Overcoming the OTA Speed Bump

Article By : Junko Yoshida

Despite the legacy complexity of today's disparate vehicle architecture, automakers are under the gun to connect their vehicles to the cloud.

TOKYO — The automotive industry often describes a connected vehicle as a “smartphone on wheels.” Nothing, however, is further from the truth.

Senichi Yoshioka knows this as well as anyone.

Today, Yoshioka is senior vice president and chief technology officer of Renesas’ automotive business. But he’s a mobile business veteran. He used to work at Renesas Mobile, a smartphone apps processor company that existed several years ago.

During our interview at Renesas’ headquarters, Yoshika casually took his smartphone out of his pocket and cradled it on his palm. He said, “Architecturally speaking, this thing is so much simpler than a connected car.”

Basically, a smartphone has one big apps processor — all that’s needed to run apps. In contrast, vehicles come with a hundred or more ECUs. They are connected to a variety of vehicle communication networks. Each network uses different communication protocols to send data.

Despite this complexity, as they scramble to run a host of vehicle applications and services on their cars, automakers are under the gun to connect their vehicles to the cloud. The now obligatory applications include over-the-air (OTA) software updates, feature upgrades, vehicle maintenance/anomaly detection and protections from cyberattacks.

But here’s the rub.

Unlike Tesla, which designed its vehicle architecture from the ground up, traditional makers of gas-guzzling vehicles suffer from their legacy in automotive architecture. Vehicle models are based on disparate architectures that have proliferated over time, due to a patchwork of add-on features, ad-hoc improvements and proprietary extensions.

In short, OTA for the connected vehicle is a whole different animal compared to OTA for a smartphone, Yoshioka explained.

Vehicle computer

As a typical vehicle’s value shifts rapidly toward software, Yoshioka said, “We think it’s critical for us to a) reduce the complexity of in-vehicle network communication; and b) simplify in-vehicle API and encapsulate systems controlled by MCUs.”

As a leader of the automotive MCU, Yoshioka said, “It is incumbent on us to propose to the automotive industry a new ‘vehicle computer,’ which can simplify the vehicle networks, translate communication protocols and take care of security.”

A vehicle MCU installed in a hub should be smart enough so that it can compress data before handing it off from Ethernet to CAN bus for example, he added.

So, which MCU fits the bill for such a job in a hub of a vehicle?

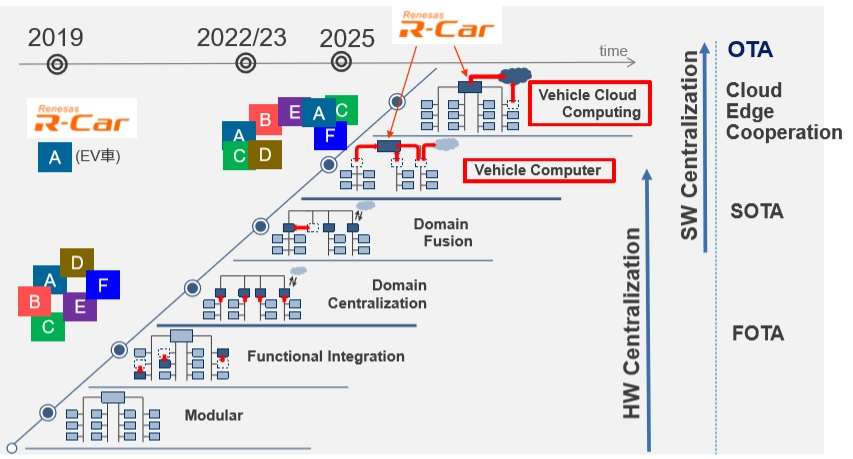

Yoshioka said, “We are using R-CAR Gen 3 right now.” But as functions further integrate and vehicle domain centralization advances, Yoshioka said Renesas is plotting a road map to launch a newly dedicated vehicle computer in 2023, he explained.

Vehicle computers will evolve as in-vehicle networks change. (Source: Renesas)

Vehicle data deeply buried inside a car

As Colin Bird-Martinez, a senior analyst with IHS Markit, once told us, “To pull off automotive OTA [from the cloud to ECUs], you need two things: deep knowledge in computing hardware and familiarities with a variety of in-vehicle network communication topologies.”

The same applies to getting vehicle data out of the car, sucking it up and uploading it to the cloud.

An oft-overlooked complication is that conventional vehicles on the move generate a lot of data. A car generates data that shows its wheel speed, wheel angles, wear and tear on components, anomalies in driving behavior and routing, and more. From a software developer’s point of view, this is a goldmine of worthy data that can turn into “information” that ADAS and autonomous vehicles can use.

Exclusive deals and flirting with Intel

A startup like Tactile Mobility, for example, is looking to use data deeply buried inside a vehicle to enhance its safety.

In a recent interview with EE Times, Amit Nisenbaum, CEO at Israel-based Tactile Mobility, told us his company plans to leverage “non-visual data” that already exist in the vehicle to “add context” to highly automated vehicles.

Tactile Mobility’s goal is to turn basic data like speed, wheel angle, RPM and accelerometers into “information” so that an onboard computer can understand, for example, “available grip” when driving around a curve or “how fast to decelerate or accelerate without skidding.”

Nisenbaum explained, “We have developed our own proprietary embedded software” designed to represent in real-time the physical factors that impact driving. The footprint of the embedded software is small — 100Kbyte — and needs only 1Megabyte of RAM, he claimed. “We are asking car OEMs to let our embedded software sit on top of the ECU that’s connected to CAN bus.”

One potential problem for Tactile Mobility is that without explicit consent and collaboration from a car OEM, the startup can’t stick its embedded software on top of any ECU. Each OEM uses a different ECU based on a separate architecture. The vehicle itself has system architecture that varies.

In other words, there is no API.

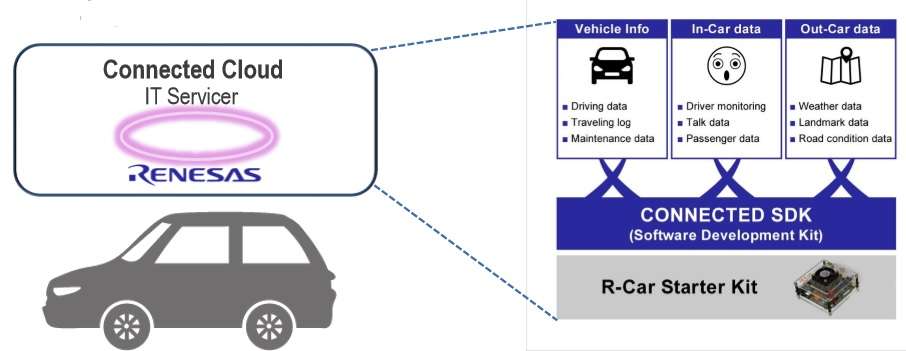

Renesas isn’t Tactile Mobility’s partner. However, Renesas sees the development of a connected car SDK as vital to its ECU business. Renesas, Yoshioka explained, wants to make it easy for software developers not only to develop application software but also to install it on Renesas’ R-Car SoC family.

Renesas is pushing its Connected Car SDK. (Source: Renesas)

Renesas is using its Connected Car Software Development Tools to “spur the development of cloud-linked services utilizing vehicle data,” by adding support for Amazon Web Services (AWS). This will allow software developers to generate new automotive services that “combine, in real time, vehicle data and cloud-based data in addition to weather reports and maps.”

Changing roles of MCU suppliers

NXP might be the world’s largest automotive semiconductor supplier, but “we have the biggest share — as much as 30% — on the global automotive MCU/SoC market,” boasted Yoshioka.

The role of MCU vendors has dramatically changed in recent years.

“Although we don’t develop software on our own, we partner with a variety of software developers,” said Yoshioka. Renesas is focused, he added, on what happens to the MCU when running certain software.

Renesas is pushing its Connected Car SDK. (Source: Renesas)

Renesas is expounding to car OEMs its connected vehicle ideas, including new applications and services. The chip vendor hopes to collaborate with carmakers on an equal footing in designing a new connected vehicle. “We want to be proactive, rather than waiting for carmakers to tell us what to do," Yoshioka said.

The connected vehicle represents a solid market opportunity for Renesas. It claims to be working with 15 car OEMs and 15 tier ones to transform a conventional vehicle into a connected car capable of OTA as well as uploading vehicle information to the cloud. Renesas is also engaged with six IT cloud and service providers on connected vehicles.

Subscribe to Newsletter

Test Qr code text s ss