Q1 Forecast Disappointing for Foundry Sales

Article By : Dylan McGrath

Semiconductor foundry revenue growth is stalling due to weak demand for advanced production processes in several end markets — including smartphones — according to one market watcher.

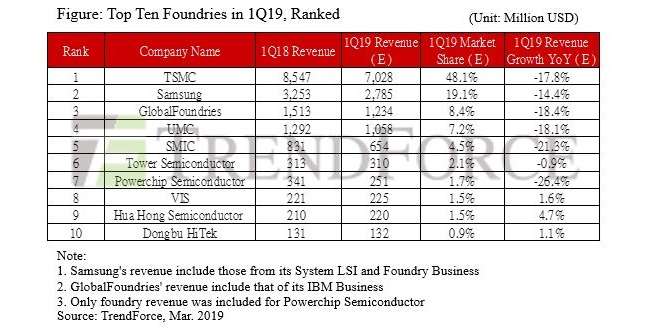

Taiwanese market research firm TrendForce forecasts that first-quarter global foundry sales will fall to $14.6 billion, down 16% compared to the first quarter of 2018.

Recommended

TSMC loses US$550 Million Due to Bad Photoresist

The top 10 foundries in terms of sales remain unchanged in the first quarter compared with last year, according to TrendForce’s estimates. However, each of the top 10 companies experienced a double-digit decline in sales compared with the first quarter of last year, according to the firm.

TSMC remains far and away the largest foundry, with first-quarter market share of 48.1%. However, the foundry giant’s first-quarter sales are on track to decline 17.8% compared to the first quarter of 2018, according to TrendForce.

TrendForce attributed TSMC’s first-quarter revenue decline partially to a defective photoresist issue that forced the company to scrap as many as 30,000 wafers last month. But the market research firm also blamed the sales shortfall on lower-than-expected sales among its smartphone customers and a drop in the market for cryptocurrency mining.

TrendForce said that it expects TSMC’s sales for the rest of 2019 to be boosted by first-quarter shipments that slipped to the second quarter as well as increased sales from customers such as HiSilicon, Qualcomm, Apple, and AMD. “We may get a chance to see TSMC’s revenue climb its way out of the 1Q19 valley season by season,” TrendForce said in a statement.

Subscribe to Newsletter

Test Qr code text s ss