Joint Venture for 200 mm Fab

Article By : Rick Merritt

New York state is well-positioned to win a bid for making analog, power, and discrete chips, according to a veteran of dozens of semiconductor fab deals

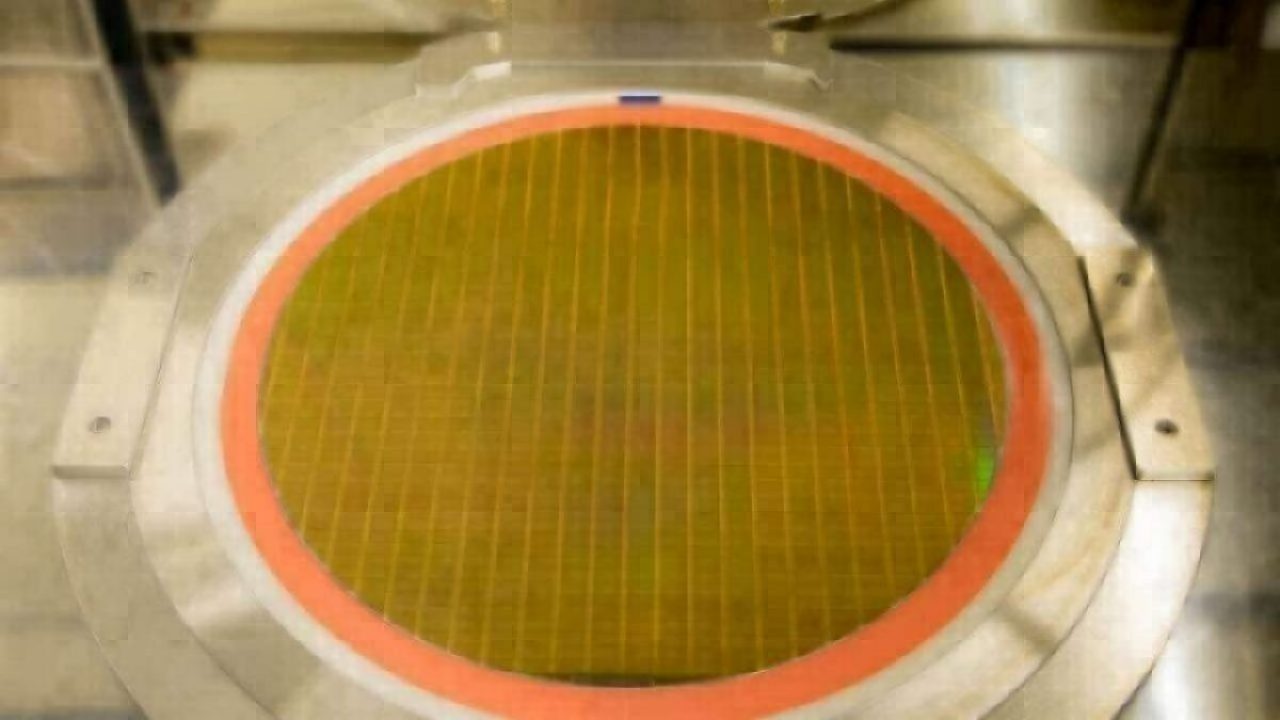

The next big fab may be a joint venture for making analog and discrete products on 200-mm wafers, far from the bleeding edge in semiconductors. That’s the view of Stephen Rothrock, who spent 20 years putting together fab deals and is bullish that the U.S. could get the next one.

Overall, 200-mm fabs and tools are in demand, while newer 300-mm facilities and tools are in oversupply, said Rothrock, chief executive of ATREG. He thinks that upper New York State is well-positioned to expand its emerging semiconductor sector.

“We haven’t seen a new 200-mm fab in the U.S. yet, but I think it’s a good possibility in the next 18 to 24 months — it could be for analog, discrete, and power products, and my guess is it will go into New York,” he said, citing investments already made there by GlobalFoundries and a Danish assembly and test company.

A joint venture in which two companies share costs of building, outfitting, and running a 200-mm fab is “a model that will get experimented with in the near future… to push to lower geometries and higher capacity,” he said, adding that they could run wide bandgap, silicon carbide, gallium arsenide, and other specialty processes.

A joint venture for a 200-mm fab would not be a first. STMicroelectronics, Philips, and Motorola partnered on the Crolles2 plant in Grenoble, France. Philips and TSMC partnered on a 200-mm fab in Singapore.

“Running the fab together allowed each company to mitigate cost of construction and have greater operational efficiencies as they were sharing costs and loading faster — a good strategy for mid-sized companies,” he said.

He foresees the possibility of a three-story fab. Two floors could each provide 100,000-square-foot clean rooms, with a lower floor handling air and water coolers.

The rise of automotive, IoT, and 5G is driving the need for 200-mm parts, Rothrock said, noting that TSMC recently announced plans to build a new 200-mm fab in Taiwan. Foundry rival Samsung also sees the opportunity. It will expand its 200-mm capacity from 2.5 million to about 3.5 million wafers per year in the next two years, the company said recently.

One challenge that all 200-mm fab deals face is that used “200-mm tools are in very limited supply today — you can’t find a complete line anywhere in the world,” he said.

A look at 300-mm deals and China’s expansion

Some analysts speculated that GlobalFoundries’ recent sale of a 300-mm fab to ON Semi was the shape of things to come as older 300-mm fabs become unprofitable and analog companies upgrade their technology. But Rothrock disagrees.

Because they have 2.5× the capacity of 200-mm fabs, the larger fabs are hard for analog and discrete companies to fill. That’s one reason why ON’s deal involved a three-year transition period. In addition, the industry “currently has an oversupply of 300-mm tools,” making sellers less willing to offload them for pennies on the dollar.

That said, two other analog and discrete vendors are ramping 300-mm fabs. Texas Instruments is expanding a factory in Richardson, Texas, and Infineon is working on a $1.9 billion 300-mm fab in Villach, Austria.

Currently, 231 200-mm fabs and 127 300-mm fabs are in production worldwide, according to the SEMI trade group. Global geopolitics is an increasing factor in where new plants are placed.

“The U.S. is becoming more efficient for fabs, with costs in eastern China rising and politicians pushing for more manufacturing in the U.S.,” said Rothrock. TI’s new 300-mm plant could employ up to 1,500 people, and “was a strong vote of confidence in the U.S.”

ATREG has no operations in China, but he gives a nod to the country’s plans to become self-sufficient in semiconductors. “I think they are going to achieve their ambitions, but it will take more time then they planned,” he said.

Buyers from China considered ATREG’s recent 200-/300-mm tool sale. They also kicked the tires of fabs recently sold in Minnesota, Scotland, and Silicon Valley. In addition, China recently bought 75% of a 300-mm fab that Micron sold in Italy.

Subscribe to Newsletter

Test Qr code text s ss