Global Semiconductor Sales Continue to Decline

Article By : Nitin Dahad

The memory segment, a drag on the market in 2019, appears to be reviving and promises to get stronger in 2020.

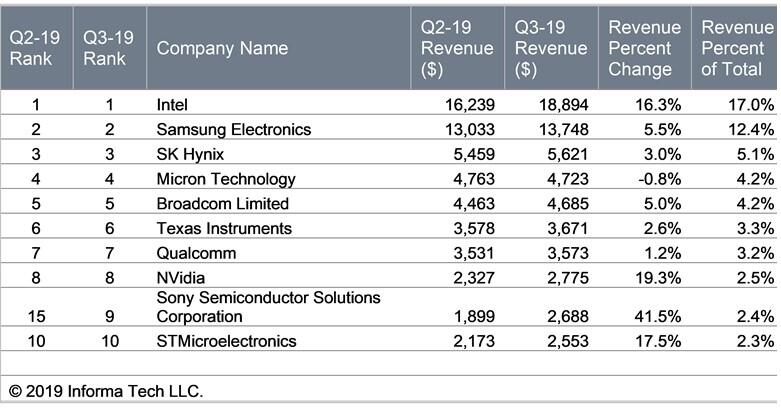

Global semiconductor sales continued to decline in the third quarter of 2019, despite growth signs in the memory market. Meanwhile, Intel retains top slot in global rankings, while Sony Semiconductor Solutions is a shining star as it entered the top 10.

In aggregate, semiconductor revenue for the first three quarters of 2019 fell by $52 billion, representing a 14.2 percent drop compared to the first three quarters of 2018. Revenue was down by 14.7 percent to $111.3 billion in the third quarter of 2019, compared to $130.5 billion during the same period in 2018. This follows year-over-year declines of 15.3 percent in the second quarter and 12.4 percent in the first quarter.

Semiconductor revenue is on track to drop by 12.4 percent for the full year, according to IHS Markit Technology. While this was being driven by weak conditions in the memory market, this particular area may be showing signs of recovery for 2020.

“Memory chips have been dragging down the semiconductor market throughout 2019,” said Ron Ellwanger, senior research analyst at IHS Markit Technology. “Memory revenue growth has been undermined by severe excess inventory, as well as by weak demand from the cloud and enterprise server businesses. Although memory revenue declined on a year-over-year basis in the third quarter, it grew compared to the second quarter, indicating that conditions are recovering in the memory segment.” Memory revenue fell by 34.4 percent during the first nine months of 2019, compared to a 6.6 percent decline for analog chips, the second biggest-declining semiconductor product category.

Wireless helps Intel retain No.1 slot, Sony Semi shines

Meanwhile, IHS Markit said Intel retained the number one semiconductor ranking in the third quarter of 2019, with revenue growth of 16.3 percent compared to the second quarter. For the first three quarters of the year, Intel managed to limit its revenue decline to just 1.1 percent, compared to a 33.8 percent plunge for number two Samsung.

Global top 10 semiconductor companies by revenue in Q3 2019 (Image: IHS Markit, now part of Informa Tech)

“Intel has continued to perform well in all application markets, particularly in the wireless segment,” said Vladimir Galabov, principal analyst at IHS Markit Technology. “The company supplies modems for wireless devices, as well as FPGAs and ASSPs for cellular base stations, which have been enjoying healthy demand.”

Intel also experienced growth in the solid-state drive (SSD) and memory markets, with a 37.2 percent increase in revenue compared to the second quarter of 2019, although it is a small player in these areas.

During the first nine months of the year, the top three memory suppliers—Samsung, SK Hynix and Micron—all saw their revenue decrease by at least 33 percent compared to the same time period in 2018.

Besides Intel, only one company among the top-10 generated growth: Sony Semiconductor Solutions Corp. Sony has been the shining star of the chip market this year, with revenue rising 27.1 percent compared to the first three quarters of 2018. The company moved into the top-10 ranking in the third quarter, gaining six places to rise to ninth place, up from 15th in the second quarter.

Sony’s CMOS image sensor business is thriving due to an increase in wireless handset sales and the expanding use of multiple cameras in each handset.

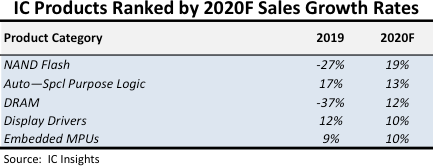

NAND flash is king of memory in 2020

A forecast and analysis of the memory market is due to be published next month by IC Insights, in The McClean Report 2020. It says NAND flash will rebound to 19 percent growth in 2020, driven by the demand from solid-state computing for high-density, high-performance NAND flash even as mobile applications continue to be a significant application. This follows a 27 percent decline in 2019. Stronger growth in NAND flash and DRAM is forecast as momentum increases for 5G connectivity, artificial intelligence, deep learning, and virtual reality in mobile, data center and cloud-computer servers, automotive, and industrial markets.

Top memory segments by 2020 forecast growth rates

Increasing electronic content onboard new cars is expected to provide the automotive—special purpose logic category with another solid year of growth. In fact, logic and embedded MPUs in this category have been on the top-5 growth list the past three years.

Automobiles have been gaining traction as a growth driver for several IC product segments in recent years, but particularly for automotive — special purpose Logic. Electronic systems that improve performance, increase safety, and add passenger convenience continue to be added or mandated in new model vehicles. In addition, advances in autonomous driving and the expansion of electronic vehicle sales around the world are collectively helping to boost the average semiconductor content per new car.

Subscribe to Newsletter

Test Qr code text s ss