Architecture for AI, security can leverage SoftBank: IHS

Article By : Junko Yoshida

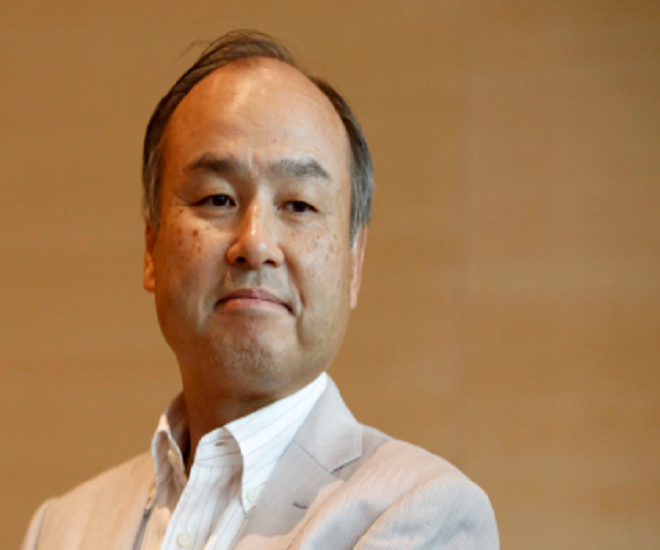

Son envisions ARM to define a platform for the future of secure IoT, connected cars and artificial intelligence.

Previous > Softbank banks hard on hardware

A chronic complaint of the semiconductor industry is the financial community's reputed undervaluing of hardware companies. If there’s a silver lining in the SoftBank-ARM deal, it’s SoftBank’s clear respect for ARM, whose processor cores have created the very fabric of the semiconductor industry today.

Son envisions ARM to define a platform for the future of secure IoT, connected cars and artificial intelligence.

ARM cores, and subsequent SoCs and system hardware built on them, have been critical in changing the course of platform innovation, according to Son. He recalled a time — in the early 2000s — when NTT Docomo was credited with a key role it played in defining the mobile platform.

However, according to Son, over time, those who became far more influential were Apple’s iPhone and Google’s Android — both backed by operating system and hardware with ARM cores inside. In his mind, hardware should never be underestimated.

Privatisation

Son also made the case for SoftBank’s ARM acquisition as an important step to turn ARM back into a private company. Freed of scrutiny and resistance from institutional investors, he explained, ARM will be able to spend more aggressively on advanced R&D.

“The management team at ARM explained to me that as long as ARM stays as a public company, they are under obligations to keep their stockholders happy. There have been a lot of things — investment wise — they could have done but was unable to pull off.”

ARM’s management team will welcome a strategic investor like SoftBank with the long view, Son noted.

Which future technologies SoftBank wants to see ARM exploring has yet to be articulated.

Asked about potential areas of tech development SoftBank might expect from ARM, Luca De Ambroggi, principal analyst, Automotive Semiconductors at IHS Markit, admitted, “This is where I struggle a bit more to find my way.”

Security, artificial intelligence

Nonetheless, De Ambroggi identified “security” and “specific architecture for artificial intelligence” as the two areas where “I would leverage and use SoftBank’s position.”

As a starter, De Ambroggi said, “Security is a must have for both IoT and automotive.” He explained that it will be “a key asset if you create the right ‘standard’ which can be deployed by all MCU/MPU/SoC.”

The analyst made it clear, “I use the word ‘standard’ on purpose because security needs a standard, and ARM’s volume deployment would allow them to be a de-facto standard.”

As for artificial intelligence, De Ambroggi said, “AI for any market and specifically deep learning for automotive needs a ‘step’ change.” In his opinion, “major IC (and IP) suppliers are working on new solutions, thinking out of the box and specifically looking at optimized AI architecture. ARM might add here a lot of value, and I am sure they were already on top of AI before the acquisition.”

Drue Freeman, a former NXP automotive semiconductor executive, now an independent consultant and investor, described the SoftBank-ARM deal “as a bit of a head scratcher."

However, he pointed out that practically every chip supplier in the automotive market is already an ARM licensee, except for Intel.

ARM cores are already driving all the daily — more mundane — workforce stuff inside the automotive architecture. Where things can get interesting is in positioning ARM for deep learning, AI and multicore solutions for autonomous driving, he explained.

“But it’s not clear to me that ARM is capable of driving it on its own.” Inevitably, however, “much investment is needed in that area, so that ARM can grow in lockstep with the new [AI, deep learning] applications of the future,” Freeman said.

China play

Son also briefly mentioned during the Japanese press conference that as soon as SoftBank announced the ARM acquisition deal, Son received a call from Alibaba’s Jack Ma. “He was very enthusiastic. He told me that he is really interested in driving the China-ARM relationship.”

While nothing has been decided, Son implied the SoftBank as a group – with a number of partnerships already put in place including the one with Alibaba, “Perhaps we have a lot more to contribute to ARM’s future business.”

IHS Markit’s Hackenberg pointed out in his research note that “ARM has not simply been riding the wave of their processor core success.” He stressed that ARM recently invested in furthering its own IoT strategies.

Hackenberg listed examples that include the acquisition of Sensinode in 2013, a software company specialising in IoT connectivity technologies. He also cited a deal last year for Sunrise Micro Devices, a developer of silicon internet-protocol (IP) core technologies for IoT connectivity, and — acquired this year — Apical, a specialist in embedded-vision and embedded-imaging technologies for processing images at the camera, a typical strategy supporting graphics in IoT applications.

Pointing out the symmetry between ARM’s vision, and that of Softbank, Hackenberg concluded that these deals might have been the tipping point for Softbank to take notice.

Subscribe to Newsletter

Test Qr code text s ss