Industrial semi rankings see significant NXP rise

Article By : Jessica Lipsky

IHS reports a slight increase of industrial semiconductor revenues, despite forecasts to the contrary. Analysts pin the increase on “the gradual acceleration in the U.S. economy” that propelled the demand for industrial equipment last year.

According to IHS, industrial semiconductor revenues increased slightly in 2015 despite many forecasts to the contrary. Year after year, global revenue rose less than 1% in 2015 to $41.9 billion

The minor revenue increase in 2015 followed growth of 11.5% in 2014 and 9.8% in 2013, according to IHS.

“The flat growth in the industrial semiconductor market last year is a bit discouraging, after a period of such robust growth, but there’s hope on the horizon,” IHS' Robbie Galoso, associate director of industrial semiconductors, said in a release. “The industrial market showed resilience in 2015 and all signs are pointing to improving growth in the future.”

IHS analysts pin the increase on “the gradual acceleration in the U.S. economy” that increased demand for industrial equipment last year. Growth in industrial electronics also pushed the market—particularly those used for commercial aircraft, LED lighting, digital-video surveillance, climate control, smart meters, traction, wireless application-specific testers and medical electronics. Weakness in industrial end-market demand caused by falling oil prices and the slowdown in China, especially in factory automation and power and energy markets, also stalled semiconductor growth.

Industrial electronics are expected to be the leading application growth driver in the semiconductor industry through 2020, with an 8.4% expected compound annual growth rate between 2015 and 2020.

However, IHS' predictions for growth in 2016 may be a little late—eight of the top 10 semiconductor suppliers saw posted annual declines in first quarter sales compared with the first quarter of 2015. Several saw sales fall by 25% or more, according to IC Insights Inc.. According to the Semiconductor Industry Association trade group, first quarter chip sales were down by nearly 6% compared with the first quarter of 2015.

Elsewhere, capital expenditures in the semiconductor industry are forecast.

Top Dogs

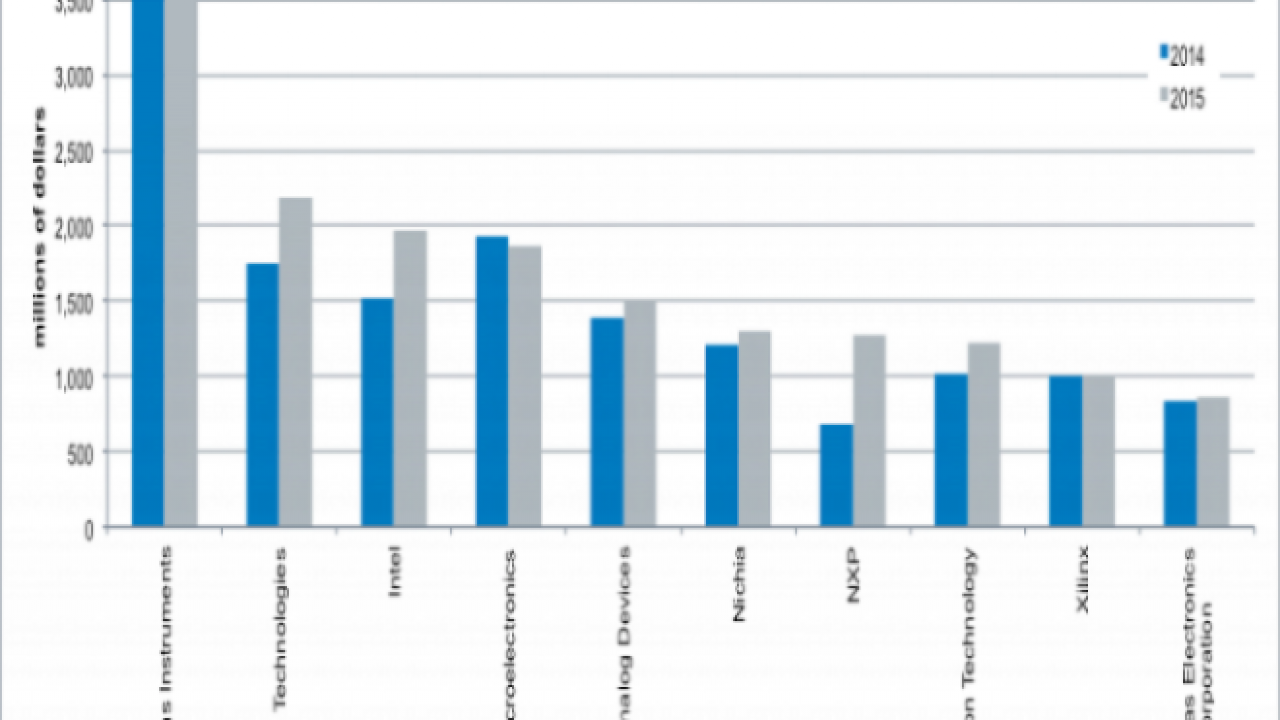

Texas Instruments maintained position as the largest industrial semiconductor supplier in the world in 2015, followed by Infineon Technologies and Intel. STMicroelectronics dropped to fourth place, while Analog Devices remained in fifth position.

![[Graph top 10 semiconductor suppliers for industrial markets ]](/wp-content/uploads/sites/2/2020/04/Top10_Ind_Semi_Chart_IHS__1.png)

__Figure 1:__ *The top 10 semiconductor suppliers for industrial markets in 2014 and 2015. (Source: IHS)*

”The semiconductor industry had a record level of merger and acquisition activity in 2015 that impacted some of the leading industrial semiconductor players,” Galoso said. “Strategic acquisitions will continue to play a major role in shaping the overall semiconductor market rankings in key industrial semiconductor segments.”

Proposed mergers approached $160 billion in market value in 2015, EE Times earlier reported, while more than $100 billion worth have been cemented. Those numbers represent more than six times the largest annual merger amount in the history of the semiconductor industry.

Chief among those massive mergers was that of Freescale and NXP, which rose from 16th position as an industrial semi supplier to seventh position. The newly formed NXP showed large share gains in several markets including manufacturing and process automation, civil aerospace, power and energy, medical electronics.

“The company will have a stronger presence in nearly all semiconductor device categories especially in microcomponents, analog and sensors,” Galoso said.

Subscribe to Newsletter

Test Qr code text s ss