Fab Tool Sales Expected to Fall After Another Record Year

Article By : Dylan McGrath

Markets expected to come back to earth after three-year growth run.

The final numbers are in, and 2018 was another banner year for not only the chip market — which had record sales of $468.8 billion last year — but also the entire semiconductor manufacturing supply chain.

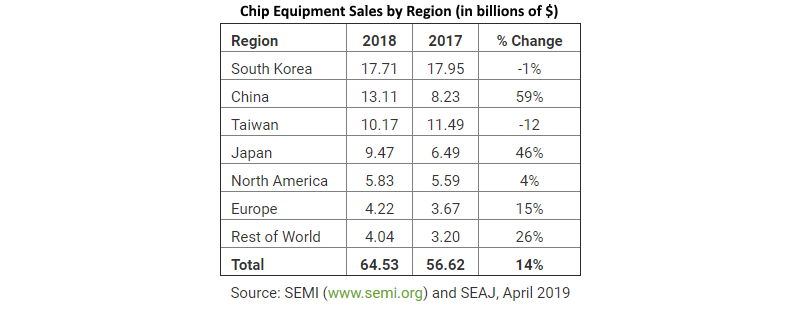

As expected, sales of semiconductor manufacturing equipment set a new all-time high in 2018, according to the SEMI trade association. A final tally of the numbers indicated that fab tool sales increased to $64.5 billion last year, up 14% from $56.6 billion in 2017, SEMI said.

However, after consecutive record-sales years in 2017 and 2018, SEMI expects the equipment market to come back to earth in 2019 as the end of the memory chip boom puts a damper on new equipment purchases. SEMI forecasts that chip equipment sales will decrease about 14% this year.

Sales of wafer-processing equipment increased by 15% in 2018, while other front-end equipment sales increased by 9%; total test equipment sales increased by 20% and assembly/packaging sales grew by 2%, SEMI said.

South Korea was the largest market for semiconductor equipment for the second consecutive year, boosted by capital expenditure increases from Samsung and SK Hynix amid an ongoing boom in semiconductor memory. South Korea held onto the No. 1 position despite the fact that its spending on capital equipment actually declined about 1% to $17.71 billion, SEMI said.

China ascended to become the No. 2 market for semiconductor capital equipment sales last year for the first time ever, with sales growing by a whopping 59% to $13.11 billion. Taiwan slipped to the No. 3 market, with sales declining 12% to $10.2 billion, according to SEMI.

Chip equipment sales to the U.S. market grew by 4% to reach $5.83 billion, enough to make it the fifth-largest market for capital equipment behind South Korea, China, Taiwan, and Japan. Sales in Japan, Europe, and the rest of the world all improved by at least 15%, according to SEMI.

Meanwhile, sales of semiconductor materials and photomasks also set new records last year.

The global semiconductor materials market grew nearly 11% to reach $51.9 billion, eclipsing the previous high of $47.1 billion set in 2011. Sales of wafer fabrication increased by 16% to reach $32.2 billion, while packaging materials sales grew by 3% to reach $19.7 billion, according to SEMI.

Taiwan — home to much of the world’s chip foundry capacity — was the largest market for semiconductor materials sales for the ninth consecutive year, with sales increasing by 11% to $11.45 billion, said the trade group.

Photomask — which accounted for 13% of the total wafer fabrication materials market — also set a new all-time high in sales with $4.02 billion. SEMI expects photomask sales to set a new record for the third consecutive year in 2019, with projected sales of $4.2 billion.

Subscribe to Newsletter

Test Qr code text s ss