DRAM Sales Fest Nearing End

Article By : Dylan McGrath, EE Times

Market decline forecast following record years

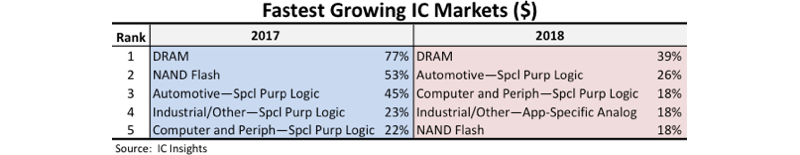

SAN FRANCISCO — DRAM will once again finish the year with the highest growth rate of any semiconductor product, though 2019 is shaping up to be a very different story, according to market research firm IC Insights.

DRAM is expected to finish 2018 with 39% growth, following up its 77% growth in 2017, IC Insights said. DRAM has once again benefited from a steady surge of rising average selling prices over the past two years amid a shortage in the market.

But the historically cyclical DRAM market appears to be headed for tougher times in 2019. After two strong years of growth, the world’s leading DRAM suppliers — South Korea’s Samsung Electronics and SK Hynix and U.S.-based Micron Technology — have significantly expanded their manufacturing capacity and are beginning to ramp up production, bringing relief to strained supplies, especially for high-performance DRAM parts, IC Insights said. Meanwhile, shipments of large-scale datacenter servers — the primary catalyst for much of the recent DRAM market surge — have begun to ease amid uncertain economic and trade conditions, the firm said.

IC Insights predicts that that DRAM will rank near the bottom of all semiconductor categories in terms of growth rate in 2019, with sales forecast to decline by 1%.

DRAM has consistently been at the top or near the bottom of all semiconductor products in terms of growth rate over the past six years, a testament to its highly cyclical nature, according to IC Insights. DRAM was also the fastest growing semiconductor product in both 2013 and 2014, according to the firm.

Subscribe to Newsletter

Test Qr code text s ss