MIPS to be Absorbed by Wave Computing

Article By : Junko Yoshida, EE Times

Enables Wave to go from AI training to inference

MADISON, Wis. — EE Times has learned that Wave Computing (Campbell, California), a startup focused on the development of AI systems using its massively parallel dataflow architecture, will announce later this week that it has acquired MIPS Technologies, a storied but beleaguered Silicon Valley company that developed MIPS processor architecture and related processing cores.

The move will allow Wave Computing to expand from AI training in data centers to AI inference for embedded systems.

EE Times called Wave Computing’s CEO Derek Meyer, and asked him what has motivated the startup to make such a move.

He told EE Times, “Our strategy has always been to push our dataflow fabric out to the edge.” The acquisition should give Wave Computing an opportunity to infuse its scalable dataflow technology with MIPS’s RISC processors while plugging it into MIPS’s ecosystem.

Bold move

An AI startup with just 100 employees acquiring another company of equal size — with long history and deep roots in the tech community — is a rare coup. Several industry analysts called Wave’s move “bold” and noted that the decision could help elevate the buyer in the AI market. “I think it is bold for a small startup to think this big, to reach for market extension before their first product is out,” said Karl Freund, lead analyst for HPC and Deep Learning at Moor Insights & Strategy. “Risky, perhaps, but that’s what it takes.”

MIPS isn’t just any old company, though. Despite its diminsihed position in the processor core IP market, MIPS architecture still has numerous supporters and nostalgic believers. More importantly, a broad range of customers is sticking with MIPS — including Microchip, Mobileye (now an Intel company), MediaTek, and Denso, Japan’s leading tier one.

MIPS’s DNA

Kevin Krewell, principal analyst at Tirias Research, noted that Wave Computing and MIPS — both partly underwritten by Dado Banatao, managing partner of Tallwood Venture Capital — have “a natural affinity.”

Indeed, MIPS’s DNA appears already embedded in Wave Computing, starting with Meyer, once a MIPS vice president for sales & marketing. Mike Uhler, Wave Computing’s vice president of operations, was MIPS’s CTO, and Darren Jones, MIPS’s former head of engineering, is now Wave Computing’s VP of engineering. Wave general counsel Paul Alpern once worked at MIPS as its lead commercial counsel.

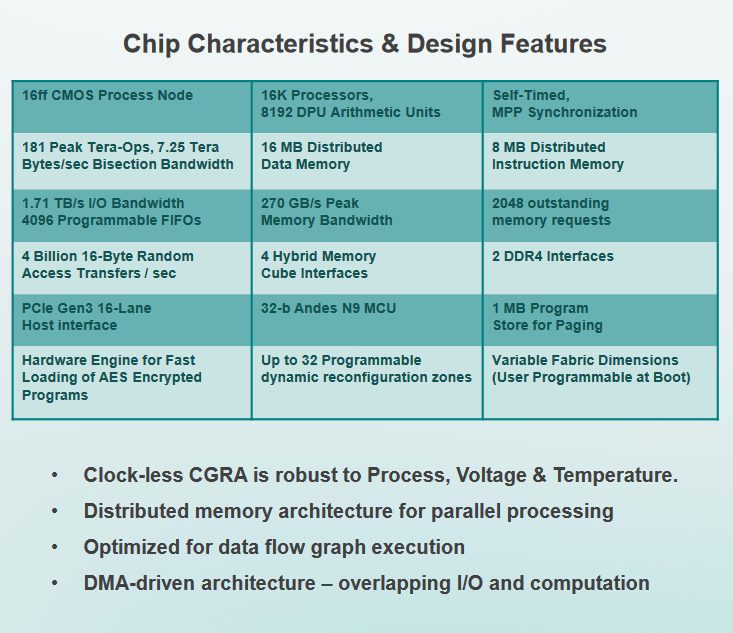

Unlike most M&As that require a lengthy period of adjustment before the two partners can develop a roadmap, the Wave-MIPS team can probably skip those preliminaries. “We’ve been thinking about this for a while,” Meyer said. Wave Computing is already “pretty far along,” to build hooks in a processor CPU for Wave’s Dataflow Processing Units (DPUs) to develop AI-ready CPU cores.

Wave Computing is scheduled to deliver its first AI systems to the first set of customers later this month and “we will be also unveiling a roadmap of our common AI platform built on MIPS and Wave’s DPU before the end of this month — most likely at Design Automation Conference (DAC) in San Francisco,” said Meyer. Asked when AI-ready MIPS will emerge, he promised “before the end of this year.”

While many CPU vendors are shopping for AI startups, “this is a bit of a role reversal,” observed Krewell, with an AI startup buying a CPU company.

As AI is “bringing a new paradigm, and changing a whole computer system,” processor CPUs need “a learning process,” said Krewell. “MIPS needs a machine-learning roadmap.”

Krewell is optimistic about Wave’s MIPS acquisition. He said that not only does MIPS have a great history, it has “an extremely flexible architecture capable of addressing broader markets ranging from servers to embedded systems.” Noting that MIPS was “mismanaged” and lost its focus as part of Imagination Technologies (Tallwood Venture bought MIPS from Imagination last October), Krewell said: “It’s time to reboot MIPS and regain its history.”

The MIPS acquisition is “both cash-flow-positive and accretive” to Wave Computing, according to the company.

The combined company will operate under the name Wave Computing. It will keep the MIPS brand and corporate identity. The MIPS team will operate as an IP business unit. MIPS will continue to license MIPS IP solutions. Licensees ready to move into AI will have the opportunity to integrate Wave’s dataflow technology. As for MIPS licensees that may already have their own AI accelerators (i.e., Denso is a MIPS licensee but it has developed AI accelerators based on ThinCI’s technology), they will continue to use MIPS but without Wave Computing’s DPU.

Common AI platform

There appears to be enough well-wishers for the Wave-MIPS combination, especially among tech veterans with institutional memory. But what will a new generation of engineers and scientists in the AI industry gain from the marriage?

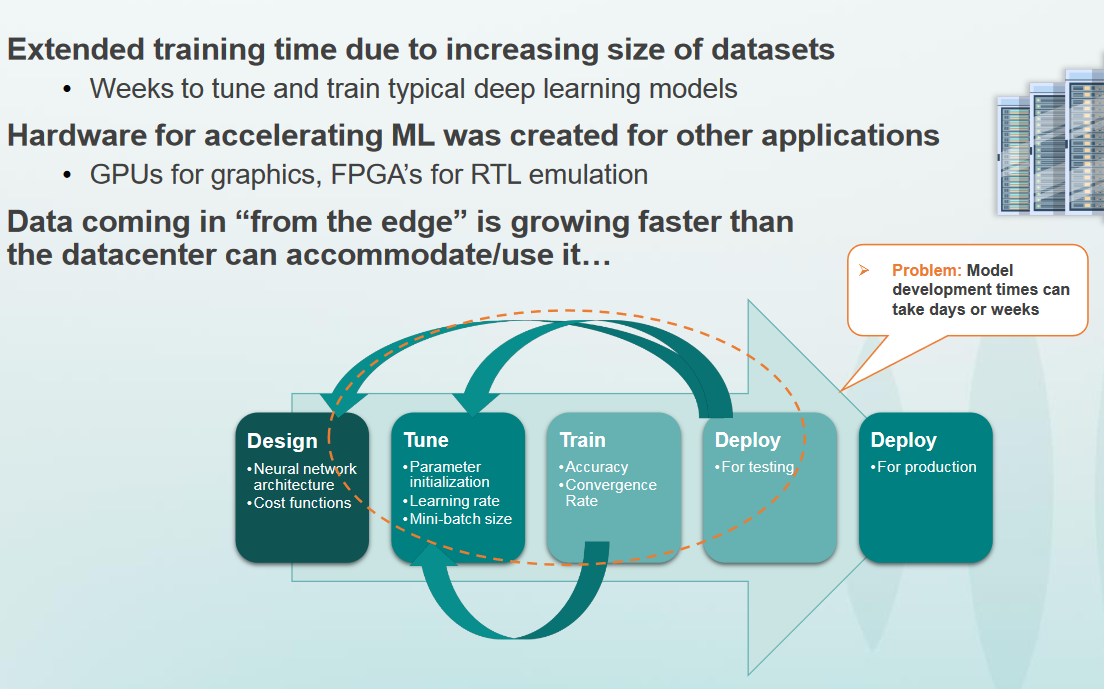

“It’s a common AI platform,” said Meyer. Today, the AI community is burdened with a “dual-architecture approach,” he explained. While deep learning is taking place in data centers using repurposed GPUs, inference languishes on the edge based on “a completely different hardware platform.”

Think about it, he said: “Training is done with a specific purpose to do certain inference, right? If so, why would we go through so many iterations of training in neural networks on one platform only to move to a completely different platform to get inferencing done?”

Challenges in machine learning. (Source: Wave Computing)

In his opinion, the lack of a common AI platform from data centers to the edge is slowing the AI market and reducing the productivity of data scientists.

Wave Computing isn’t alone in looking at the need for a common AI platform. Krewell noted that Google started its Tensor Processing Unit (TPU), an AI accelerator ASIC, initially for inference of machine learning. It recently moved on to a second-generation TPU more geared to training.

Nvidia has a similar story, according to Krewell. Nvidia, a leading GPU vendor, sees much of its AI revenue coming from the training side. But it is also promoting Xavier, an SoC loaded with CPU and GPU cores and other hardware accelerators, designed to power the company’s AI self-driving platform inside automated vehicles.

Having control over both — AI training and inference — is “advantageous” while making the process more efficient, noted Krewell. The industry is still in a “nascent” stage of building standards necessary to transfer data from training to inference without losing data accuracy, he explained.

Wave Computing, for example, offers a complete agent library for TensorFlow called WaveFlow agents. It’s great to be able to use common software — “individual library elements” — for both training and inference, explained Meyer.

Because of the extreme scalability and reconfigurability enabled by Wave Computing’s DPUs, combined with scalable MIPS processor cores already used in a broad market ranging from servers to embedded devices, Meyer believes that pushing an AI common platform to both ends — edge and data centers — is a natural move.

Edge computing, however, can come in many shapes, sizes, and power requirements. How AI-ready MIPS cores, once launched, might stack up against AI-enabled cores from competitors like Arm and Imagination is anyone’s guess. Moor Insights & Strategy’s Freund said, “We will need to wait and see how Wave incorporates data flow architecture into these devices.”

Meyer, however, insisted that the MIPS team, when designing their own AI-enabled CPU cores, will get a head start because of Wave Computing. “We’ve been offering our AI customers compilers, tools, IPs, RTL, chips, our entire AI box, and software,” he explained. “Competing processing core IP suppliers will not get such insights as to how AI solutions must work at customers’ sites.”

‘I told Dado it’s time’

After Tallwood Venture’s Dado Banatao bought MIPS from Imagination last fall, MIPS veteran Meyer opened his mind to the possibility of a merger. But he insisted, “As a startup, our focus was to get our first product out the door. So we’ve maintained an arm’s-length relationship with MIPS.”

Reached by EE Times earlier this year, Meyer stated that Wave Computing and MIPS had no previous relationship. Their only common thread was that “Dado invested in each.” Asked about the relevance of MIPS on today’s competitive RISC processor core market, including RISC-V, Meyer said at the time, “I’ve always loved MIPS and love it more with Dado involved. He’s a real visionary.”

When Wave Computing was getting closer to completing its first product and MIPS was getting its house back in order, Meyer went to Banatao and expressed interest in buying MIPS. Banatao was surprised, said Meyer. “But I told him it’s time.” With Banatao in his corner, Meyer went to Wave Computing’s board and got the green light.

Wave Computing is not disclosing how much it paid for MIPS.

— Junko Yoshida, Chief International Correspondent, EE Times

Subscribe to Newsletter

Test Qr code text s ss