China’s Share of Fabless Market Grows but U.S Dominant

Article By : Dylan McGrath

Fabless chip vendors based in China have grown faster than in any other region of the world this decade, though a good chunk of these sales are internal.

SAN FRANCISCO — Fabless chip vendors based in China have grown faster than in any other region of the world this decade, though a good chunk of these sales go into systems marketed by the same firm or a parent company.

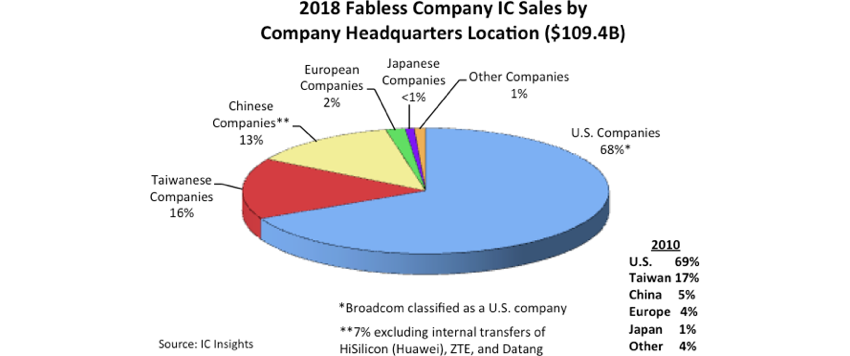

Fabless chip companies based in China accounted for 13% of the world's $109.4 billion in 2018 IC sales, up from just 5% in 2010, according to market research firm IC Insights. In addition, the firm found that four of the fastest growing fabless chip vendors in 2018 were Chinese — BitMain, ISSI, Allwinner and HiSilicon.

The market research noted that China-based fabless firms accounted for just 7% of fabless sales last year when excluding the internal transfers of ZTE, Datang and Huawei (which sells more than 90% of its chips to its parent).

Globally, sales for fabless chip companies increased by 8% last year, or $8.3 billion, according to IC Insights.

The U.S. remains far and away the top region for fabless chip firms. U.S.-based fabless chip companies accounted for 68% of all fabless sales last year, down from 69% in 2010, IC Insights said. Taiwan is No. 2 on the list, with Taiwanese firms pulling in 16% of fabless revenue in 2018, down from 17% in 2010, according to IC Insights.

European companies accounted for just 2% of the fabless IC sales in 2018, down from 4% in 2010, IC Insights said. The loss of share was partly attributed to two acquisitions that occured in 2015 — UK-based CSR by Qualcomm and Germany's Lantiq by Intel.

Japan and South Korea each had only one fabless chip company that ranked in the top 50 last year, according to IC Insights. Japan's Megachips experienced a sales increase of 19% last year, while South Korea's Silicon Works had a 17% increase in sales last year, IC Insights said.

The fastest growing fabless chip company last year was China's BitMain — which is really a systems supplier that provides cryptocurrency mining equipment. BitMain's sales increased by 197% last year. But with the crash in cryptocurrency prices, IC Insights forecasts that BitMain's sales will fall sharply in 2019.

In all, five of the top 50 fabless chip firms registered growth of more than 25% last year: China's BitMain, ISSI, Allwinner and HiSilicon and U.S.-based Nvidia, according to IC Insights. Twenty-one of the top 50 fabless firms had double digit sales increases last year, the market research firm said.

Subscribe to Newsletter

Test Qr code text s ss