NAND Flash Prices In Decline

Article By : Dylan McGrath, EE Times

Slight oversupply on market after high 2017 demand

SAN FRANCISCO — The NAND flash market, which enjoyed one of its best years on record in 2017 thanks to strong demand and tight supply, took a step toward equilibrium between supply and demand in the fourth quarter as yield rates improved, with contract pricing for NAND in PCs, tablets and servers remaining flat or declining slightly, according to DRAMeXchange.

Coming off the high seasonal demand for NAND in the fourth quarter, the NAND market is currently in a state of slight oversupply, with NAND suppliers likely to see sales suffer as they cut prices on products to spur demand, according to DRAMeXchange, a unit of market research firm TrendForce that tracks memory pricing. The firm said that NAND suppliers can still maintain a healthy level of profit despite the oversupply because costs to produce 64- and 72-layer 3D NAND have also declined.

The only types of NAND that showed increasing contract pricing during the fourth quarter were eMMC and Universal Flash Storage (UFS), DRAMeXchange said.

Constrained by limited capacity and early 3D NAND hiccups that impacted supply, sales of NAND flash increased by more than 40 percent last year. However, sales increased only about 7 percent in the fourth quarter compared with the third quarter, the company estimated.

South Korea’s Samsung Electronics remained the leader in NAND revenue by a wide margin in the fourth quarter, increasing its market share to an estimated 38 percent, up from 37 percent in the third quarter of 2017, according to DRAMeXchange. Much of Samsung’s fourth quarter market share growth appears to have come at the expense of Japan’s Toshiba, which remained the No. 2 player in NAND despite its market share slipping to 17.1 percent in the fourth quarter from 18 percent in the third quarter of the year, DRAMeXchange said.

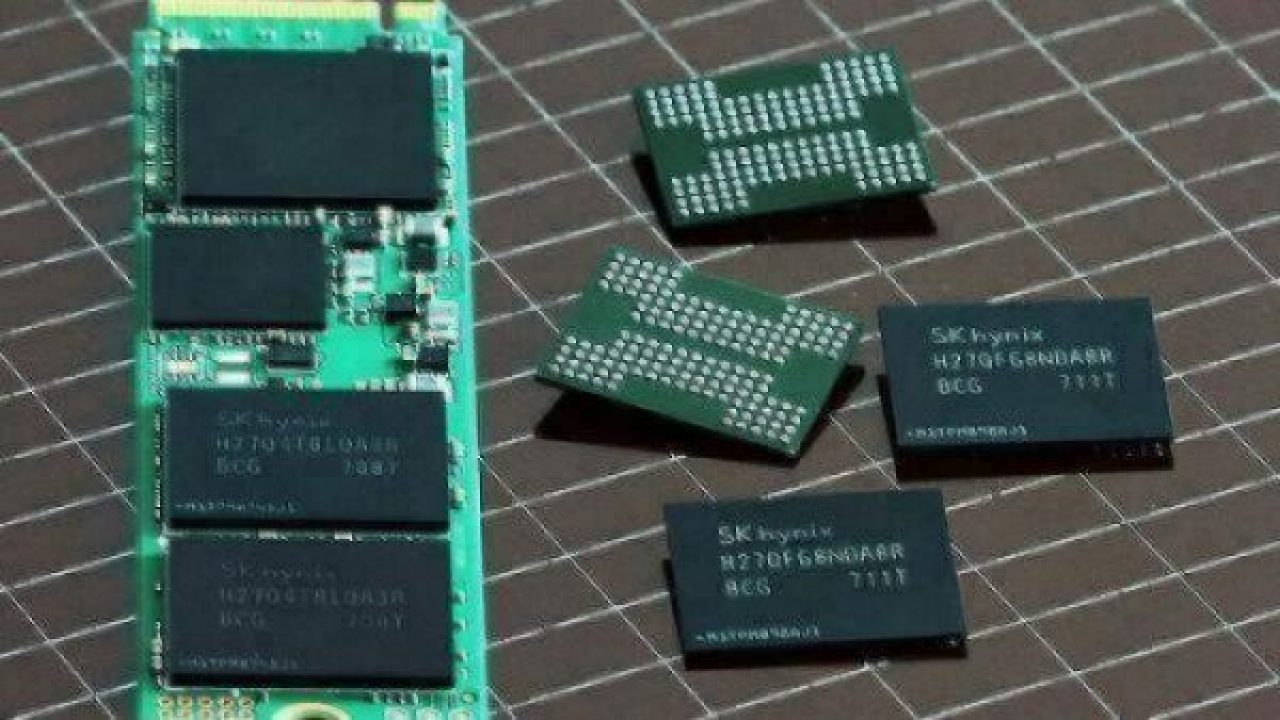

Western Digital and Micron, the third and fourth ranked players in NAND respectively, also lost market share during the fourth quarter despite growing sales, according to DRAMeXchange. SK Hynix, meanwhile, gained more than a percentage point of market share as the company’s NAND sales increased by nearly 20 percent from the third quarter to the fourth quarter of last year, the firm said.

— Dylan McGrath is the editor-in-chief of EE Times.

Subscribe to Newsletter

Test Qr code text s ss