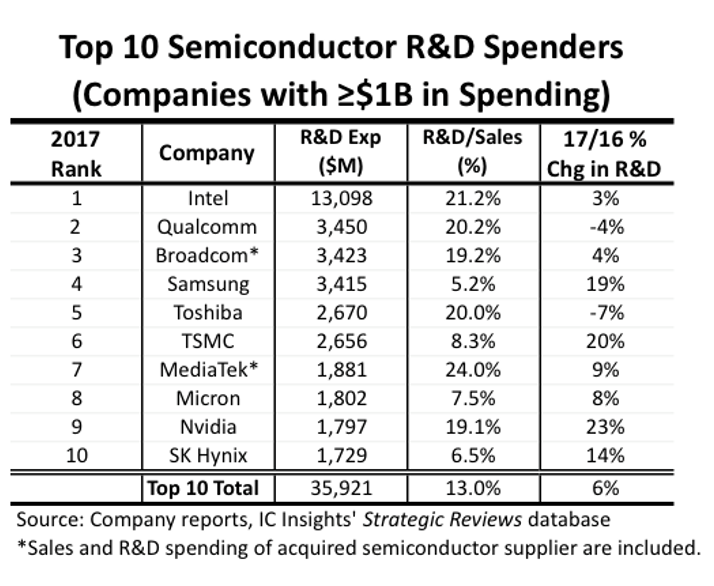

Intel Top Semiconductor R&D Spender

Article By : Alan Patterson

Intel joined by Qualcomm and Broadcom in top three as top ten increase R&D expenditure.

TAIPEI — The 10 biggest semiconductor R&D spenders raised the ante last year by 6 percent, led by Intel, according to market research firm IC Insights.

The top 10 increased their overall expenditures to $35.9 billion in 2017, compared with $34 billion in 2016.

Intel’s $13.1 billion in 2017 accounted for 36 percent of the total expenditures for the group, IC Insights said in a February report emailed to EE Times. The dollar figure amounted to about a fifth of Intel’s 2017 sales, according to the report.

Underscoring the growing cost of developing new IC technologies, Intel’s R&D-to-sales ratio has climbed significantly over the past 20 years, IC Insights said. In 2017, Intel’s R&D spending as a percent of sales was 21.2 percent, up from 16.4 percent in 2010 and 9.3 percent in 1995.

Intel’s R&D spending increased just 3 percent in 2017, below its 8 percent average annual growth rate since 2001, according to the report. The company’s R&D spending exceeded the combined outlays of the next four companies in the ranking —Qualcomm, Broadcom, Samsung and Toshiba.

Total worldwide semiconductor R&D expenditures were worth $58.9 billion in 2017, according to IC Insights. Collectively, the top-10 R&D spenders increased their outlays by 6 percent in 2017, leading the 4 percent R&D increase for the entire semiconductor industry, according to the report. Combined R&D spending by the top 10 at $35.9 billion exceeded total spending by the rest of the semiconductor companies at $23 billion in 2017.

Qualcomm again ranked as the second-largest R&D spender, a position it staked out in 2012. The company’s R&D outlays dropped by 4 percent in 2017, after a 7 percent drop in 2016.

Third-ranked Broadcom and fourth-placed Samsung boosted R&D spending by 4 percent and 19 percent, respectively.

Despite increasing its R&D expenditures in 2017, Samsung had the lowest investment-intensity level among the top-10 spenders, with funding by the world’s largest memory maker at 5.2 percent of sales last year. Samsung’s 49 percent increase in semiconductor revenue in 2017, driven by strong growth in DRAM and NAND flash memory, lowered its R&D as a percent of sales from 6.5 percent in 2016.

Fifth-ranked Toshiba and sixth-ranked Taiwan Semiconductor Manufacturing Co. (TSMC) each allocated about the same amount for R&D spending in 2017. Toshiba’s R&D spending fell by 7 percent while TSMC stood out with one of the largest increases in R&D spending among the top 10 companies. TSMC’s R&D expenditures grew by 20 percent as the world’s largest foundry raced rivals Samsung and Globalfoundries to launch new process technologies. TSMC’s sales rose 9 percent to $32.2 billion in 2017.

In the memory space, SK Hynix’s sales soared 79 percent in 2017, while its R&D spending increased 14 percent, resulting in an R&D/sales ratio of 6.5 percent versus 10.2 percent in 2016. Similarly, Micron Technology’s revenues surged 77 percent in 2017, while its R&D expenditures grew 8 percent, resulting in an R&D/sales ratio of 7.5 percent compared with 12.5 percent in 2016.

Rounding out the top 10 were MediaTek and Nvidia, which moved from 11th place in 2016 to 9th position to displace NXP in the 2017 ranking.

A total of 18 semiconductor suppliers allocated more than more than $1 billion for R&D spending 2017. The other eight manufacturers were NXP, TI, ST, AMD, Renesas, Sony, Analog Devices and GlobalFoundries.

— Alan Patterson covers the semiconductor industry for EE Times. He is based in Taiwan.

Subscribe to Newsletter

Test Qr code text s ss