Foundry Market Challenges in the Spotlight

Article By : Dylan McGrath

TSMC's announcement last week that it expects its quarterly sales to decline precipitously

SAN FRANCISCO — TSMC's announcement last week that it expects its quarterly sales to decline precipitously quarter-to-quarter put the chip foundry market on notice as it begins what is expected to be a challenging year.

TSMC (Hsinchu, Taiwan) said it expects sales to decline nearly 14% quarter-to-quarter to between $7.3 billion and $7.4 billion. It would be the largest quarter-to-quarter sales decline for the world's leading foundry since 2009.

The expected shortfall has been largely blamed in weaker-than-expected sales of Apple's newest iPhones, which features Apple-designed processors built by TSMC. But the weak sales guidance is also indicative of larger challenges facing the foundry industry, according to Bill McClean, a veteran semiconductor analyst and president of market research firm IC Insights.

"The foundry market is in a difficult position in 2019," McClean told EE Times in an email exchange. IC Insights said earlier this month that nearly all of the pure-play foundry industry's growth in 2018 came from Chinese firms. TSMC alone saw its revenue from China increase by 61% last year, according to the firm.

"Apple represented about 22% of TSMC's sales last year, and we all know that Apple has backed down its expectations for this year," McClean said. Apple earlier this month cut its sales forecast for the first time since 2002.

Much of the growth in foundry business from China came from the cryptocurrency business, a market which has softened considerably amid a plunge in cryptocurrency prices, McClean said.

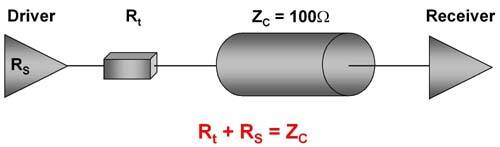

According to McClean, the pure-play foundry market also faces technology challenges. "TSMC is the only pure-play foundry offering leading-edge feature size technology," he said. "All of the other pure-play foundries are now labeling themselves as specialty foundries, offering embedded memory, image sensor, SOI, etc. technology at relaxed feature sizes."

The result has been a glut in specialty foundry capacity, McClean said. Both TSMC and Samsung — an integrated device manufacturer which also offers leading-edge foundry capacity — are also players in the specialty foundry market, he said.

"It is so bad now that most foundries talk about overcapacity at the 28nm node lasting for a couple of years," McClean said.

IC Insights is currently forecasting that the foundry market will grow about 2% in 2019, the same growth rate that the firm has projected for the semiconductor industry as a whole.

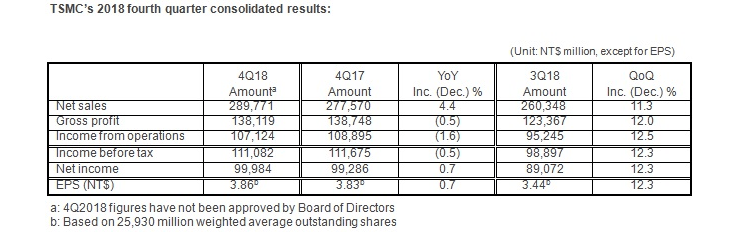

TSMC reported sales of $9.4 billion for the fourth quarter of 2018, up 10.7% compared to the third quarter of 2018 and up 2% compared to the fourth quarter of 2017. TSMC reported that 7nm revenue was 23% of the company's fourth quarter total, while 10nm accounted for 6% and 16/20nm accounted for 21%.

Subscribe to Newsletter

Test Qr code text s ss