NXP Launches ARM Vehicle Development Platform

Article By : Junko Yoshida, EE Times

Targets EVs and Hybrids with ARM-based GreenBox development platform

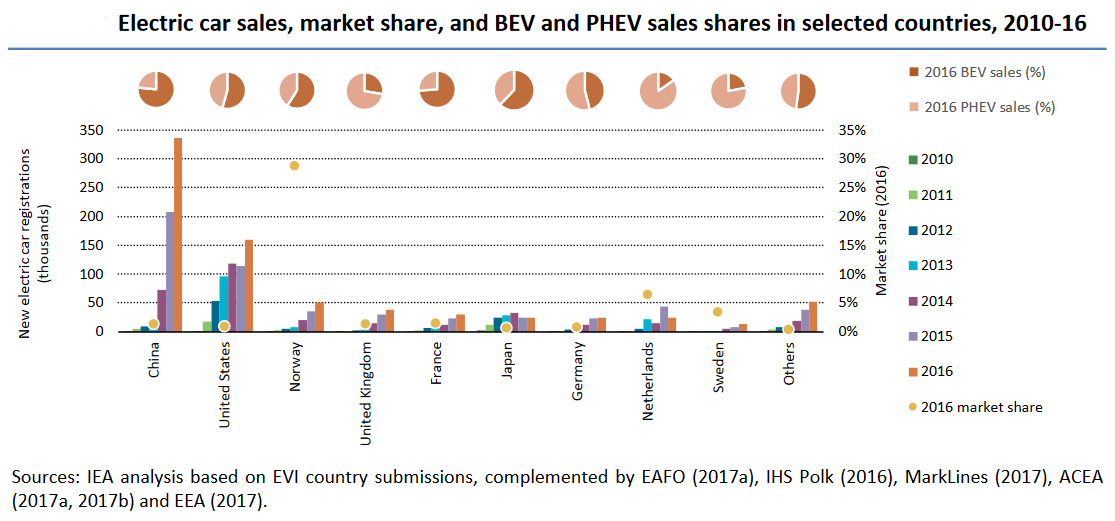

MADISON, Wis. — For all the talk and activity around electric vehicles, the number of pure-electric and plug-in hybrid cars represented barely 1 percent of the 17 million cars and light trucks sold in the United States last year.

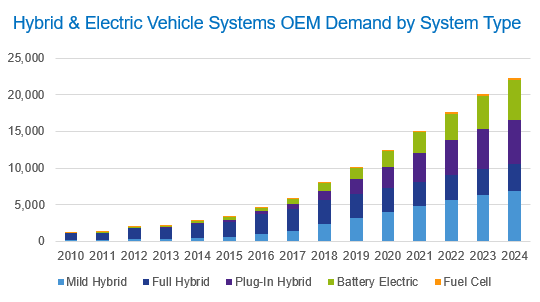

But sales shouldn’t be seen as the only guide when assessing a global EV market where semiconductor companies hope to sell automotive chips. After all, car OEMs around the globe are investing billions of dollars into electric technologies to meet increasingly tougher emission rules.

Global momentum for vehicle electrification has motivated NXP Semiconductors to launch on Tuesday (Feb. 20th) its GreenBox development platform.

Shift from Power to Arm

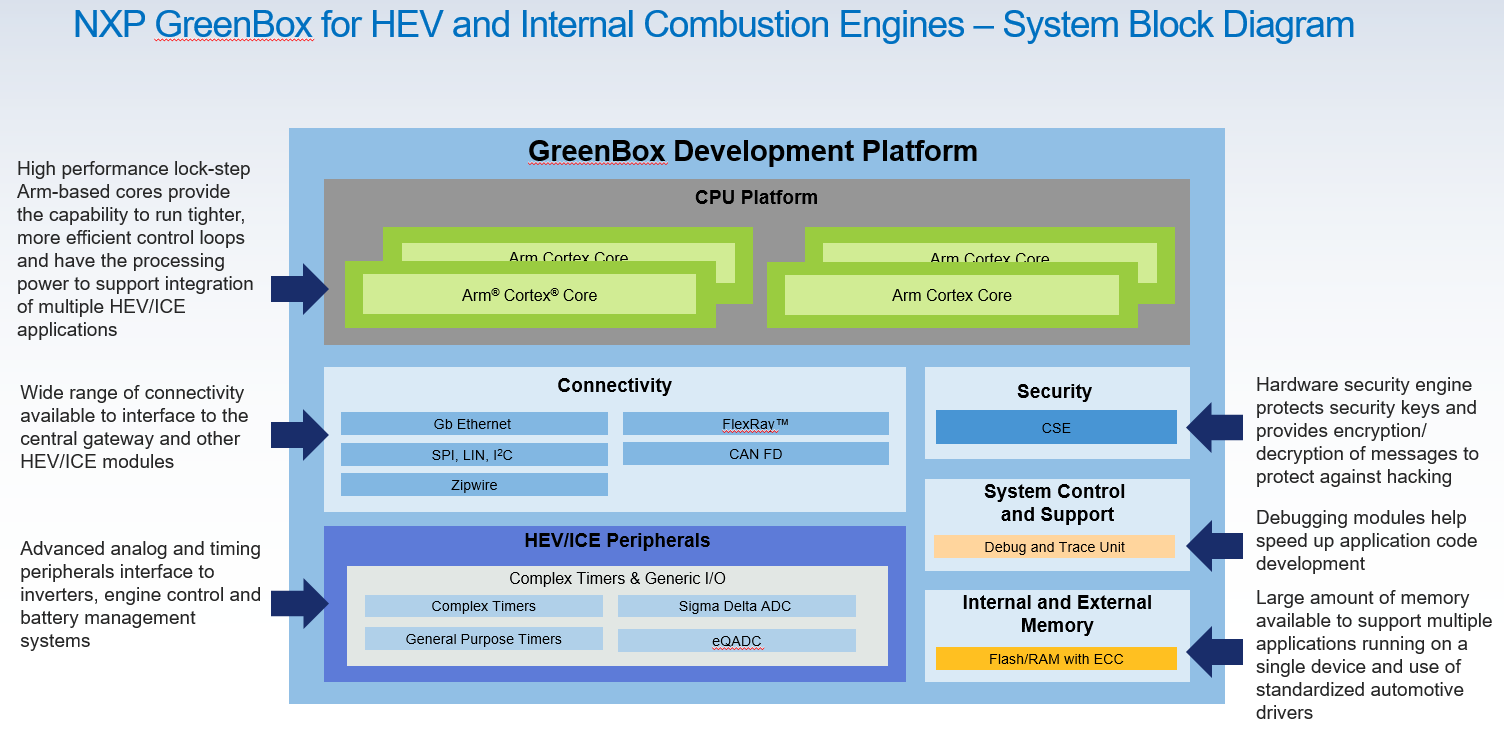

With GreenBox, “Car OEMs can start developing new hybrid and electric vehicle applications on NXP’s S32 automotive processing multicore platform,” noted Ray Cornyn, vice president and general manager for NXP’s vehicle dynamics and safety product line. With the Greenbox launch, NXP is officially shifting its EV and hybrid EV development platform from Power architecture to Arm Cortex technology.

Together with NXP’s BlueBox 2.0 platform (also based on S32), a development platform for the brain of highly automated vehicles, NXP is introducing its Arm portfolio “from top to bottom” to be designed into vehicles, noted Cornyn, “ranging from high-end infotainment ADAS systems to more deeply embedded automotive applications.”

(Source: NXP)

(Source: NXP)

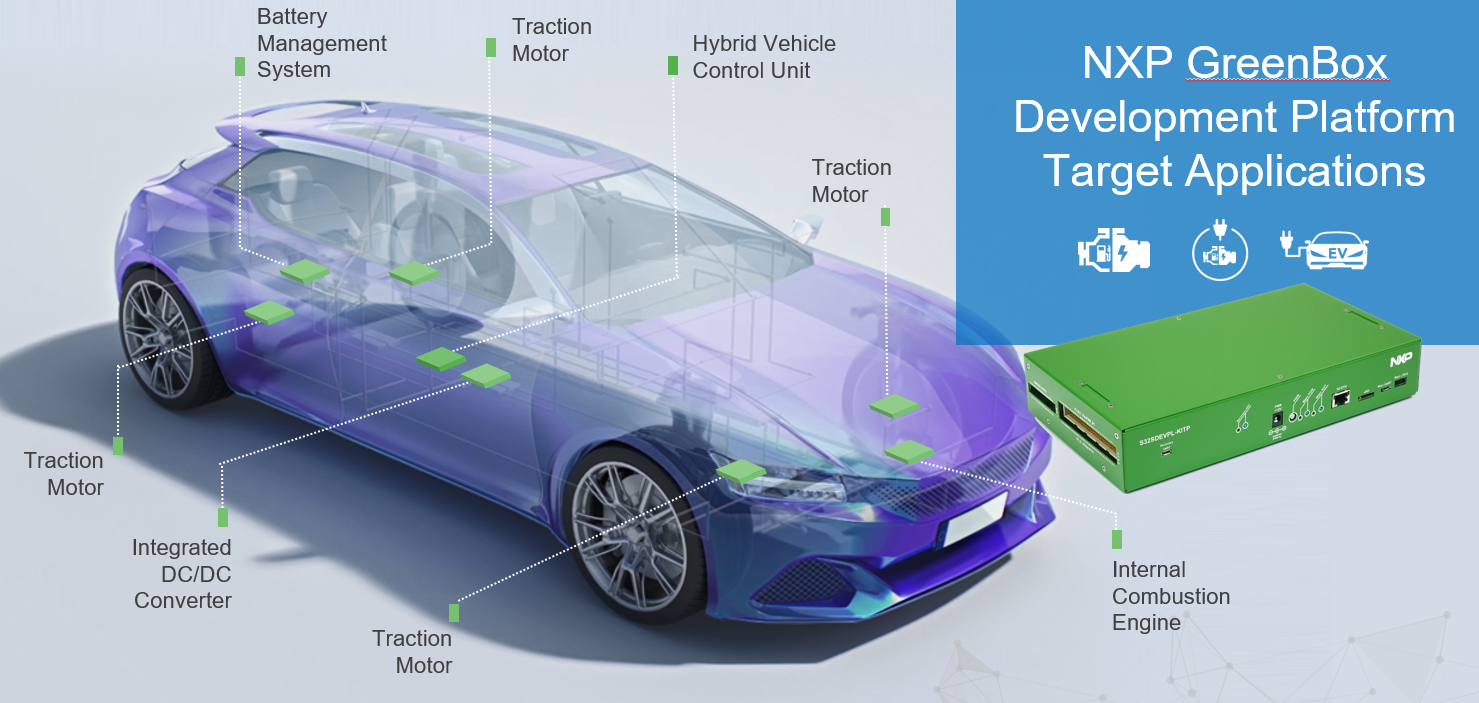

Asked what sort of app development is expected on the GreenBox platform, Cornyn noted, “You can develop pretty amazing stuff” — such as applications that can boost overall energy efficiency in route planning.

For example, a designer can create a piece of software that takes advantage of specific route knowledge — when an HEV needs to drive a long uphill road, for example — to do battery management more effectively, as well as transmission control and energy planning for an internal combustion engine.

Hypervisor

Having an S32-based automotive processing platform — designed for a whole vehicle — lets OEMs and tier ones maximize the re-use of codes, software and common capabilities across vehicle domains, applications and SoCs. “You can use Arm’s new hypervisor architecture to isolate energy management from transmission control, for example,” explained Cornyn.

NXP’s GreenBox Vehicle Electrification Development Platform meets with “high performance and memory requirements for tomorrow’s HEV/EV applications,” the company claimed.

In a keynote address at the International Solid-State Circuits Conference (ISSCC) last week in San Francisco, Yukihiro Kato, senior executive director at Denso Corp., told the audience that the automotive industry is in a period of “once-in-a-century transformation.” Drastic changes include efficient driving enabled by EVs, connected vehicles and highly automated vehicles.

In that context, the EV, regardless of its slow progress on the market, is crucial, Kato noted. To advance the electrification of vehicles, one must “downsize automotive inverter by increasing power density,” Kato said. Typically, that means the use of Silicon Carbide (SiC), gallium nitride (GaN), or insulated-gate bipolar transistor (IGBT) technology to improve power conversion efficiency.

Asked what NXP is doing in this context, Cornyn acknowledged that that’s a domain where companies like Infineon excel. They offer what “muscle EVs need,” he said, while “we provide [the] ’intelligence’ EVs can use.” For NXP’s EV customers, NXP works with Fuji Electric as a supplier of IGBT. NXP is also currently negotiating with a potential partner to supply SiC, Cornyn explained.

Autonomous vehicles and EVs/HEVs will eventually share a lot of smarts and intelligence. Information collected by autonomous cars, for example, will be used by an EV’s vehicle control unit — start, stop and steer — so it can calculate the juice it needs to complete an energy-efficient journey, said Cornyn. NXP believes its common, S32-based BlueBox and GreenBox platform will enable that vision.

Where are we with legislations on EVs?

Of course, any EV/HEV discussion is incomplete without understanding where the global market is heading.

In its press release, NXP pointed out that China, India, France, several states within the U.S. and other countries have either passed laws on internal combustion engine production termination or have signaled legislative intentions.

The two main electric car markets are China and the United States. Six countries reached EV market shares of more than 1% in 2016: Norway, the Netherlands, Sweden, France, the United Kingdom and China

China often emerges as a nation serious about advancing an EV agenda — not only for environmental reason but to foster its ambitions to dominate the global EV market.

Last fall, China set a deadline of 2019 to impose tough new sales targets for electric plug-ins and hybrids. Car makers will need to amass credits for so-called new-energy vehicles (NEVs) equivalent to 10 percent of annual sales by 2019, according to China’s industry ministry. That level would rise to 12 percent for 2020.

Meanwhile, Europe has mandatory 2020 CO2 emission targets for new passenger cars and light-commercial vehicles within the European Union. The passenger car standards are 95 g/km of CO2, phasing into 95 percent of vehicles in 2020 with 100 percent compliance in 2021. The light-commercial vehicle standards are 147 g/km of CO2 for 2020.

Some European countries have set their own aggressive targets. The Netherlands, where NXP is headquartered, has taken a comprehensive set of actions to achieve ambitious national goals of 75,000 privately owned EVs on its roads by 2020, and for 50 percent of all new cars sales to be plug-in electric — with at least 30 percent fully electric — by 2025, according to the Dutch government.

Meanwhile, the Norwegian Parliament has decided that all new cars sold by 2025 should be zero (electric or hydrogen) or low (plug-in hybrids) emission, according to the Norwegian Electric Vehicle Association.

These ambitious EV goal extend to India. Quoting plans set out by India’s energy minister, the Climate Action Program last year reported that “All cars sold in India will be electric vehicles (EVs) by 2030 in a bid to curb air pollution.”

Perhaps the more useful yardsticks to gauge the EV market trend around the world might reside in city-level initiatives. Last fall, the International Council on Clean Transportation, an independent nonprofit, identified 20 EV capitals in the world. They range from Beijing, Hangzhou, Qindao, Shanghai and Shenzhen to Paris, Tokyo, Amsterdam, Oslo, Stockholm, Los Angeles, New York, San Jose and London. It noted that these 20 cities alone account for about 40 percent of the world’s EVs. The report said, “These cities are each in their own way helping to overcome electric vehicle barriers, propelling the market forward, and leading by example.”

The report also added, “Cities are providing preferential access for electric vehicles to parking, bus lanes, carpool lanes, and toll roads to steer the vehicle fleet toward electric. Some cities with the most pervasive air quality problems are beginning to authoritatively exercise their control over access to the city.”

Why now?

NXP’s Cornyn reiterated that the long development cycles for automotive development, along with regulation and market indicators, are prompting carmakers to “jumpstart the development of HEV/EV systems now.” NXP is promoting its GreenBox platform ahead of the rollout of NXP S32 electrification MCUs.

NXP said the GreenBox electrification development platform is available today in limited quantities to Alpha customers.

— Junko Yoshida, Chief International Correspondent, EE Times

Subscribe to Newsletter

Test Qr code text s ss