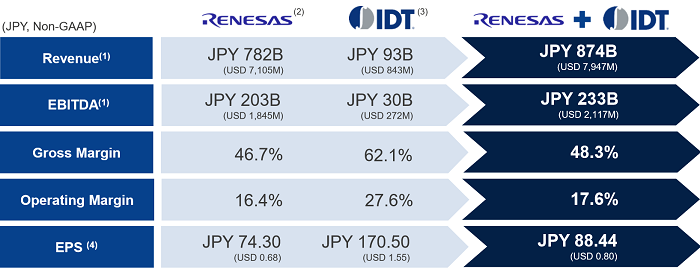

Compelling financial benefits: Renesas describes the deal as immediately and highly accretive to non-GAAP gross margin and non-GAAP EPS by approximately 1.6% points and 18% respectively (Source: Renesas)

Can Renesas/IDT match TI?

Waters painted a picture of the combined Renesas/IDT claiming a unique space within a global semiconductor business in which sales are expected to exceed $460 billion in 2018. “We are neither in a big microprocessor business like Intel is, nor in a memory business like Samsung is today,” said Waters. “We are in the embedded microcontroller business with mixed signal chips — in which we will become a new global champion.”

Asked if Texas Instruments is already the leader in the particular segment he referred to, Waters acknowledged, “OK. You’re right, this isn’t exactly a new category of the semiconductor industry, and we are much smaller than TI.”

Waters explained that the IDT’s robust success in growth margin and growth rate — both well above the semiconductor industry average — lends momentum to Renesas/IDT team. “We have a chance to lead this segment,” he said.

Renesas goes into Lidar business?

While not central to the Renesas-IDT deal, IDT’s on-going partnership with LeddarTech to develop the lidar company’s new LeddarCore IC for mass-market solid-state lidars affords Renesas/IDT a good chance in the solid-state lidar market. With IDT’s optical technology, Renesas’ microcontroller expertise, IDT’s experience in designing custom circuits for LeddarTech, “We will have all the elements necessary” to go after and design solid-state lidars, explained Waters.

Future of Greg Waters

Waters remained vague about whether he plans to stay after the IDT acquisition is signed and sealed. Acknowledging that “We’ve always said that we don’t have global management talent at Renesas,” Kure said that he and Waters are still in discussion about his colleague’s future.

Waters briefly added that even if he leaves, IDT will keep calm and carry on. “People know what to do,” he said.

— Junko Yoshida, Global Co-Editor-In-Chief, AspenCore Media, Chief International Correspondent, EE Times

Subscribe to Newsletter

Test Qr code text s ss