Datacenter Processing Next for ARM

Article By : Rick Merritt

Smart offload processors a stepping stone to bigger things

Arm put smart offload processors in the spotlight at its annual developers’ conference because they are stepping stones to its data center ambitions. The cloud is the latest target for the still-small designer of cores that investor Softbank is betting will be a semiconductor giant someday.

The name is a relatively new handle, but the chips have been around for years. They first emerged as TCP offload engines more than 15 years ago. Now, they sometimes ride network interface cards called smart NICs.

Along with the new smart names, the chips have taken on more jobs. Today, they handle a flexible basket of security, storage, and virtualization tasks.

The chips have big, high-volume customers. Microsoft’s Catapult uses Intel FPGA cards as smart NICs. Amazon’s Nitro uses Arm-based controllers that it acquired in 2015 from startup Annapurna.

The latter chips represent a solid position in the hyperscale data center for Arm, but it’s just a start. These I/O processors are valued generally in double digits, while the processors that they serve sell for 10 to 100 times as much.

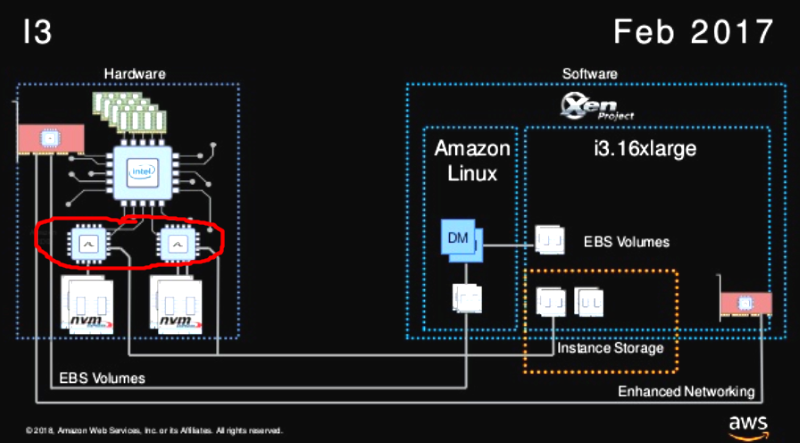

Arm-based controllers from Annapurna (circled in red) are key to Amazon’s Nitro services. Click to enlarge. (Source: Amazon)

Arm hopes to bridge its way into the big bucks in part with CCIX, a cache-coherent extension of PCI Express. CCIX is basically the Intel processor bus for the rest of the industry, linking CPUs to accelerators and more.

Today, only one Xilinx FPGA sports a CCIX port. Five other designs are said to be in flight. Initially, they expand PCIe Gen 4 up to 25-Gbits/s speeds. Future versions will leverage Gen 5’s 32G data rates and maybe even extend them to 56G.

By 2020, there should be a decent ecosystem of CCIX processors, accelerators, and switches in the market, perhaps including x86 chips from AMD and even Power processors from IBM. They will provide a broad set of alternatives to the basket of goodies that Intel will offer data centers with its Xeon, Stratix, Nervana, and Optane chips.

Of course, Arm’s partners still need to deliver a set of compelling server SoCs leveraging its new Neoverse cores. But that’s another story.

In the past two years, Arm hired roughly 2,000 engineers. It’s a big number, but Arm’s ambitions around its technology rival, Intel, are still a David-and-Goliath story.

At its event, Arm claimed that it is responsible for 20 times more wafers per year than Intel at 35 million versus 1.6 million. That’s breathtaking, but it obscures the fact that the revenues of Arm versus Intel chips dramatically skew the other way.

Intel’s 2017 revenues for data center products alone were about $18.8 billion. That’s about 14 times the size of Arm’s total 2017 revenues, including the many cores in each of the billion-plus smartphones that it powers up each year.

At last count, Intel had about 102,000 employees. Arm now has about 6,250 thanks in part to the 2,000 bankrolled by its new owner, SoftBank chief executive Masayoshi Son.

“Masa’s first instruction to me was go, go, go,” said Arm chief executive Simon Segars in a press Q&A after his keynote. “So we’ve invested in engineering headcount and hired about 2,000 people — largely in engineering — over two years.

Segars shared his vision for the company in his keynote at Arm Tech Con. (Image: EE Times)

“That has had a negative impact on our profitability [down to about $280 million in 2017], but that’s fine. Masa is not too worried about short-term results,” he said, adding that the hiring was across Arm’s products and geographies.

Arm is essentially SoftBank’s biggest startup. Compared to Intel, it has plenty of room to grow.

“Being part of SoftBank and not a public company means we can invest in many things in parallel,” said Segars. “Two years ago, I would have had to pick one or two of them.”

SoftBank is on track to fulfill its promise to double Arm’s headcount within five years of buying the company in late 2016, he added. That’s impressive, but even an 8,400-person company has to do a lot of punching above its weight to make it into the top ranks of semiconductor giant.

Five years ago at the event, the big news was Hewlett Packard’s Moonshot servers using Arm-based processors. The systems never got market traction in part because server software supporting Arm was still immature.

Today, the Arm software for servers is more solid, but the chips are somewhat in disarray. I give Arm credit for using SoftBank’s funds to fuel a smart restart of its cloud ambitions. I expect that it will be 2020 before we see any results of the latest foray.

— Rick Merritt, Silicon Valley Bureau Chief, EE Times

Subscribe to Newsletter

Test Qr code text s ss