ADI Drops Macom Suit

Article By : Junko Yoshida, EE Times

ADI and now-subsidiary Hittite fold before matter gets anywhere near courts

A lawsuit filed by Analog Devices Inc. (ADI) on May 21 accusing MACOM Technology Solutions Inc. of intellectual property theft has fizzled less than two months later.

The suit, which alleged that, since 2016, MACOM has launched several products similar to those by ADI after three former ADI employees left the company and started working for MACOM, was withdrawn Monday, with prejudice, according to the notice of voluntary dismissal filed in the U.S. District Court in Massachusetts.

At the heart of the case involving the two Massachusetts-based rivals lie misappropriated trade secrets that have led to allegations of patent infringement related to two products: monolithic microwave integrated circuit (MMIC) wideband distributed amplifiers and voltage-controlled oscillators (VCOs).

Three former ADI employees, who allegedly carried the secrets to MACOM, used to work for Hittite Microwave Corp., which was acquired by ADI in 2014.

It is not clear why ADI and co-plaintiff Hittite (now a wholly owned subsidiary of ADI) suddenly decided to fold. MACOM had until July 27 to respond to the ADI charges. The first court conference was scheduled for Aug. 6.

EE Times reached out to ADI and MACOM for comment, but both companies declined an interview. So was this just a frivolous gambit by ADI? We may never know.

Nonetheless, the ADI versus MACOM case, despite its disappearance, opens a window to the RF/microwave world, which industry experts describe as a “fairly small club of vendors.” The wave of M&A and consolidation within the semiconductor industry appears to affect how members treat one another. Meanwhile, competition among a shrinking number of vendors seems to have grown more cutthroat than ever.

Rob Lineback, senior market research analyst at IC Insights, told us that ADI and MACOM “definitely go toe-to-toe in RF amplifiers, switches, and some other analog ICs in communications network gear.” He observed, “The fact that they are both headquartered in the greater Boston area increases the ‘hometown’ rivalry between them for engineering and R&D talent as well as some RF, microwave, and analog product areas.”

Think BC versus BU in the Beanpot.

ADI dwarfs MACOM

It’s important to note, though, that MACOM isn’t in the same league with ADI when it comes to business size. Lineback said, “Analog is about eight times the size of MACOM, in terms of annual revenue, and has nearly nine times the number of employees worldwide — about 15,300 at ADI versus 1,800 workers at MACOM last year.”

More specifically, ADI’s 2017 sales totaled $5.8 billion, “making it the 18th largest semiconductor company in the world,” said Lineback. MACOM’s revenue was about $678 million last year.

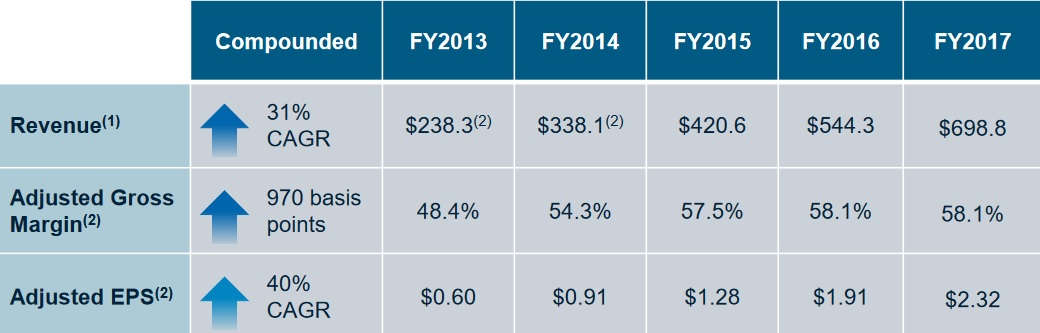

The rivalry might also be more personal. After its IPO in 2012, MACOM hired John Croteau as its CEO to guide the company into a growth mode. Since then, Croteau has succeeded in supercharging MACOM, increasing revenue at a compound annual rate of 31%. Although Croteau worked at NXP Semiconductors before joining MACOM, he had made his reputation during a 20-year executive career at ADI.

As general manager responsible for the convergence platforms and services group at ADI, Croteau reportedly had P&L responsibility for a $300 million portfolio spanning DSP microprocessors, mixed-signal peripherals, software, and development tools for various consumer, industrial, military, and automotive markets.

In the original court filing, ADI noted, “Attack on market share occupied by Analog/Hittite is a core aspect of MACOM’s business strategy.” Referring to a 2016 MACOM earnings call, ADI quoted Croteau, saying that MACOM’s “strategy is to regain preeminent [market] share from traditional competitors like Hittite, TriQuint, RFMD, and Microsemi as they undergo consolidation.”

Why sue?

This plotline — a company accuses former employees of taking proprietary information and documents on technology when they leave to join another chipmaker — is familiar in the semiconductor industry.

Lineback observed, “Often, these lawsuits involve employees joining a direct rival or startup, but not always.” Many companies see legal action as a way of protecting investments in intellectual property and a way to caution existing employees. Lineback told us, “Analog Devices’ suit is probably driven by a number of factors, but sending a message to its workforce is most likely one of them in addition to safeguarding its technology.”

Another industry observer who spoke on the condition of anonymity told us that, while lawsuits like ADI versus MACOM sound like common occurrences, “I have actually seen only a few lawsuits, and they were usually patent-related rather than employee-related.” He observed that most were settled out of court with a cross-licensing agreement. In contrast, “employees taking confidential information — that’s a very different story and reflects badly on both the individual as well as the hiring company.”

In the cozy RF/microwave vendor world, the norm tends toward vendors “looking on each other as supporting the industry in general,” he noted. “As a result, it’s looked upon as bad form to ‘steal’ confidential information, bad for everyone as it reduces the industry to a bunch of low-life slimeballs rather than noble warriors for the cause.”

The same applies to the basic “analog” world, he noted. ADI/LTC (Linear Technology, which is now part of ADI), Maxim, TI, and others compete, but “the engineers and marketers (who are also engineers) do look on themselves as upholders and advancers of the analog message and cause,” he concluded.

In other words, ADI versus MACOM might signal the end of the gentlemen’s agreement among the analog/RF/microwave world.

Where the two rivals overlap

Lineback noted, “I’m not totally sure how much revenue is represented by the products mentioned in ADI’s lawsuit, but my impression is that MACOM is more deeply involved in defense and aerospace RF, microwave, and radar than Analog Devices.” He added, “However, they are going up against each other in some of these systems as well as more commercial wireless systems.”

Because both MMIC amplifiers and VCOs are popular building-block devices, they open the door to the rest of the RF/microwave signal chain, one of the analog industry observers told EE Times. “Both ADI and MACOM are coming at these products from different perspectives to arrive at the same place,” he explained.

MACOM has always been in the RF/microwave space exclusively. ADI has been there, too, but not to the same extent. It has many other product lines and markets. But ADI is reportedly pushing into this area, with innovative processes, even MEMS-based RF switches, based on advanced technologies and processes.

Another semiconductor industry source who spoke on the condition of anonymity speculated that ADI’s legal action against MACOM might have been a tactic to slow down MACOM.

According to Lineback, MACOM’s Aerospace and Defense sales represented 14% of its fiscal 2017 revenue of $699 million (for the 12 months ending September 2017). Another 14% of sales came from the company’s Multi-Market group (covering industrial, medical, mobile systems, and scientific end-use applications). MACOM’s Networks group accounted for 72% of its sales (covering infrastructure for fiber-optic communications, cellular transmissions, data centers, satellite comm, cable TV, etc.).

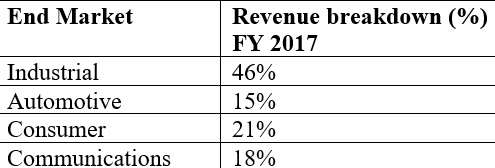

At Analog Devices, about 18% of its $5.1 billion in sales was generated by communications systems in FY17 (also ending September 2017), but another 46% came from industrial, according to Lineback. He believes that the rest might fall outside of MACOM’s current businesses, but he added, “This is a rough estimate.”

Furthermore, “It’s worth noting that ADI’s calendar 2017 sales were higher than FY17 by the acquisition of Linear Technology in March 2017, and that probably changes the percentage of revenue in different end-use applications in the current FY18 year, ending this September,” said Lineback.

— Junko Yoshida, Chief International Correspondent, EE Times

Subscribe to Newsletter

Test Qr code text s ss