Blog: New Memories Seek Embedded Use

Article By : Paula Doe, SEMI

Emerging memories likely will find high-volume markets in embedded applications replacing NOR flash for storing code in MCUs and ASICs.

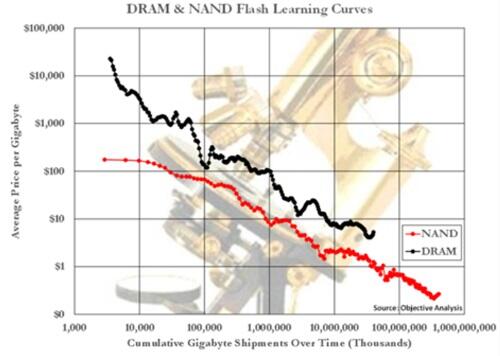

“At some point the door is going to close on NOR because of scaling issues, and all MCU and ASIC makers and their logic foundries will need a new non-volatile memory technology for code storage–whether it will be at 40nm or 14nm may depend on the foundry’s logic process,” said Jim Handy, analyst at Objective Analysis, who will give a market overview in the emerging memory program at Semicon West.

The challenge is that until the new memory technologies reach volume production, they will be more expensive. MRAM has an advantage because Everspin has been selling standalone chips for temporary immediate storage, Handy said.

For its part, GlobalFoundries is supporting embedded MRAM (eMRAM). “We’re working with four of the five biggest makers of MCUs, and what they need after 40nm is a less expensive alternative to e-flash for FinFETs or FD-SOI, where the cost to add eFlash to a logic platform begins to increase dramatically,” said David Eggleston, vice president of embedded memory at GF and another event speaker.

Eggleston notes that eMRAM is starting to mature and produce higher volume as GlobalFoundries, TSMC and Samsung enter risk production of different variations of eMRAM–FD SOI, bulk, and SRAM replacement, respectively.

GlobalFoundries has introduced a 22nm process with eMRAM and makes the Everspin 256-Mbit and Gbit standalone MRAM products. GlobalFoundries and TSMC have each demonstrated high-temperature performance for eMRAM to reassure automakers and industrial users that it will be capable of retaining data at high temperatures including through solder reflow at 260°C.

GlobalFoundries is also working with eVaderis, a design IP vendor, to supply an embedded MRAM design that reduces power consumption leakage. “Automakers have turned out to be most interested in eMRAM’s ability to improve the power budget by reducing leakage compared to SRAM,” said Eggleston.

Among other alternatives, “ReRAM has the advantage of scalability, since the difference between filament and no filament for 1 and 0 remains large enough to be measurable, even when closely packed,” said George Minassian, chief executive of Crossbar Inc. who will provide a ReRAM update in the Semicon program.

Initial applications for ReRAM will be for embedded memory in logic, said Minassian. Crossbar devices are in qualification and verification with customers using conventional CMOS materials.

Microsemi recently licensed the Crossbar technology. In addition, the company is demonstrating a ReRAM chip for AI image recognition at the edge.

“ReRAM gets more interesting at smaller nodes where the simpler and potentially lower-cost devices that use diodes instead of transistors for selectors may compete on price for code storage with embedded flash,” said Eggleston. “Although the stack itself is very simple, designing everything outside of the bitcell to manage the inherent variability is a struggle that has repeatedly delayed ReRAM introduction,” he added.

The only commercial application for ReRAM so far appears to be Adesto Technology’s conductive bridging memory (CBRAM). The radiation-hardened devices are used in surgical instruments that use X-ray sterilization, says Handy.

Ferroelectric FETs using high-K dielectrics are another alternative. They promise to halve costs of eMRAM or e-flash while offering low power and easy integration with logic, said Eggleston. But they still need improved endurance, so “FeFET remains an interesting R&D project,” he said.

Fujitsu has produced older generation PZT FeRAM devices in high volume for subway fare cards, but the lead-based technology had some fab integration issues, Handy said. The newer hafnium-dioxide-based devices have the advantage of using a material already in high volume production in fabs, but the devices may have wear issues and endurance is currently extremely limited.

The session on new memory technologies also will feature speakers from Everspin, Imec and Spin Transfer Technologies.

— Paula Doe is a director of technology for the SEMI trade group

Subscribe to Newsletter

Test Qr code text s ss