Questions for the Mobile Industry

Article By : Junko Yoshida

The MWC's cancellation doesn’t mean the mobile industry has stopped working. Nor does it mean that the curiosity of the media and analysts has dried up. Here are our seven questions.

BARCELONA — In the absence of the Mobile World Congress (MWC), Barcelona is eerily quiet.

When GSMA pulled the plug on MWC earlier this month, all the face-to-face appointments at the show got scrapped. Moreover, all the pre-briefings — arranged as phone interviews before the show — were also cancelled. Presumably, all the announcements cleverly timed for an MWC splash are “postponed.” But no companies were ready to tell me when, where and how they are rescheduling their planned product introduction.

[That said, Huawei just announced today Mate Xs, the company’s updated version of the foldable phone.]

Obviously, the show’s cancellation doesn’t mean the mobile industry has stopped working. Nor does it mean that the curiosity of the media and analysts has dried up. Given that the industry is still in the early phase of 5G rollout, as features, functions, designs and smartphone apps continue to evolve, there’s no less scrutiny on the mobile industry.

There are questions that would have been easier to get answers for, had those with the answers all gathered at MWC. Since they aren’t going to be all in one place, all at the same time, these are the questions we’ll be asking moving forward:

- When will we have a “universal” 5G smartphone?

Today, we have a 5G phone that works in networks using mmWave, but that phone is non-functional in networks where the frequency band is sub-6 GHz.

During the Qualcomm’s Snapdragon Tech Summit last December, company president Cristiano Amon said, “Real 5G is really the combination of sub-six and millimeter wave, and that’s going to happen on a global scale.” He noted then that the industry’s expectation was that by the end of the first quarter of 2020, there will be smartphones supporting both millimeter wave and sub-6 GHz.

MWC could have given a clue as to which smartphone vendor could be first to launch the universal phone.

- What kind of apps will really drive mmWave 5G?

Some wireless carriers — especially in the U.S. market — are using very high frequency bands, over 24 GHz. The downside of these signals (in mmWave bands) is their limited geographic range. The upside, however, is its ability to offer maximum downlink speeds.

It’s been reported that if you’re near a cell tower, you’ll see peak cellular speeds between 1- to 3 Gbps, roughly 30-80 times faster than today’s typical U.S. 4G connections. This matches or exceeds current top-performing home broadband packages. Meanwhile, Qualcomm and Samsung are now saying that their latest 5G modems can peak at over 7 Gbps on mmWave.

That sounds all good, but really, who needs that much speed to do exactly what?

Claire Troadec, Power & Wireless Division director at Yole Développement, told EE Times, “They say that mmWave will be leveraged by B2B, but what are those applications?”

- Fallout of The U.K.’s 5G directive on the limited use of Huawei gear

Earlier this month, the U.K. decided not to ban Huawei outright. Government agencies will allow U.K. mobile operators to deploy Huawei’s 5G network equipment at a controlled rate.

Specifically, Huawei will not be allowed to provide more than 35 percent of the base station site equipment in any 5G network, nor carry more than 35 percent of any network’s traffic.

This “limited-use” approach isn’t entirely good news for U.K. operators, because of its unintended consequences. EE Times’ telecommunication editor John Walko explained in his recent story, “This inevitably means that operators will have to start ‘ripping out a significant portion of the installed 4G equipment,’ because operators must deploy the same vendor’s equipment across 4G and 5G to avoid interoperability problems.”

We have no idea if other European countries will follow suit. The MWC would have been a forum for operators to compare notes and exchange some work-around ideas — either publicly or behind closed doors.

- Invest in Nokia or Ericsson?

On the other hand, the Trump Administration’s outright ban on Huawei equipment among U.S. mobile operators could mean opportunity for Nokia and Ericsson. Neither company, however, has commented on their strategy.

Meanwhile, in early February, US attorney general William Barr suggested that the United States should acquire a controlling share in Ericsson and Nokia to help build a stronger competitor to Huawei.

As Walko put it, “Barr’s thesis seems to be that if the U.S. industrial and financial community, with the backing of the administration, were to put its muscle behind such a strategy, and combined size of the U.S. market, it would create a group much more able to compete with — clearly — Huawei in global markets, and eliminate any security concerns.”

Barr’s idea, apparently, has not been run by either of the Scandinavian duo or the Finnish and Swedish governments. But the MWC would have been a good venue to probe whether Ericsson or Nokia would welcome a trans-Atlantic investment.

- China will continue to ‘design out’ US technology

Paul Triolo and Kevin Allison, at the Eurasia Group, recently co-authored an essay entitled “Will the battle over Huawei kill globalization?” The authors described today’s Huawei “in overdrive to ‘design out’ U.S. technology.”

Indeed, Huawei had already claimed success in designing a 5G base station with no U.S. components.

The big question here is: Who might have been seen hobnobbing with Huawei at the MWC, had the Congress taken place?

One lingering issue is that 5G will need a ton of parts and components to get its front-end right. Vendors must use additional power amplifier (PA) modules with filters, switch, and potentially low noise amplifiers (LNA) — both for uplink and downlink data streams, explained Yole. Tuner count will also increase, to enable each stream’s antenna optimization.

It is well known that the U.S. banishing Huawei has created opportunities for Japanese component companies such as Murata, Sony, Toshiba, Taiyo Yuden and Kyocera. But that’s not all. Yole’s Troadec, for example, expects that this pressure will serve to reinforce China’s ecosystem.

It goes without saying that the big losers are U.S. parts and component companies. The Trump trade war with China has already caused a measurable revenue loss among U.S. vendors. This could trend into a loss of their leadership on the global market, Troadec observed.

- Radar in your handsets?

Google last fall rolled out its Pixel 4 smartphone, which deployed a radar-based technology for the first time, so that it offers “Motion Sense” capabilities.

Under a project named “Soli,” Google designed a radar technology that tracks a range of human gestures, from a finger-tap to whole body movements.

Google’s so-called Soli chip and its underlying hardware technologies were developed by Infineon Technologies.

Pixel 4 poses a big-volume opportunity for Infineon’s radar chips. But will radar-equipped handsets become a new trend on the smartphone market?

Yole’s Troadec said, “I would have liked to find out if other smartphone vendors have an appetite for radar chips,” had the MWC been held this year.

- Time-of-flight sensors in smartphones

Last year, the foldable handset was all the rage at the MWC. The bezel-less or bezel-free smartphone was another hot trend observed in recent years. The obvious benefit is that less bezel means more screen.

You might ask who cares about such cosmetic changes. But you should care. New shapes, aesthetic designs and shiny-object features that pop up in each new smartphone generation at MWC tend to trigger a fresh demand for certain ICs and components.

For example, in pursuit of a bigger screen, smartphone system designers began eliminating the buttons on the front of the phone a few years ago. For this, they had to embed a fingerprint sensor underneath the smartphone display. Apple, on the other hand, took a structured light approach in 2017 to create a front 3D camera for face-unlock.

If the 2019 MWC was all about foldable handsets, what would have been this year’s hottest trend for next-generation smartphones at MWC?

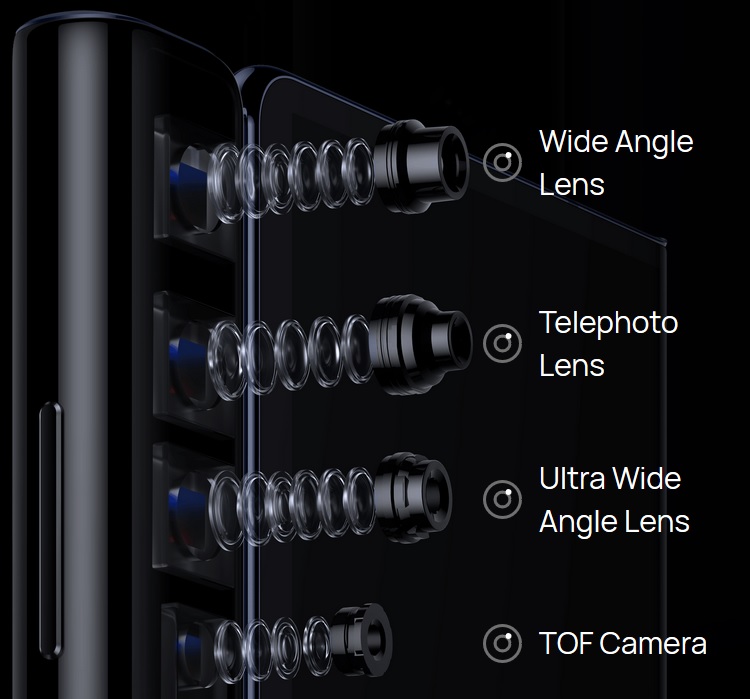

Yole’s Pierre Cambou believes that the proliferation of 3D sensors in smartphones is a trend already well established in 2019. These 3D sensors, he noted, won’t be based on a structured light, but time-of-flight (ToF) cameras. ToF sensors are typically far less complex (compared to what Apple did with its structured light), reliable in direct sunlight, and require lower computational processing, he explained.

(Apple itself is reported to be considering replacing structured light with something else, possible ToF. —ed.)

Beyond the transition from structured light to ToF, Huawei has already proven Cambou wrong by switching placement of ToF sensors from front to rear camera.

Many analysts initially expected that 3D camera applications would be in the field of authentication and security, as well as creation of more AR games and 3D measurement by smartphones.

While the industry’s hope is eternal for such AR/VR applications enabled by ToF sensors, it was Huawei who changed the game by leveraging its rear-view ToF camera to generate depth information to dramatically improve the image quality. The 3D camera feeds data to the phone’s AI software to defocus the background of an image, for example. The effect is called the bokeh blur, favored by professional portrait photographers.

Again, what we don’t know is the new applications smartphone vendors could have talked up at MWC 2020 — enabled by their new smartphones.

Barcelona without MWC

On a side note, I find Barcelona without MWC pleasant. With hotel reservations that I couldn’t cancel and train tickets that couldn’t be fully refunded, I decided to come here anyway.

I’ve never seen the Rambla so empty.

On the subway, there’s no shoving and pushing by mobile geeks, who usually occupy whole train platforms. No big crowds snaking up the staircases to connecting trains. No human bottlenecks at the exit turnstiles leading to the Fira de Barcelona Gran Via.

But even without the MWC mob, I’ve still heard a few people talking shop. I hear the magic word: “5G.” And like those hotel reservations that couldn’t be cancelled, there’s a non-refundable billboard near the Rambla that says “Hola 5G, Hola Oppo.” The Chinese smartphone company must have bought that space with good intentions, long before fears of a Chinese epidemic quarantined this year’s MWC.

I also found a poster (below) plastered on the wall in the downtown Barcelona. The artist succinctly distilled the message: Coronavirus killed the show.

Subscribe to Newsletter

Test Qr code text s ss