LoRa, NB-IoT Lead the Pack in LPWAN Race

Article By : Rick Merritt

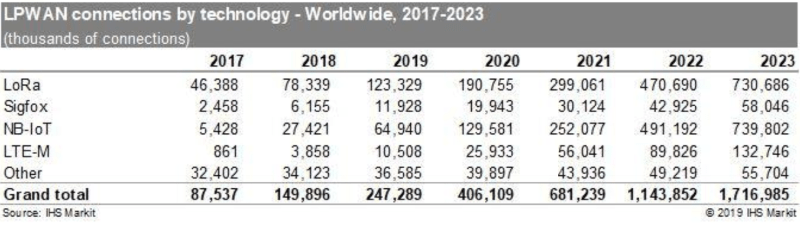

LoRa and the NB-IoT will grab most of the long-range IoT network action through 2023, according to a new report.

LoRa and cellular’s Narrowband-IoT are far ahead of a pack of low-power wide-area networks (LPWANs) staking out early design wins in the Internet of things. The LTE-M version of 4G cellular is a distant third and Sigfox trails, according to a new report from IHS Markit.

The report suggests a once wide-open field is beginning to narrow significantly. However, it’s still early days. IHS estimated just 150 million LPWAN links were deployed in 2018, a figure it expects to expand at a 63% compound annual growth rate to hit 1.7 billion links by 2023.

It’s also worth noting some alternatives are just emerging from the lab. For example, multiple vendors are shipping their first chips this year for a 900-MHz version of Wi-Fi called HaLow that’s expected to hold significant promise for long-range connections. And last year research institute CEA-Leti announced early work on a new option based on a patented Turbo-FSK waveform.

That said, IHS forecasts NB-IoT and LoRa could claim 86% of all LPWAN links in 2023. “We think it is a two-horse race by 2023 with LoRaWAN more in private and NB-IoT mainly in public networks,” said Christian Kim, one of the authors of the report.

Interestingly, Huawei’s HiSilicon division is the leading supplier of today’s NB-IoT chips, 90% of which are deployed in China. Taiwan’s Mediatek is second, and China’s RDA Unisoc is third in NB-IoT silicon. NB-IoT had its origins in technology from U.K. startup Neul, acquired by Huawei in 2014.

The relatively sluggish market for LTE-M chips is led by Qualcomm, followed by Sequans and Altair. Semtech is by far the dominant supplier of LoRa chips, the current market leader among LPWANs.

Overall, 54% of last year’s LPWAN deployments were in China versus about 23% each in the Americas and the EMEA region. Government-backed smart-city projects in China are driving NB-IoT today with deployments in smart meters, parking meters and streetlights.

“Most projects are using government money. A lot of enterprises have not warmed to NB-IoT even in China,” said Kim.

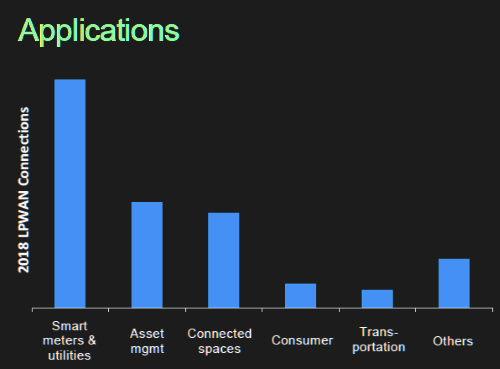

To some extent, the LPWANs are solutions seeking problems. IHS currently tracks 20 use cases proposed for the links.

The China government is promoting use of NB-IoT in smart homes for electronic locks, smoke detectors and other uses, and Huawei has talked about its use in agriculture for more efficient dairy farms. However, it has not yet taken hold in such applications to date, Kim said.

In the U.S., Wi-Fi and Bluetooth by far dominate in the smart home. And in developed countries, dairy farms already are operating at high efficiency levels, he added.

LoRa and NB-IoT could command 86% of all LPWA deployments by 2023.(Source: IHS Markit)

LoRa and NB-IoT could command 86% of all LPWA deployments by 2023.(Source: IHS Markit)

Sequans, IHS have different views of LTE-M

Both NB-IoT and LTE-M are based on 4G LTE. LTE-M offers Mbps data rates with a generally more expensive module while NB-IoT is limited to about 200 kbps and sports a simpler, cheaper module.

Operators in Australia, Japan, Korea and the U.S. are taking longer than counterparts in China to roll out NB-IoT because it requires some new hardware in their networks. They were quick to turn on LTE-M because it could be supported with software upgrades.

Nevertheless, “they had trouble implementing LTE-M… A lot of them got stuck or are still stuck in test phases, and some carriers even told their vendors to bring products back when they were working,” Kim said, noting network errors have largely been cleared up.

“Sequans has been showing less than expected revenues for LTE-M for the last two quarters, and they were the biggest advocate of it,” said Kim. “They had an aggressive expectation to begin with, but by design LTE-M is more expensive and not designed for a volume play,” he added.

Asset tracking leads as many as 20 LPWAN use cases market watchers track.(Source: IHS Markit)

Asset tracking leads as many as 20 LPWAN use cases market watchers track.(Source: IHS Markit)

Didier Dutronc, chief marketing officer for Sequans, disagreed.

“NB-IoT is the leading IoT technology in China because it was made mandatory by the Chinese government, but outside of China LTE-M is being driven by market demand due to the shutdown of older technologies such as CDMA, 2G, and 3G,” Dutronc said in an email.

“Because LTE Cat M has enough capability, it will replace most of the legacy M2M (industrial IoT) connections. This is already seen in North America and Japan where LTE-M has been deployed first,” he said.

By contrast, “NB-IoT volume will be 80 percent driven by China, mostly for new applications where devices need to be built and business cases proven. Sequans provides technology for both LTE-M and NB-IoT (deployed and operating) and is the only non-Chinese chip company with a dedicated NB-IoT-only chip,” he added.

LPWAN got its start when Sigfox nailed $115 million in venture funding in early 2015. In the gold rush after that deal other rivals such as OnRamp emerged but have been quiet since.

Sigfox came under pressure last year to show investors returns. Inquiries to two Sigfox managers in the U.S. were not immediately returned.

“It’s still really early days for LPWAN…even China’s numbers have been disappointing,” said Kim.

Subscribe to Newsletter

Test Qr code text s ss