Huawei Tops Apple in Smartphones, Analyst Says

Article By : Alan Patterson

Huawei has surpassed Apple for the first time in global smartphone sales to become the new number two, a Hong Kong-based analyst said. "While this could be temporary, it nevertheless underscores the rate at which Huawei has been growing."

TAIPEI — Huawei has surpassed Apple for the first time in global smartphone sales to become the new number two, according to a Hong Kong-based analyst.

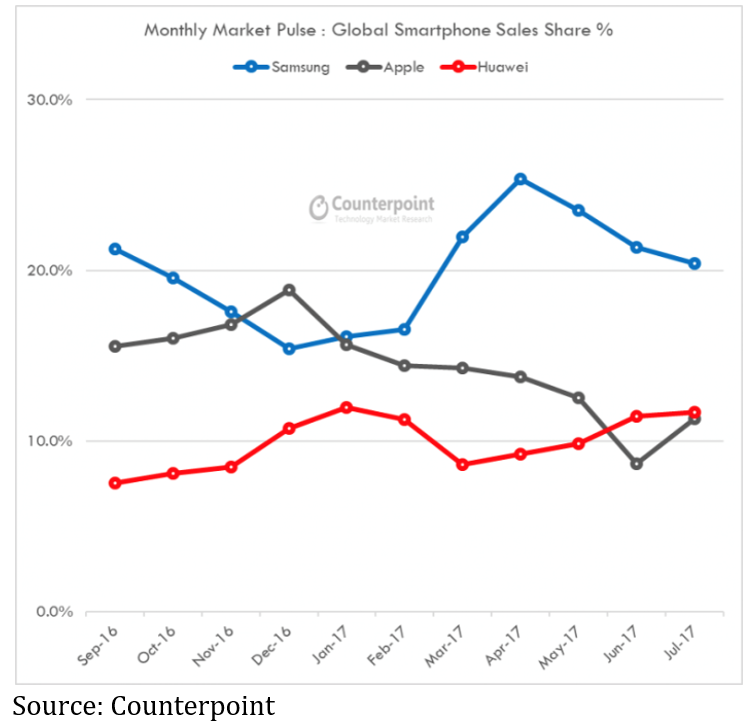

China’s largest smartphone maker has led Apple in worldwide sales during June and July this year mainly on the strength of consumer demand in its home market, according to market research firm Counterpoint, in a September 5 report. China has the world’s largest smartphone market, with about one-third of the world’s 1.9 billion users, according to data provider Statista.

“The global scale Huawei has been able to achieve can be attributed to its consistent investment in R&D and manufacturing, coupled with aggressive marketing and sales channel expansion,” Counterpoint Research Director Peter Richardson said in the report. “While this streak could be temporary considering the annual iPhone refresh is just around the corner, it nevertheless underscores the rate at which Huawei has been growing.”

Apple is expected to unveil its iPhone 8 on September 12, according to the Wall Street Journal.

New Kids on the Block

As growth in the smartphone business has peaked, Huawei and other smartphone makers in China have been gaining market share at the expense of the top-two brands, Samsung and Apple, by offering many of the same features on high-end phones at lower prices.

Huawei, Oppo, Vivo and Xiaomi have gained access to key supply-chain partners, which has allowed them to launch designs with bezel-free, full displays, augmented reality, in-house chipsets and advanced camera features that have kept them toe-to-toe with rivals, the Counterpoint report said. These players have become just as important as Samsung or Apple to the global supply chain, application developers and distribution channels as they continue to grow in scale more rapidly than the incumbent market share leaders, according to the report.

Huawei may have difficulty keeping its number-two spot, however. The company’s weak presence in the South Asian, Indian and North American markets limits Huawei’s potential in the near-to mid-term to hang on to the second-place position behind Samsung, according to Counterpoint. Huawei is over-dependent on China, where it enjoys the leadership position, as well as operator-centric markets in Europe, Latin America and Middle East, the report said.

While Huawei climbed to number two overall, none of its models have broken into the top-ten rankings, Counterpoint said. This is due to a multiple semi-knockdown unit (SKU) portfolio that currently lacks a true hero device, Counterpoint analyst Pavel Naiya said in the report. While a diverse portfolio allows Huawei to fight on multiple fronts, it does little to build overall brand recognition; something Huawei badly needs if it is continue to gain share, he added.

While Huawei has trimmed its portfolio, it likely needs to further streamline its product range just as Oppo and Xiaomi have done – putting more muscle behind fewer products, according to the report.

— Alan Patterson covers the semiconductor industry for EE Times. He is based in Taiwan.

Article originally posted on EE TImes.

Subscribe to Newsletter

Test Qr code text s ss