Automotive Industry Steers European Patent Growth

Article By : Nitin Dahad

The European Patent Office's 2018 annual report indicates that automotive and smart vehicle patents drove growth in the number of patents filed, especially from Germany and Ireland.

LONDON — Automotive and smart vehicle patents drove growth in the number of patents filed in Europe last year, especially from Germany and Ireland, according to the European Patent Office's 2018 annual report. In addition, Siemens overtook Huawei to take the No. 1 position in the number of patents filed, according to the report, published earlier this month.

The report indicates that the number of patent applications filed with the EPO grew by 4.6% last year to 174,317. The U.S. remained the top country of origin, accounting for 25% of total filings, followed by Germany, Japan, France, and China. Collectively, European companies filed 47% of all patent applications at the EPO originating from the 38 EPO member states, while the combined share of China, Japan, and South Korea grew moderately to a 22.6% share.

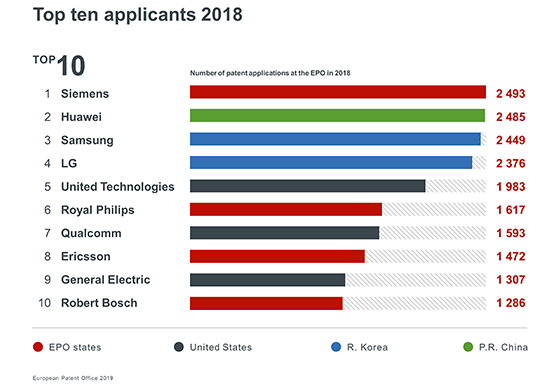

Siemens was the top patent applicant at the EPO in 2018 with 2,493 applications, switching positions with Huawei, which came in second. They were followed by Samsung, LG, and United Technologies. The top 10 was made up of four companies from Europe, three from the U.S., two from South Korea, and one from China.

Applications from China rose by 8.8%, their lowest rate in the past five years, mainly attributable to slower growth in some of the country’s most patent-intensive fields, including computer technology, electrical machinery and energy, and audio-visual technology. U.S. and Japanese companies reported increases of 2.7% and 3.9%, respectively, in 2018, while South Korea went up by 13%, boosted by a rise in patent applications in digital communication, electrical machinery and energy, and computer technology.

German applications increased 4.7% to reach 26,734, its fastest growth since 2010; this was mainly due to an upward trend in the automotive sector and related areas, such as sensors. Applications from Ireland grew by 21.4% (though this was on smaller patenting volumes), largely attributable to greater patenting activity in pharmaceuticals and medical technology, as well as in areas related to smart vehicle technology.

Transport, which covers vehicles, aircraft, trains, and vessels, was the field with the largest share of applications (59%) originating from Europe, and seven of the leading 10 businesses in transport were European. This also confirms the findings of a recent EPO study on the patent landscape in self-driving vehicles, which sees Europe and the U.S. in the lead, each accounting for about one-third of all European patent applications since 2011, some way ahead of Japan (13%), South (7%), and China (3%).

The study also found that many of the top 25 patent applicants in the self-driving vehicle sector, including some of the European ones, are not traditional automotive/transport companies but ICT or telecoms firms, and that those traditional companies are exhibiting a growing tendency to behave like ICT firms in their patent application strategies.

In the U.K., Imagination Technologies was the country’s 10th most active patent applicant in 2018, with 64 European patent applications filed during the year, putting it ahead of other technology companies such as Dyson Technology (13) and Arm (14). Paul Leaves, director of patents, Imagination Technologies, said that there is a growing understanding of the value of patent protection in China as well as Europe. In recognition of this, Imagination files Chinese patent applications at a similar rate to the filing of European patent applications.

The EPO’s Annual Report shows that 5,736 European patent applications were filed by U.K. companies in 2018, an increase of 7.8% from the previous year, and the number of European patents granted to British companies and investors also rose by 22.8% to 3,827.

Subscribe to Newsletter

Test Qr code text s ss