Samsung Warns of Slow Growth Ahead

Article By : Dylan McGrath, EE Times

But is unrelenting in semiconductor capital expenditure

SAN FRANCISCO — Samsung Electronics said that it would cut its semiconductor capital spending slightly and warned that the memory market is headed for a seasonal slowdown after two years of spectacular growth.

Samsung said that it would cut its 2018 semiconductor capex to about 24.9 trillion won (about $22.6 billion), a decline of about 9% from last year’s total of 27.3 trillion won. Factoring in exchange rate fluctuations, in U.S. dollar terms, the 2018 target represents a decline of just 7% from Samsung’s aggressive 2017 spending level, according to Bill McClean, president of market research firm IC Insights.

Despite slowing price growth for DRAM and NAND flash memory chips over the past few months, “Samsung is barley taking its foot off the gas pedal for semiconductor capital spending,” said McClean. While third-quarter spending declined about 29% compared to the second quarter, the company plans to spend about $6.2 billion on semiconductor capex in the fourth quarter, an increase of 55% compared to the third quarter.

Samsung hasn’t said how much it plans to spend on semiconductor capex in 2019.

“Most likely, it will be down, but the question is by how much,” said McClean. “This will depend on the overall market conditions and pricing trends at the time. It is obvious the company is adjusting its spending on a quarterly basis like many of the large semiconductor firms do.”

Samsung’s capex announcement came as the company issued its third-quarter financial report, which included a record profit of 17.6 trillion won (about $15.5 billion) — driven largely by memory — on sales of 65.5 trillion won (about $57.5 billion). Samsung also announced that it would cut company-wide capital expenditures by about 27% this year.

Samsung’s third-quarter semiconductor sales totaled 24.8 trillion won (about $21.8 billion), up 13% from the second quarter and up 25% from the third quarter of 2017. The company’s semiconductor business reported an operating profit of 13.65 trillion won (about $12 billion).

Samsung said that it expects overall earnings across the company to decline in the fourth quarter, due mostly to expected seasonal weakness in the semiconductor market.

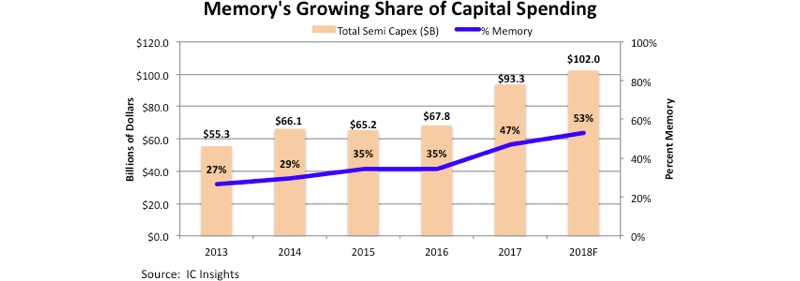

The share of capital spending for memory devices has nearly doubled from 27% in 2013 to a forecast of 53% this year. (Source: IC Insights)

“Looking to 2019, while the memory market may slow down in the first quarter due to seasonal effects, supply and demand dynamics are forecast to stabilize from the second quarter thanks to an increase in overall demand, mainly from server and mobile,” said Samsung in a statement.

The company said that it expects earnings to strengthen later in the year as business conditions improve, particularly in the memory market.

TrendForce, a market research firm that tracks memory chip pricing, is forecasting that DRAM and NAND prices will both decline in the fourth quarter and for the full year 2019 as demand fails to grow as fast as supply.

Subscribe to Newsletter

Test Qr code text s ss