Rumours of an End to the Trade War Met with Skepticism

Article By : Junko Yoshida

Tech leaders at the Global CEO Summit in Shenzhen welcome the possible truce in the U.S.-China trade war, but most are jaded enough to suspect it's "fake news."

SHENZHEN, China — Technology leaders gathered here at an annual conference have heard the rumor about a possible truce in the U.S.-China “trade war,” but most are jaded enough by now to regard it as a “fake news” bulletin.

A year ago, when Aspencore (the media company that owns EE Times) hosted the Global CEO Summit here, two topics that occupied almost every conversation were AI and Donald Trump. Engineering executives from China, the U.S. and Europe, were almost unanimously anxious about the growing “economic tension” between the world’s two largest nations. Speakers avoided these topics on the keynote stage, but in corridors and during coffee breaks, they quietly discussed the threat of trade friction.

No one then, however, was calling it “a trade war” — yet.

Fast forward to this Thursday, back in Shenzhen. Just as the conference opened, the Chinese commerce ministry in Beijing announced that China and the United States have agreed in principle to “cancel” tariffs imposed in their trade dispute.

This seemingly good news didn’t exactly trigger a lot of champagne-popping at the CEO Summit. Most attendees, previously aware of a “potential truce” in the works, remained skeptical. They even stayed mum during breaks and at the awards dinner.

More than a year-long exchange of tariff threats and proposed restrictions on each country’s companies (and technologies) have by now conditioned the global electronics industry to accept a permanent state of uncertainty.

The prevailing sentiment is that no news is good news is fake news.

The announcement on Thursday came from Beijing, not Washington. Reuters reported that Gao Feng, spokesman at the commerce ministry, explained that China and the United States must simultaneously cancel some tariffs on each other’s goods for both sides to reach a “phase one” trade deal. “The trade war started with tariffs, and should end with the cancellation of tariffs,” Gao told reporters.

However, he did not give a timeline.

Trump is China’s BFF?

EE Times asked several participants at the Global CEO Summit about the trade war.

One Chinese executive said, half-jokingly, “Trump is China’s best friend.”

By talking up China so much, the U.S. President has afforded Chinese tech companies the appearance of equal standing with American rivals, he said. “But in fact, Chinese companies are still so far behind, compared to their counterparts in the United States.”

A Huawei employee earlier this year also tried to put a positive spin on the adverse situation. “The U.S.-China trade war was the best thing that happened to us. Five years ago, nobody in the world knew who we were.”

The U.S.-China trade war, however, is real. It has forced the U.S.-based key semiconductor companies to drop their business with China — especially with China’s telecom gear giant Huawei. Qorvo is one such casualty. Asked who will fill the gap when Huawei can’t source RF solutions for their 5G handsets from Qorvo, a company executive, who spoke on the condition of anonymity, said, “local Chinese companies and Japanese vendors.”

He added, “They are not as good as we are,” but Huawei has been able to continue their business.

IP ownership issues

Aside from dealing with perpetual political uncertainties, global chip companies have been wrestling with another big hassle: Figuring out intellectual property ownership issues for their cores or SoCs.

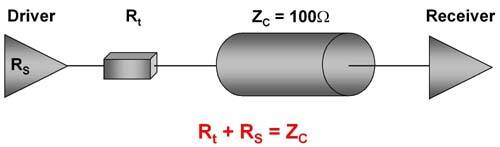

If more than 25 percent of intellectual property used in any particular core or chip has been designed or originated in the U.S., their export to China would be restricted. Since most global semiconductor companies have design teams scattered all over the world, accurately measuring IP content and proving their provenance is next to impossible. Today, self-certification is the common practice, but no socially responsible companies can risk not doing their homework on IP content, just in case a government agency decides to run random checks. “We can’t afford to fail the compliance test,” said another executive.

Arm which sent an internal memo in May, instructing its employees to cut off all contact with Huawei, reversed its position in September. Asked why, Arm told us:

After an assessment of Arm’s products and its partnership with Huawei, Arm concluded that the patents behind its major chip design architectures were based on technologies from the U.K. and thus will not be affected by the U.S. trade ban for business with Huawei and HiSilicon.

Recommended

Arm Reaffirm Their Relationship with Huawei

It took Arm months and millions of dollars to trace which design teams in which locations generated each IP, in order to determine what the company could safely sell in China and what it could not.

According to Huawei, one third of its supply chain runs through the United States. Last year alone, Huawei spent $11 billion with U.S. suppliers.

In the era of restricted trades between the two countries, many tech companies — both based in China and the United States — have grown accustomed to avoiding public discussions on their present and future relationships.

Huawei recently held in China its annual event honoring key suppliers. Reportedly, some U.S.-based chip companies who have done some limited work with Huawei this year were also invited. But fearful of unnecessary scrutiny from the Trump Administration, Huawei refrained from publicly presenting the Americans with any award. Instead, those companies were recognized privately.

Self-sufficiency becomes a mantra

Meanwhile, “self-sufficiency” has become the growth mantra for China’s semiconductor industry. As indicated in the recent rollout of China’s Big Fund Phase II, the government’s explicit goal is to build an independent, self-sufficient and “controllable” supply chain for the Chinese IC industry.

Wayne Dai, CEO of VeriSilicon, however, told EE Times, “It’s unfortunate for China to become so inward-looking.” The development of technologies should be fundamentally a global activity, he added.

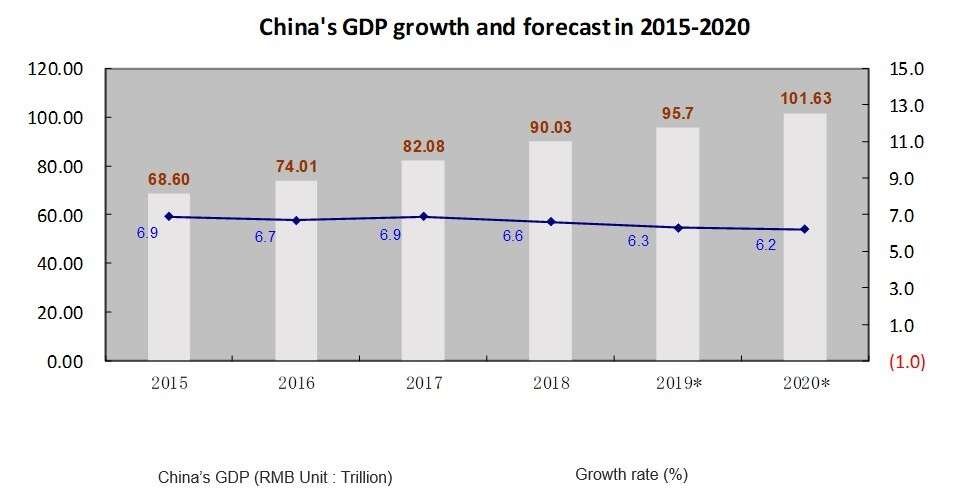

Both the United States and China are under pressure to reach an interim deal. China’s growth has this year slowed to its lowest level for three decades, posing a substantial drag on the global economy. Presumably, if the two governments decide on a major rollback of existing tariffs, the deal would have a broader beneficial economic impact.

Subscribe to Newsletter

Test Qr code text s ss