Big OEMs Partnering for AV

Article By : Junko Yoshida

The VW-Ford alliance is another instance of carmakers scrambling to adapt to the AV market being pushed out to 2030. OEMs are hooking up, though none of the relationships seem particularly exclusive.

Volkswagen last Friday agreed to invest $3.1 billion into Ford Motor Co.’s Argo AI self-driving unit. In parallel, the German automaker unveiled that it will be sharing with Ford in Europe its modular electric vehicle platform called MEB (Modularer E-Antriebs-Baukasten).

The deal extends an existing partnership. VW and Ford cooperate in commercial vehicles and mid-size pickup trucks as a means of expanding production and sales in fragmented markets.

With the new agreement, the two will continue hand-in-hand into highly automated vehicle (AV) development. With VW investing $2.6 billion and purchasing $500 million worth of Argo shares from Ford, the automakers will hold equal stakes in Argo AI, a Pittsburgh-based startup focused developing a full-stack AV platform.

This alliance illustrates, if nothing else, the scramble among car OEMs to find a place in the yet-to-emerge highly automated vehicle market. With full autonomy unlikely to form a volume market until 2030, the AV race will be a long haul, requiring OEMs to make a huge financial investment, recruit software talent, establish partnerships and convince customers.

The VW-Ford partnership allows the two companies to share financial burden in this challenge. The startup will gain two large OEM customers to design autonomous vehicles on Argo’s AV platform.

A complex web of partnerships

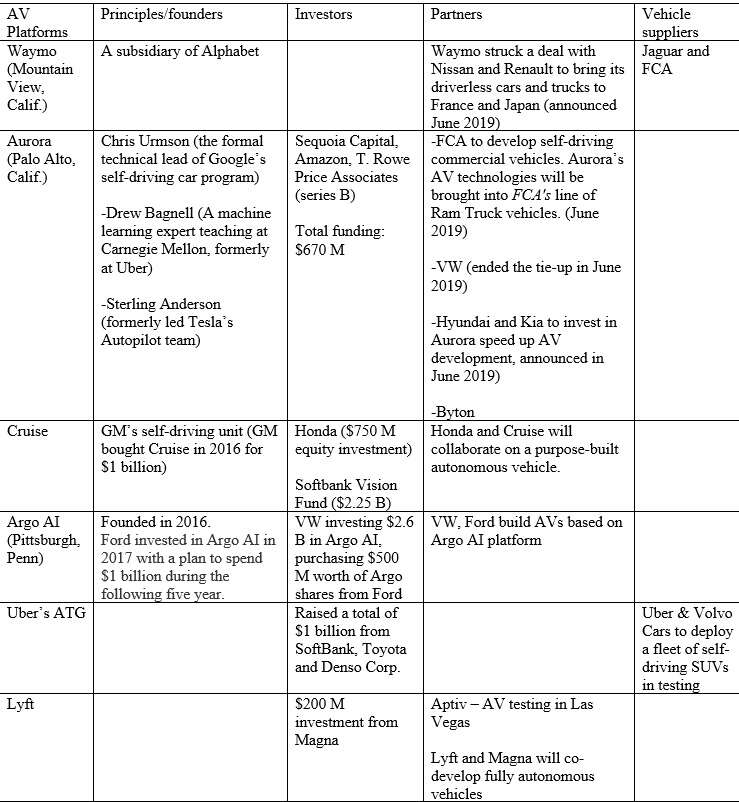

The AV landscape today is a tangled web of partnerships, alliances and investment deals. Some companies are focused on financial investments to gain expertise in ride-share service models. A billion-dollar stake in Uber earlier this year by SoftBank, Toyota Motor Corp. and Denso Corp. is a good example.

Others are interested in joint technology development, as seen in the Intel/Mobileye/BMW partnership. A few carmakers are supplying their vehicles to Waymo, to equip models by Fiat Chrysler Automobiles and Jaguar Land with its self-driving systems.

Mike Demler, senior analyst at The Linley Group, noted that the road to AVs today divides into robo-taxis and mass-market vehicles. “There’s definitely some overlap, but those are two different segments,” said Demler. Thus, different types of partnership are forming that correspond to the separate segments. Many partnerships aren’t exclusive, and, as Demler noted, “they are all over the map.”

Phil Magney, founder & principal advisor of VSI Labs, acknowledged, “The AV space is hot with deals and acquisitions…seems like every week.” A significant fact is that full AV stack platforms “carry high valuations, as the market has shown us,” he added. “A billion here, a billion there.”

So, what’s driving this? Magney said, “Major OEMs don’t have confidence in their robo-taxi technology and I think this has to do with the long tail of development.” In Magney’s opinion, “It is not that hard to do level 2 technology because the driver is always your backup. But robo-taxis are different. The software has to be rock solid.”

He stressed, “Full stack AV technologies are super hard. Especially for the OEMs who may know ADAS but not advanced automation.” The reality is that when it comes to level 4/level 5 AV software, there are few companies with the necessary competence, according to Magney.

Key players in the AV full stack

Among the few in the AV full stack space, there are Aurora, Argo and Cruise. Magney added that Uber and Waymo fall into this category as well.

VW, which unveiled a tie-up with Aurora during the Consumer Electronics Show in January 2018, recently ended that relationship in favor of partnering with Argo, as it entered into its larger alliance with Ford.

Earlier this month, BMW and Daimler announced a new long-term partnership to co-develop automated driving technologies including levels of automation up to Level 4 by 2024. The deal is said to also include advanced driver assistance system features.

But as Magney pointed out, this scene is getting harder to sort, because BMW is a key member in the Intel/Mobileye/BMW camp, while Daimler (partnered with Bosch) and Mercedes Benz are known to be in the Nvidia camp. “We will see how this plays out now,” said Magney.

Demler explained that these so-called partnership deals often involve different aspects of the AV business. “Some are investment partners, some are development partners, and some are just customers, distributors, and the like.”

Cruise Automation, the self-driving unit of General Motors, last fall teamed with Honda to collaborate reportedly on an autonomous vehicle, manufactured at high volumes for global deployment, to serve a “wide variety” of uses. Honda is said to be devoting $2 billion over 12 years. Together with a $750 million equity investment in Cruise, this brings Honda’s total commitment in AV to $2.75 billion.

Meanwhile, just last month, Aurora struck a deal with Fiat Chrysler Automobiles to develop self-driving commercial vehicles.

The partnership will seek to integrate Aurora’s technology into FCA’s line of Ram Truck commercial vehicles. The deal reportedly aims to specifically develop and deploy self-driving commercial vehicles that could be used by any third party with a delivery-to-consumer need. For instance, once Aurora’s technology is integrated into its commercial vans, FCA could sell them to a third-party logistics company — like Amazon — that intends to use autonomous vehicles for deliveries.

Then, there is $1 billion investment in Uber’s Advanced Technologies Group by Toyota Motor, along with Denso and SoftBank. Magney observed, “I think this investment is more about the ride-sharing model than the AV stack.”

Based on the last few years in the industry, many of these AV deals are evolving and often changing partners, while none seems to be particularly exclusive.

Significance of VW/Ford/Argo deal

VW’s $2.6-billion investment in Ford’s Argo AI self-driving unit is viewed in the automotive industry as a huge boost to the two-year-old startup — often overlooked in the shadow of Waymo and Aurora, pushing it into the top rank of the AV sector.

According to Argo, VW was investing $1 billion in cash and contributing to its European self-driving unit, a subsidiary called Autonomous Intelligent Driving (AID), valued at $1.6 billion. The investment deal gives Argo a valuation of just over $7 billion, one of the highest in the AV sector.

Magney, while calling the agreement “a decent deal,” cautioned, “You have got to take the valuations with a grain of salt, though. VW is also reportedly paying Ford $500 million in return for half of Ford's shares in Argo. And to say that AID is a $1.6 billion contribution to Argo is somewhat fictional.” He noted, “Sure, AID employees may accelerate R&D work somewhat, but nobody would pay $1.6 billion for the VW-Audi subsidiary. That'd be $8 million per employee, crazy!!”

AV software on which hardware platform?

It is not known which hardware platform Ford/Argo AI is using to run its own AV software stack.

“They haven’t disclosed their hardware platform,” said Demler. “I think almost all of the companies actually building AVs are using components from multiple suppliers.” He added, “Even Jensen (Huang, Nvidia’s CEO) has said Nvidia’s customers aren’t just taking the [Nvidia’s] Drive systems out of the box and using them. Most companies developing AVs do at least some development on Nvidia platforms, but higher-level autonomy is still a research project, no matter what Elon Musk or anyone else says.”

He noted, “It depends again on whether you’re looking at robo-taxis or mass-production vehicles, and for the latter, what ADAS level? It’s relatively straightforward to install Mobileye’s EyeQ-based Level 2 system, for example. But for anything that allows hands-off capabilities, it’s a more complex hardware/software platform that OEMs and carmakers will want to build on their own.”

What about Waymo and Uber? Demler told us, “Both are building their own systems combining many components, no doubt including some from Intel and Nvidia.”

While both Uber and Waymo already have their own AV stack, neither talked about “licensing their AV technologies,” observed Magney. “On the vehicle supplier side, Waymo has deals with FCA and Jaguar and Renault-Nissan. Uber has deals with Volvo and Toyota.”

Who are leading in AV?

Asked to rate leading AV vendors today, Magney said, “This is a hypothetical question but in my opinion I would give that label to Waymo for the robo-taxi business and Tesla for series production.”

He observed that Cruise and GM are struggling a bit while Ford gets a boost with Argo. The European and Asian OEMs are lagging in L4 robo-taxi development.

Demler named Mobileye, Nvidia and Waymo as “the companies that have demonstrated the most advanced technology.” He added that Uber and Tesla have demonstrated how dangerous their systems can be. Tesla is ahead of Audi and Cadillac, “though not by as much as Elon [Musk] would like to think. The latter companies are just taking a more safety-conscious approach to deployment.”

Surveying the AV landscape, Magney predicted “the scramble” to continue “for software, AI, data science, and all the disciplines that go with it.” In his mind, one thing is clear: “I think the major OEMs are desperately trying to stay in the robo-taxi game and be more than just a coach builder.”

Demler summed it up: “We’re getting over the irrational exuberance. Most of the companies in the AV ‘race’ are taking a cautious and more reasonable step back from the mad rush to fully self-driving cars.” He added, “The first higher-level autonomous deployments will be robo-taxis. Deployment of progressively more advanced ADAS will be an evolutionary process,” with most in the industry looking to 2030 for “full autonomy.”

Subscribe to Newsletter

Test Qr code text s ss