Semiconductor Market Conditions Worsen

Article By : Dylan McGrath

Gartner slashes forecast as memory price declines, trade war hit industry harder than originally forecast.

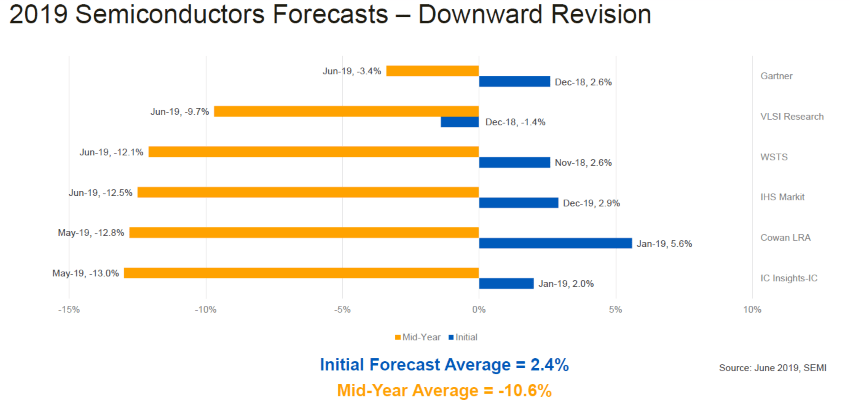

SAN FRANCISCO — Semiconductor industry revenue is on track to decline further than initially expected this year as a combination of factors including memory price declines and the U.S.-China trade war continues to hit the industry harder than originally forecast, according to market research firm Gartner.

Gartner (Stamford, Conn.) said it now expects chip sales to fall by nearly 10% to $429 billion this year, which would mark the lowest revenue for the industry since 2017. The forecast represents a revision from Gartner’s previous forecast, issued last quarter, which called for chip sales to decline by 3.4% this year.

The revised forecast also brings Gartner more in line with some of the other major research firms. Last month, the World Semiconductor Trade Statistics organization issued a revised forecast calling for a 12.4% decline this year. IC Insights, IHS Markit and independent semiconductor analyst Mike Cowan have all projected that chip sales will be down between 12.5% and 13% this year.

The ongoing trade war between the U.S. and China, as well as the Trump Administration’s decision to place Chinese telecom giant Huawei Technologies on an export control blacklist loom as major obstacles for the semiconductor industry in 2019 and beyond. Gartner and other market watchers believe these combined issues will accelerate China’s domestic semiconductor production, as well as create local forks of technologies such as ARM processors. Some manufacturing is already relocating outside of China, and Gartner predicts that many other companies will seek to diversify their manufacturing base to reduce further disruptions

An oversupply in memory chips — which drove the semiconductor industry boom for more than two years — remains the biggest culprit in the market’s 2019 outlook. Gartner projects that DRAM pricing will decline by 42% and predicts that DRAM oversupply will extend through the second quarter of 2020. Gartner cites signs of a slower demand recovery among hyperscale vendors and the increasing inventory levels of DRAM vendors.

Meanwhile, oversupply conditions that have existed in the NAND flash market since the first quarter of 2018 have grown more pronounced, as the near-term demand for NAND is weaker than expected, Gartner said.

“We expect that high smartphone inventory and sluggish solid-state array demand will last for a few more quarters,” said Ben Lee, a senior principal research analyst at Gartner, in a press statement.

“Given the aggressive price declines for NAND, it is possible to see a more balanced supply/demand outlook in 2020,” Lee added. “However, looking further out is concerning given slowing demand drivers, such as PCs and smartphones, and more capacity as new fabs in China impact the market.”

Subscribe to Newsletter

Test Qr code text s ss