Fab Tool Spending On the Rise

Article By : Dylan McGrath, EE Times

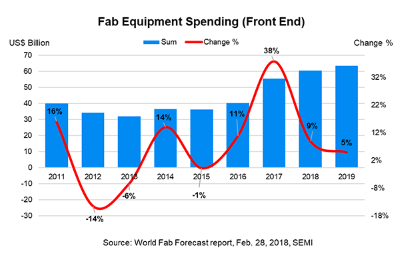

Global fab tool spending to increase by 9 percent in 2018, making it the third year in a row with increased tool spending

SAN FRANCISCO — A surge in spending on new wafer fabs in China is projected to drive up global spending on fab tools in 2018, the third straight year of increases and the first time that has happened since the mid-1990s.

Total global fab tool spending will increase 9 percent to reach more than $62 billion this year, according to the latest forecast from the SEMI trade association. Spending on tools is forecast to rise an additional 5 percent in 2019, which would mark the fourth straight year of spending increases, said SEMI (San Jose, Calif.).

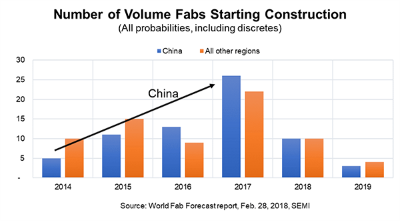

Most of the expected increases in 2018 and in 2019 will be driven by new fabs under construction in China. A record 26 volume fabs began construction in China in 2017, and they are buying equipment over the next two years, SEMI said.

China’s fab tool spending is forecast to increase 57 percent in 2018 and an additional 60 percent in 2019, SEMI said. The trade group expects China to become the top region in the world for fab tool spending in 2019, topping South Korea.

South Korea’s fab equipment spending — which rose to more than $20 billion in 2017 — will decline 9 percent to $18 billion in 2018 and fall a further 14 percent to $16 billion in 2019, according to the SEMI forecast.

Equipment spending in Taiwan — expected to be the No. 3 market in 2018 — will fall by 10 percent to about $10 billion in 2018 before rebounding to grow 15 percent to more than $11 billion in 2019, SEMI said.

South Korea’s Samsung Electronics is expected to maintain its spot as the global leader in fab tool buying in both 2018 and 2019, but the company’s spending in each of those years is expected to be below 2017, when it spent more than $18 billion on fab tools.

Spending on tools for 3D NAND production is expected to increase by 3 percent in both 2018 and 2019 to reach $16 billion and $17 billion, respectively, SEMI said. Tool spending for DRAM production is forecast to grow by 26 percent this year to reach more than $14 billion before declining by 14 percent to $12 billion in 2019, according to the SEMI forecast.

Fab tool buying by foundries is expected to grow by 2 percent to reach $17 billion this year, SEMI said. Foundries are projected to increase their spending dramatically next year, up 26 percent to $22 billion to support 7nm and additional capacity, according to the forecast.

— Dylan McGrath is the editor-in-chief of EE Times.

Subscribe to Newsletter

Test Qr code text s ss