Xilinx Envisions its Future Without Huawei

Article By : Barbara Jorgensen

With appeals to keep shipping to one of its largest customers denied, Xilinx is going to have to just cope with the loss.

Xilinx Inc. is planning a future that does not include Huawei Technologies, CEO Victor Peng told analysts yesterday.

The chip maker has not received the necessary approvals to ship products to the Chinese networking giant, which the U.S. government has deemed a security risk.

Xilinx shipped $50 million worth of product to Huawei in its first fiscal (June) quarter — just prior to U.S. trade restrictions imposed in May. “Considering the continued trade restrictions with Huawei and the uncertainty presented to our business, we believe it is prudent to remove all remaining revenue expectations related to Huawei from our fiscal 2020 outlook,” Peng said.

Huawei was placed on the United States “entities list” in May, restricting technology sales to the networking giant. Suppliers have been able to apply for special licenses that allow them to ship components to Huawei.

A Huawei-Xilinx breakup will significantly stress both companies and the global 5G supply chain. Huawei reportedly stockpiled U.S. components — including Xilinx FPGAs — in anticipation of the U.S. trade ban. Some industry observers believe that Huawei will soon exhaust the key components needed to manufacture 5G wireless devices.

Xilinx’s FPGA technology allows the reprogramming of 5G base stations by changing the code, even if the base station is already installed in a tower. Telecom companies value that flexibility with 5G because the technology is new and will probably require frequent adjustments over time. The Huawei trade ban increases the likelihood that Xilinx will be designed out of its 5G products.

Joe Madden, chief analyst of California-based research firm Mobile Experts, told The Washington Post that Huawei is running low on its stockpile of Xilinx FPGA chips.

Recommended

外媒称华为库存将耗尽,华为:不含美元器件5G模块已全球发货

“I predict that Huawei will use up Xilinx FPGA chips in November,” Madden told the Post, “when they will switch to their own products. But this may reduce the appeal of Huawei 5G devices to global buyers, because Huawei Technology may not be as advanced as Xilinx.”

Huawei’s chips aren’t likely to be field programmable in the same way Xilinx’s are, he said.

Zhang Wenlin, president of Huawei’s strategy department, has publicly stated that Huawei’s base stations that do not contain U.S. parts are no worse than those that include American components. In other words, the full use of domestic parts for 5G base stations is only the first step for Huawei, but it is also the most critical step.

Is Huawei concerned?

Madden believes that if Xilinx’s chips are replaced, Huawei will be in trouble. However, during Huawei’s recent 10th Global Mobile Broadband Forum (MBBF), Yang Chaobin, president of Huawei’s 5G product line, said that Huawei’s 5G commercial contracts have reached more than 60.

Chaobin pointed out that some of its 5G modules contain U.S. components while others don’t. From the perspective of products, there is no difference, he said.

Huawei has shipped more than 400,000 5G base stations, Chaobin said. Of the 60 commercial contracts signed, 32 are from Europe, 11 are from the Middle East, 10 are from Asia Pacific, 7 are from the Americas, and 1 is from Africa.

“It is a fact that we can survive without the supply of the United States,” said Huawei founder Ren Zhengfei at a business forum in late September. Huawei is already producing 5G base stations that do not contain U.S. parts, he added. Beginning this month, Huawei is starting mass production of those base stations and plans to more than double its output by 2020.

Huawei has not closed the door on the U.S., Zhengfei added. “First, we are willing to follow the FRAND principle of international practice to license 5G patents to U.S. companies in a fair and non-discriminatory manner. Secondly, Huawei would like to license its 5G technology to the United States so American, European, and Chinese companies can roll 5G out at the same time and continue to compete on new technologies. Third, the United States can choose 5G base stations based on U.S. general-purpose chips or choose those chips plus Huawei chips. That way, if we need our 5G chip technology, we can also transfer the license.”

The United States is still welcome to resume supply, Zhengfei added. Because Huawei has been in contact with suppliers for more than 30 years, Huawei’s inability source parts hurts its partners as well.

Xilinx is still in the base station business

Xilinx has stressed it is not out of the 5G base station business, even in China. “Clearly, the Huawei [decision] has significant impact, but they’re not our only customer in China,” Peng told analysts. “So, we are still participating in China deployment, though Huawei has a big impact.”

Xilinx has been able to ship some of its older products to Huawei, Peng said, but the revenue has been negligible. “Multiple research analysts had estimated our full-year revenue exposure to Huawei to be approximately 6 percent to 8 percent of our total revenue, which is in the range of what we are anticipating at the beginning of the fiscal year. Huawei is an important customer, and we hope that an agreement between the US and Chinese governments is reached as soon as possible, so we can resume engaging in a manner consistent with an important customer. “

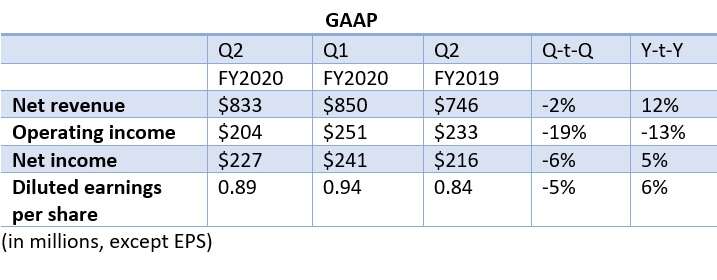

(Source: Xilinx)

Xilinx reported revenue of $833 million its second fiscal quarter of 2020, down 2 percent from the prior quarter and up 12 percent year over year. GAAP net income for the September quarter was $227 million, or $0.89 per diluted share. Non-GAAP net income for the September quarter was $240 million, or $0.94 per diluted share.

“Overall, the first half of our current fiscal year remained strong despite the impact of continued business restrictions related to Huawei which was offset by higher than expected 5G product demand from other global communications OEMs and stronger than expected growth in our data center business,” said Peng.

Several semiconductor makers — including Skyworks Solutions, Qorvo, and Micron Technology — have resumed sales to Huawei. Xilinx will continue to monitor its license applications, Peng said.

“We obviously have been tracking [our trade compliance] extremely carefully with our internal and external counsel, and we talked to Department of Commerce. We applied, as I said in our prepared remarks, for our licenses. None of those have come through.”

Subscribe to Newsletter

Test Qr code text s ss