MRAM on the Rise

Article By : Gary Hilson

eVaderis and GlobalFoundries looking to make a splash in battery-powered IoT applications

TORONTO — As magnetoresistive random access memory (MRAM) gathers steam as an emerging option with increasingly more cost-effective applications, the ecosystem is also emerging to support it.

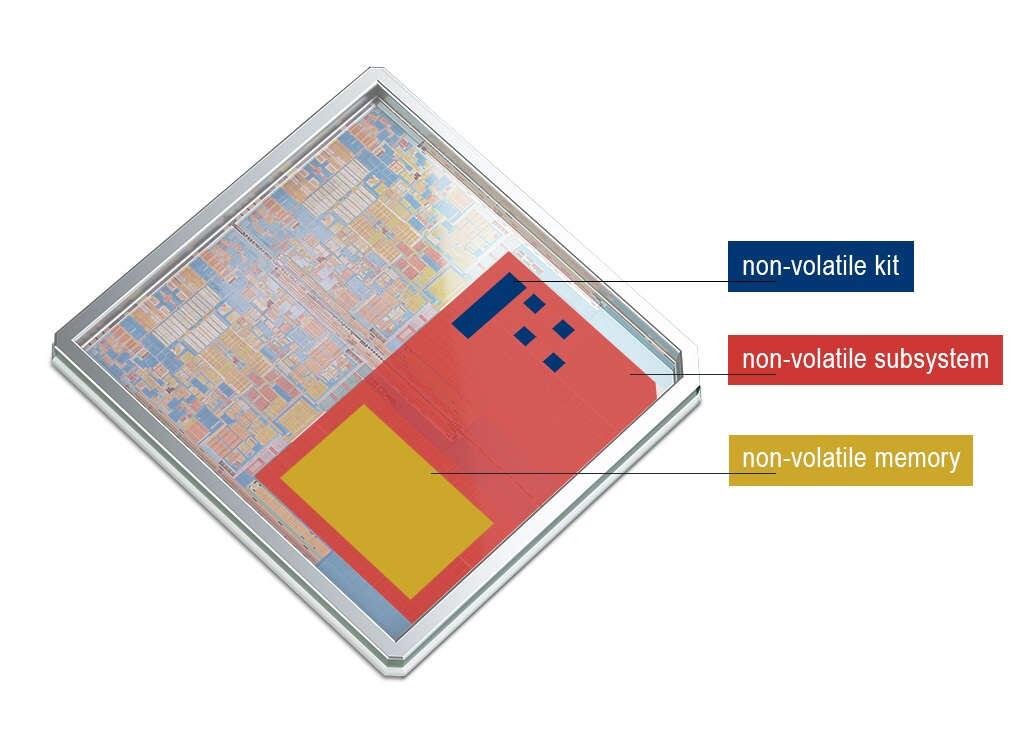

eVaderis recently announced co-development efforts on an ultra-low-power microcontroller (MCU) reference design using GlobalFoundries’s embedded MRAM technology on the 22-nm FD-SOI (22FDX) platform. Together, the companies are looking to support a wide range of low-power applications such as battery-powered Internet of Things (IoT) products, consumer and industrial microcontrollers, and automotive controllers.

GlobalFoundries has been aggressive on the MRAM front of late. As one of several foundries that publicly announced plans to put MRAM into production by the end of last year and into 2018, it has a deep collaboration with Everspin Technologies, the first MRAM maker to gain any commercial traction with the emerging memory. At the 2017 International Symposium on VLSI Technology, Systems and Applications in Japan, Globalfoundries outlined in a technical paper Everspin’s progress with moving eMRAM forward into the 22-nm process node and how it can significantly improve data retention for embedded applications. Meanwhile, Spin Transfer Technologies has made progress recently on its efforts to commercialize MRAM technology.

eVaderis designed its MCU technology through GlobalFoundries’s FDXcelerator partner program to leverage the efficient power management capabilities of the 22FDX platform. In a telephone interview with EE Times, eVaderis president and CEO Jean-Pascal Bost said that using GlobalFoundries’s eMRAM as a working memory allows sections of the eVaderis MCU to power-cycle frequently. It also doesn’t incur the typical MCU performance penalty, achieving more than 10 times the battery life and a significantly reduced die size compared to previous-generation MCUs.

eVaderis’s progress on the eMRAM MCU reflects the company’s anticipation that the emerging memory would gather significant momentum in 2016, and rather than wait for the business to be there, eVaderis got started in 2014. Bost said that its goal was to offer innovative IP solutions based on disruptive embedded memory technologies such as MRAM and RRAM. The company has three internal teams: one focused on design automation, one focused on making tools, and one focused on systems.

Overall, eVaderis is set up so that processes can be transferred from one memory to another and one foundry to another, and today, the company focuses mainly on developing energy-efficient IPs for memories such as MRAM and RRAM, said Virgile Javerliac, eVaderis’s founder, deputy CEO, and head of technology and marketing.

Bost said that some things have changed since they initially set up the company. “Five years ago, we thought we’d have to fight at 40 nm against flash, which is not the case today,” he said. “Today, the story’s different. The three main foundries have adopted MRAM as a non-volatile memory solution for nodes starting at 28 mm and below, and that there would be no flash available for these nodes. That was good news for us.”

M

M

Javerliac said that the ability to read and write at the bit level and give the customer direct access to the compiler is helping to speed time-to-market. Unlike flash, in which you’re working at the macro level, it’s possible today to work at the logic level with MRAM. “You can enable a specific kind of function within your CPU.” And unlike flash, he said, you can distribute the technology throughout your system.

Bost said that, in its early days, eVaderis conducted a lot of customer interviews to understand the expectations around the performance of both MRAM and RRAM because the company didn’t know who the winner would be. He said that the latter has experienced some renewed interest because it’s shown potential to be the right solution for certain applications. “There’s room for both technologies. Clearly, the biggest market share would be for MRAM.”

eVaderis’s jointly developed reference design with GlobalFoundries’s 22FDX using eMRAM is slated to be available in the last quarter of this year. Process design kits are available now, and customer prototyping of 22FDX eMRAM on multi-project wafers is already underway.

Jim Handy, principal analyst with Objective Analysis, said that, to date, emerging memories on MCUs haven’t been too popular because of the higher cost of the new technology when compared to NOR flash or SRAM. “As processes shrink past 14 nm, that’s expected to change [because] NOR no longer works and SRAM starts becoming larger and larger,” he said.

eVaderis’s low-power MCU with low-power MRAM sounds like a great match for battery-powered equipment, said Handy. “MRAM persistently stores data a lot more efficiently than flash.” However, a flash write, whether it’s NAND or NOR, consumes a high current for a long time. “The compulsory pre-erase is an even bigger power hog.”

He said that the one particularly appealing feature of MRAM and other emerging nonvolatile technologies is that the programmers have flexibility of how they use the memory. “They no longer need to confine the code to the size of the NOR or the data to the size of the SRAM,” said Handy. “This not only eases design, but it may also save cost for certain customers by allowing the same MRAM-based MCU to be used for a number of applications, allowing them to be purchased at higher volumes for deeper discounts.”

—Gary Hilson is a general contributing editor with a focus on memory and flash technologies for EE Times.

Subscribe to Newsletter

Test Qr code text s ss