ST’s Automotive Plans

Article By : Junko Yoshida, EE Times

CEO Jean-Marc Chery explains the company's way forward, talking ADAS, EVs and China

SHENZHEN, China — The continuous expansion of electronics inside cars — both internal combustion and EV — has made automotive the semiconductor market’s lead driver in recent years.

In a recent one-on-one interview with EE Times, STMicroelectronics CEO Jean-Marc Chery described competition on the global automotive market as “very intense.” Citing a broader automotive segment covering both “legacy and smart driving,” he said, “We see Infineon, Renesas, and NXP in front us, and there is also Rohm.”

Unlike NXP Semiconductors, which can simply call itself “the world’s largest automotive chip supplier,” it’s tough for ST to describe an automotive business that consists of multiple layers. For example, while supplying products to Tier Ones and OEMs, ST also provides fabless chip vendors with ST’s ASIC design, sometimes customer-owned tooling (COT), and foundry services.

Key automotive questions for ST include:

- How does ST plan to compete with its rivals — not just in today’s market but also in the future automotive industry?

- What’s ST’s strategy in China now that it is the world’s largest automotive market?

- What kind of ADAS platform does ST have to address a market of increasingly automated vehicles?

An area where ST has pulled ahead of the competition is its lead in silicon-carbide (SiC) technology. System Plus Consulting, which is Yole Développement’s partner, for instance, found that Tesla’s Model 3 inverter is using a SiC power module. The market research company suspects that this is a fruit of ST’s close collaboration with Tesla.

In contrast, ST appears to be lagging in development of its own ADAS platform. Chery asserted that ST is working with a yet-to-be-named partner on an ADAS platform to address “the medium- to low-end automotive market in China and Asia.” However, he eschewed specifics. When asked if the platform has a name, Chery said that there is none — at least, not yet.

Tight with partners

ST has relied heavily on a strong partner, Mobileye, to elevate itself as a player in the ADAS market.

Explaining ST’s role as Mobileye’s ASIC partner, Chery noted, “Mobileye designs complex [vision, safety] software, but Mobileye needs a strong semiconductor company like ST.”

ST, for example, interfaces with foundries, sources the wafers, assembles the dies into a package, tests the ASIC, and then ships to Mobileye.

Matching EyeQ SoC’s “mission profile with technology features” of a process design is no cakewalk, explained Chery. “You need a strong know-how in the physical implementation of a design and verification.”

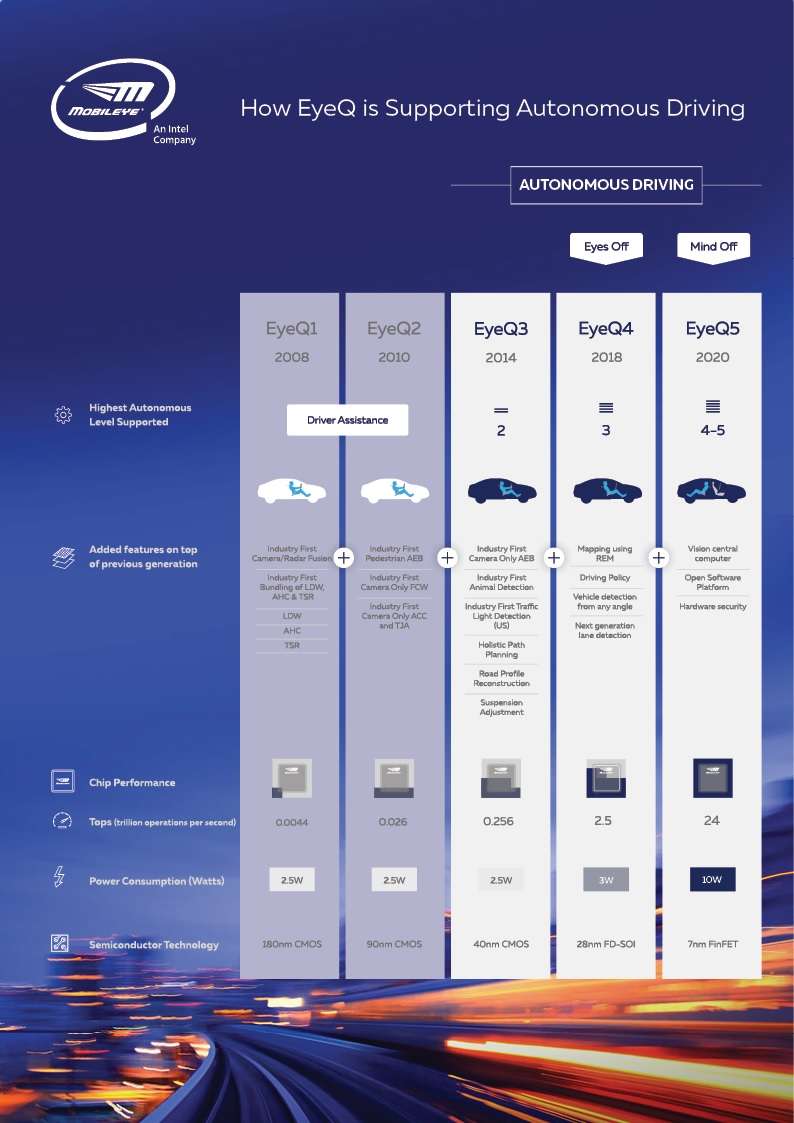

Evolution of Mobileye’s EyeQ SoCs (Source: Mobileye)

Up to 28nm (Mobileye’s EyeQ4 is based on FD-SOI), it was easy for ST, said Chery, because ST has been manufacturing Mobileye’s chips at its own fab in Crolles, France. But as Mobileye’s new EyeQ5 moves to TSMC’s 7nm process node, the transfer “has required intense collaboration with the foundry.”

Mobileye is already an undisputed leader in the global ADAS market. The company claims as much as an 80% share. By extension, said Chery, “ST is behind that 80%.”

He added, “Thanks to Mobileye, we are proposing a host of products that play complementary roles in ADAS vehicles. They include a small lidar (a derivative of ST’s time-of-flight sensors), radars (24 GHz and 77 GHz), microcontrollers with secure element, and V2V connectivity chips developed by Autotalks.

Who has full ADAS solutions?

Asked if ST has an ADAS platform of its own (something equivalent to NXP’s Bluebox, for example) consisting of various microcontrollers (gateway MCUs, for example) and sensor fusion chips, Chery declined to comment. He said, “We are a pragmatic company. We are not trying to do everything.” He added, “In fact, who has full ADAS solutions today? Maybe Mobileye and Nvidia … but really, nobody has the full solution.”

Indeed, EE Times’ recent interview with Lars Reger, NXP’s automotive CTO, reveals that NXP is putting in place a partnership deal with an unnamed high-performance computing chip company to complete its ADAS/autonomous platform.

Chery acknowledged that ST now has a partner to address the low- to mid-end markets in China and Asia. He added, “We will be using chips that are less sophisticated than those by Mobileye.”

Asked if ST microcontrollers in the new ADAS platform will deploy FD-SOI, Chery said, “Could be.” ST might take “a similar path” to what NXP has done for its i.MX series of processors based on FD-SOI technology (NXP is using Samsung as its foundry). Chery, however, added, “But it also depends on other factors such as [the readiness of] the IP ecosystem. We do not forbid ourselves from using other process technologies because ADAS is pure digital. ADAS requires real-time, high-performance processing.”

‘Go for a disruption’

According to its CEO, ST’s key to the EV market is “our decision to go for a market disruption” with the company’s SiC technology. “This had been in development at ST’s site in Catania, Italy, by advanced R&D guys.”

Chery said, “We took a pragmatic approach. We thought if we really want to go fast with SiC, we should start working with a car maker very closely.”

Chery acknowledged that system development for a SiC module using power MOSFETs was not easy. But ST’s early lead in the market appears to be paying off.

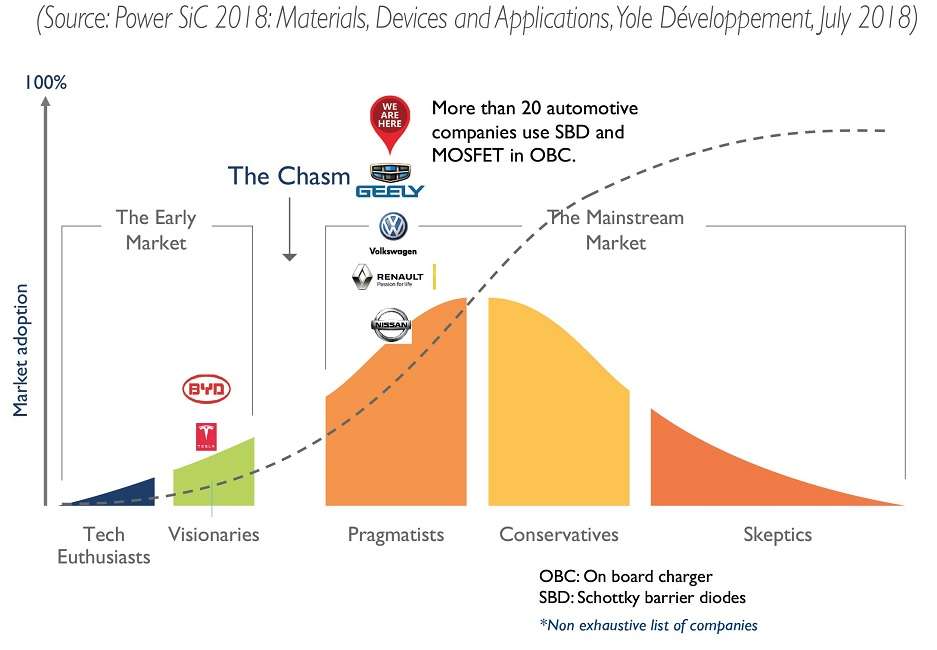

As System Plus noted in its research report, “SiC MOSFETs and SiC IGBTs are in competition in various applications in the 1,200-V range. As of 2018, the SiC MOSFET market is still small compared to that for SiC IGBTs due to lack of maturity and high cost. However, market acceptance is increasing as the technology improves, costs fall, and more device manufacturers enter the market.”

Do SiC technologies cross the chasm? (Source: Yole Développement)

As Chery tells the story, ST shared the risk of SiC with customers, and together, “we are shrinking our technology.” ST’s plan is to leverage SiC technology and its capabilities to make modules “to attack the competition on IGBT.”

— Junko Yoshida, Global Co-Editor-In-Chief, AspenCore Media, Chief International Correspondent, EE Times

Subscribe to Newsletter

Test Qr code text s ss